The Unexpected Weakness of the Dollar: A Conundrum of Tariffs and Market Sentiment

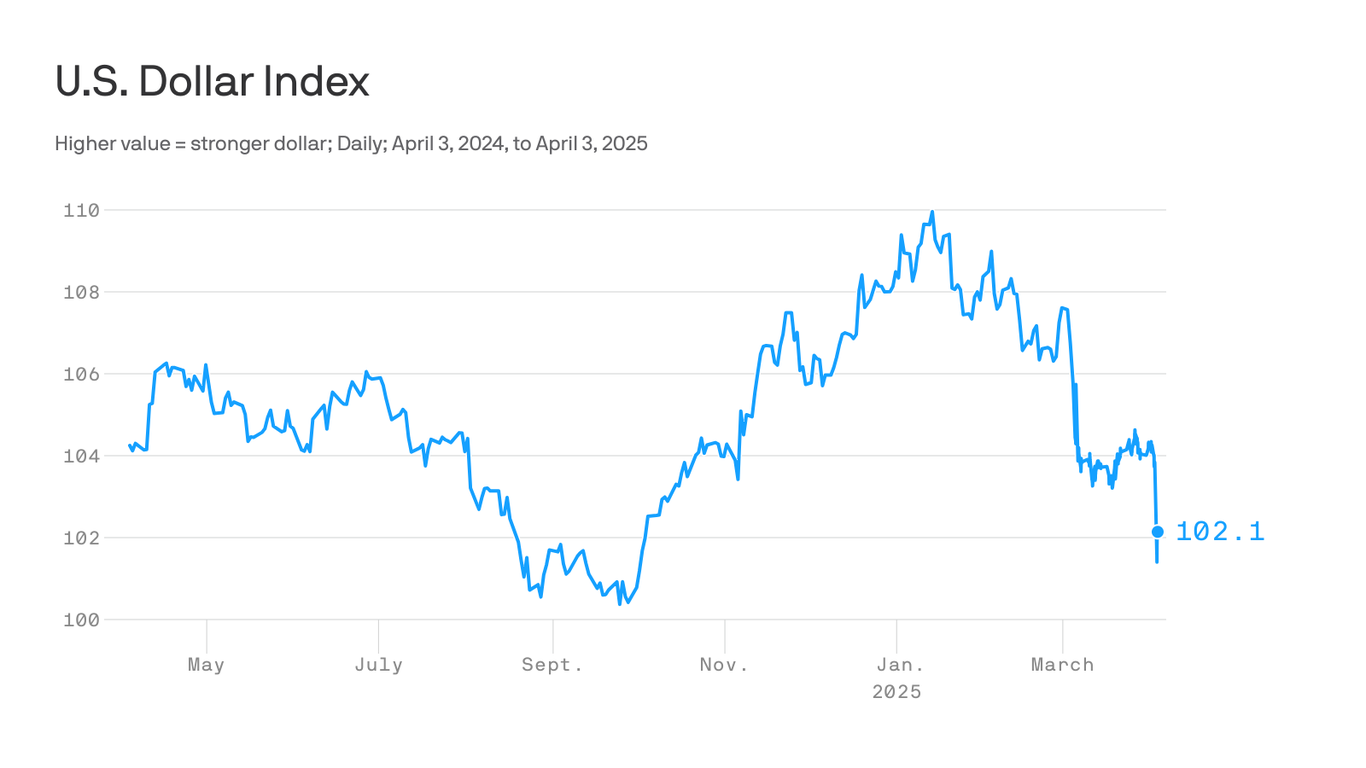

The US dollar, typically perceived as a safe haven asset, has recently exhibited behavior that defies traditional economic models. While conventional wisdom suggests that imposing tariffs should strengthen a nation’s currency, the reality has been quite the opposite. The recent implementation of significant tariffs has, counterintuitively, led to a decline in the dollar’s value, leaving economists and market analysts scrambling for explanations.

The core principle at play is the relationship between trade balances and currency valuation. Higher tariffs, in theory, make imports more expensive, reducing the demand for foreign currencies needed to purchase these goods. Simultaneously, they can boost domestic production, increasing the demand for the domestic currency. This combined effect usually leads to currency appreciation. However, the current situation demonstrates the limitations of this simplified model, highlighting the intricate interplay of various economic factors.

One critical factor contributing to the dollar’s weakness is investor sentiment. The imposition of tariffs is often perceived as a sign of economic instability and protectionism. This perception can negatively impact investor confidence, leading them to reduce their holdings of dollar-denominated assets. Uncertainty surrounding the future trade relations and the potential for retaliatory tariffs from other countries further exacerbates this negative sentiment. Investors, seeking safety and stability, may shift their investments towards other currencies deemed less risky.

Furthermore, the magnitude of the tariffs imposed plays a significant role. While modest tariffs might lead to the anticipated strengthening of the currency, large-scale tariffs can trigger a different response. The sheer scale of these trade actions can overwhelm the positive effects predicted by basic economic models. The resulting disruption to global trade flows, supply chains, and investor confidence may overshadow any localized benefits from increased domestic production.

Another important aspect to consider is the global economic landscape. The strength of a currency isn’t determined solely by domestic factors. The relative strength of other major currencies and the overall global economic health significantly influence its value. If other economies are performing better or experiencing less uncertainty, investors might be more inclined to shift their investments away from the dollar, regardless of tariff policies.

Beyond these macroeconomic elements, market speculation and currency trading dynamics play a crucial role. Currency markets are highly volatile and susceptible to short-term fluctuations driven by news events, trader sentiment, and speculative trading activities. Any negative news related to the tariffs, or even the perception of such negativity, can trigger a rapid sell-off in the dollar, further amplifying its decline.

In conclusion, the current weakness of the dollar, despite the imposition of tariffs, underscores the complexity of international finance. While basic economic theory suggests a positive correlation between tariffs and currency strength, the reality is far more nuanced. The interplay of investor sentiment, the magnitude of tariffs, global economic conditions, and speculative trading all contribute to the dollar’s performance, demonstrating that simple models often fail to capture the dynamism of real-world markets. The current situation serves as a reminder of the limitations of relying solely on textbook economics when analyzing complex global phenomena.

Leave a Reply