The Unexpected Weakness of the Dollar: Defying Economic Logic

The US dollar, typically viewed as a safe haven asset, has recently exhibited puzzling behavior, defying established economic principles. While conventional wisdom suggests that protectionist trade policies, such as tariffs, should bolster a nation’s currency, the reality has proven far more nuanced and, in the current context, contradictory. The dollar’s recent weakness is a complex issue, stemming from a confluence of factors that extend beyond the simplistic textbook explanations.

One of the core tenets of basic economics dictates that increased tariffs, by limiting imports and potentially boosting domestic production, should lead to higher demand for the domestic currency. This increased demand, in turn, should drive up the value of the currency relative to others. Intuitively, this makes sense: if a country is perceived as being more self-sufficient and less reliant on foreign goods, its currency becomes more attractive to investors.

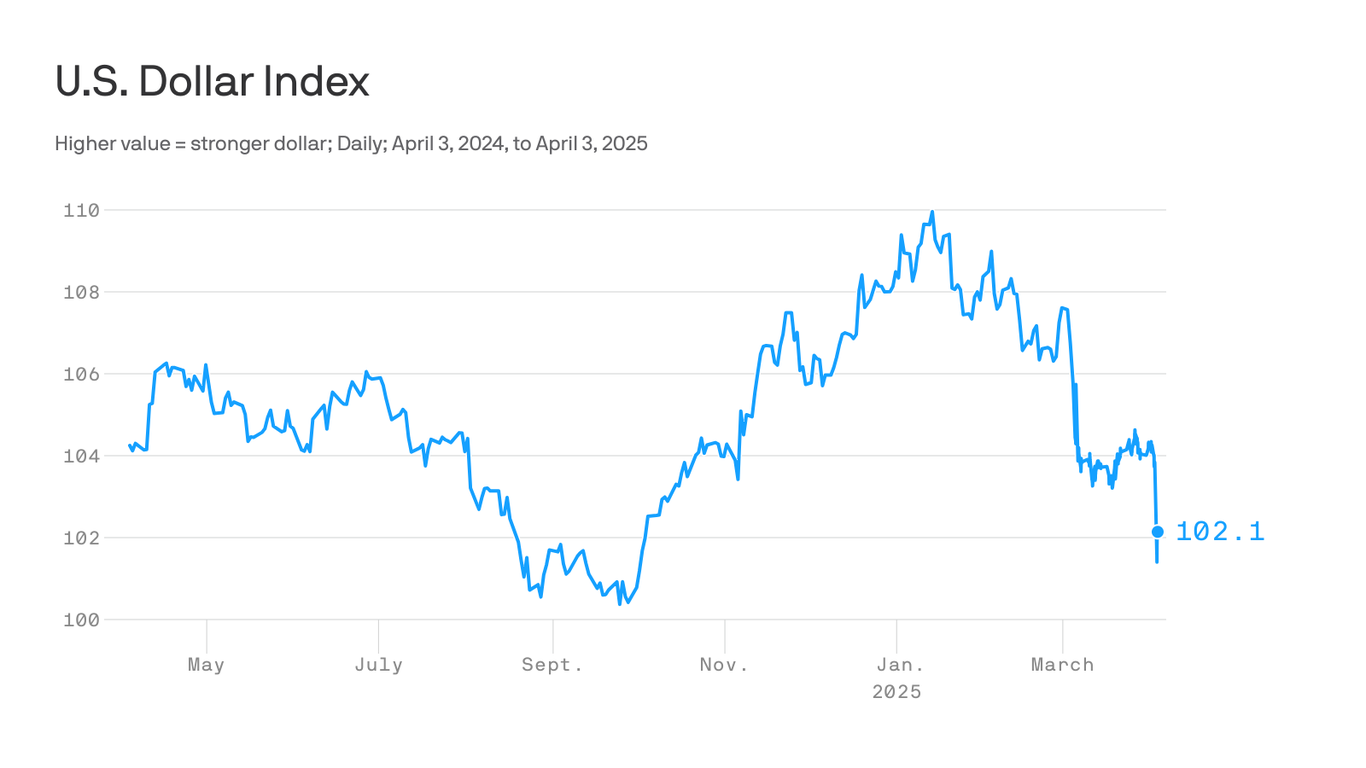

However, the recent imposition of significant tariffs has had the opposite effect. Instead of strengthening, the dollar has weakened, prompting a reevaluation of the prevailing economic models and a deeper dive into the intricacies of the global financial landscape. The disconnect between the theoretical impact of tariffs and their actual outcome highlights the importance of considering several crucial factors often overlooked in simplified analyses.

Firstly, market sentiment plays a crucial role. While tariffs might theoretically strengthen a currency, negative investor sentiment can easily override this effect. Fear of trade wars, uncertainty about future economic policies, and a general sense of instability can trigger capital flight, leading to a devaluation of the dollar. Investors often prioritize stability and predictability; if a country’s economic policies appear erratic or unpredictable, the value of its currency suffers.

Secondly, the magnitude and scope of the tariffs matter significantly. Imposing tariffs on a select few products might have a relatively minor impact, but imposing broad, sweeping tariffs can disrupt global supply chains, leading to higher prices for consumers and potentially harming economic growth. This negative economic outlook can outweigh the theoretically positive effects of the tariffs themselves, thus leading to a weaker dollar.

Thirdly, global economic conditions play a substantial part. The strength of a currency is not determined in isolation; it’s a relative measure influenced by the performance of other major economies. If other major currencies are performing better or are perceived as less risky, investors might shift their investments accordingly, leading to a weaker dollar regardless of the tariffs.

Finally, the reaction of other countries to the tariffs is critical. Retaliatory tariffs imposed by trading partners can negate any potential positive effects of the initial tariffs, and can even amplify the negative consequences. A trade war, characterized by tit-for-tat tariff increases, creates uncertainty and instability, further depressing investor confidence and weakening the dollar.

In conclusion, the dollar’s recent weakness in the face of significant tariffs underscores the limitations of simplified economic models and the importance of considering the broader geopolitical and macroeconomic context. While higher tariffs might theoretically strengthen a currency, the actual outcome depends on a complex interplay of factors, including investor sentiment, the scale of the tariffs, global economic conditions, and retaliatory actions from other nations. The current situation serves as a reminder that the dynamics of international finance are far more intricate than often portrayed, and simplistic explanations are frequently inadequate.

Leave a Reply