The Unexpected Weakness of the Dollar: A Conundrum of Tariffs and Market Sentiment

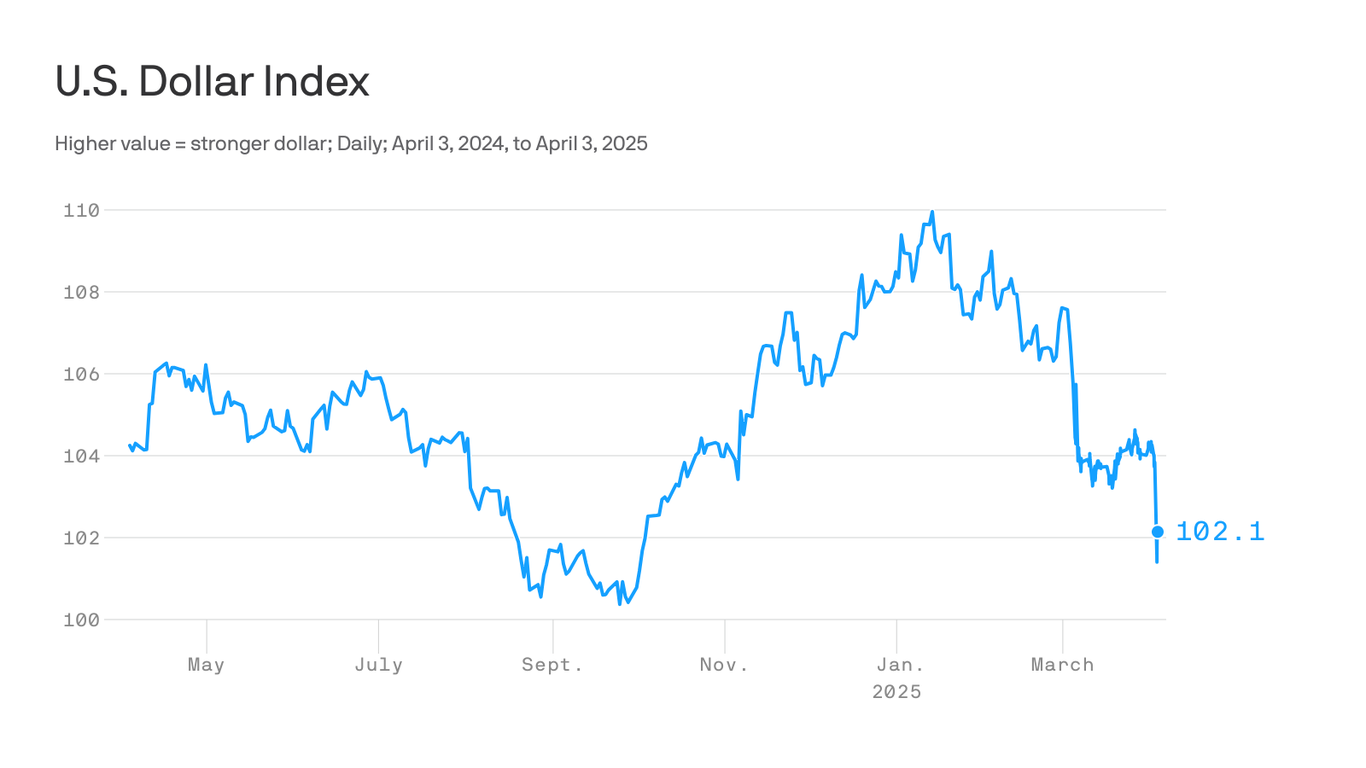

The US dollar, traditionally a beacon of global stability, has recently exhibited behavior that defies conventional economic wisdom. Specifically, the imposition of significant tariffs, actions expected to bolster the dollar’s value, have instead resulted in a surprising weakening of the currency. This unexpected outcome underscores the complex interplay of factors influencing exchange rates, beyond the simplistic textbook models.

Economic theory suggests that higher tariffs, by restricting imports and potentially boosting domestic production, lead to increased demand for the domestic currency. This increased demand, in turn, should drive up its value. Intuitively, if a country is buying fewer foreign goods, it needs less foreign currency, thus increasing the relative value of its own. This fundamental principle seems to be contradicted by recent events.

The reality, however, is considerably more nuanced. The market’s reaction to tariff announcements is not solely determined by the immediate impact on trade balances. Investor sentiment, expectations about future economic performance, and the overall global economic landscape all play crucial roles.

One major factor contributing to the dollar’s weakness is the uncertainty generated by unpredictable trade policies. Businesses and investors dislike uncertainty. The imposition of tariffs, particularly when implemented in a seemingly haphazard manner, introduces significant uncertainty into the global economic outlook. This uncertainty can prompt investors to move their assets away from the dollar, seeking safer havens in other currencies or assets. The fear of further trade wars and retaliatory measures further fuels this capital flight.

Furthermore, the impact of tariffs is not immediate or uniform across all sectors. While some industries might benefit from protectionist measures, others may suffer from increased input costs and reduced export opportunities. This uneven impact can lead to a net negative effect on overall economic growth, undermining the dollar’s long-term strength. A weakening economy naturally translates to a weakening currency.

Another crucial aspect is the global context. The strength of a currency is not solely determined by domestic factors; it’s relative to other currencies. If other major economies are experiencing stronger growth or implementing more stable policies, their currencies will likely appreciate relative to the dollar, further contributing to the dollar’s weakness.

Moreover, the narrative surrounding the tariffs themselves also matters. If the tariffs are viewed as a sign of economic instability or protectionist tendencies harming global trade, the market reaction might be significantly negative, outweighing any potential benefits from increased domestic demand. Negative perceptions can quickly translate into a self-fulfilling prophecy, further driving down the dollar’s value.

In conclusion, the dollar’s recent weakness demonstrates that economic models, while providing valuable frameworks, are not always sufficient to predict real-world market reactions. The interplay of investor sentiment, uncertainty, global economic conditions, and the perception of a country’s economic policies all contribute to the complex dance of exchange rates. Attributing the dollar’s behavior solely to the impact of tariffs oversimplifies a multifaceted issue with long-term ramifications. Understanding this complexity is crucial for navigating the increasingly interconnected and volatile global financial landscape.

Leave a Reply