The Unexpected Weakness of the Dollar: A Conundrum of Tariffs and Markets

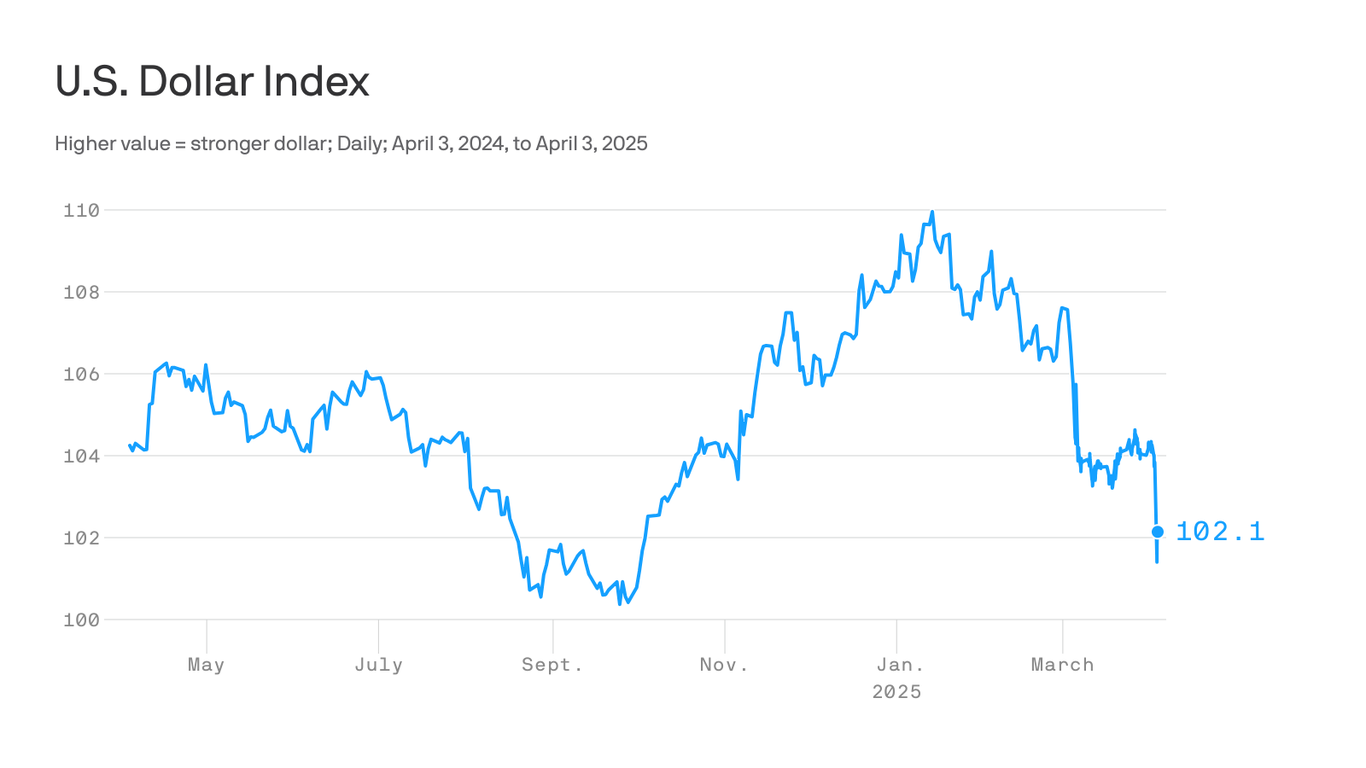

The US dollar, the world’s reserve currency, is behaving in a way that defies traditional economic principles. While higher tariffs are typically expected to bolster a nation’s currency, the recent imposition of significant tariffs has, counterintuitively, caused the dollar to weaken. This unexpected trend raises important questions about the complexities of global economics and the limitations of textbook models.

Economic theory suggests that tariffs, by increasing the cost of imported goods, should reduce the demand for foreign currencies and increase the demand for the domestic currency. This increased demand, in turn, should lead to appreciation of the domestic currency – in this case, the dollar. Imports become more expensive, leading to decreased demand for foreign goods and a corresponding increase in demand for domestically produced goods, bolstering the domestic currency. The logic seems straightforward.

However, reality, as is often the case, proves far more nuanced. The current situation demonstrates that the impact of tariffs extends far beyond simple supply and demand mechanics. Several factors contribute to the dollar’s unexpected weakness despite the imposition of substantial tariffs.

Firstly, market confidence plays a crucial role. The imposition of tariffs can be interpreted as a sign of economic instability or protectionism, potentially eroding confidence in the long-term health of the economy. This decreased confidence can trigger capital flight, as investors seek safer havens for their investments. This outflow of capital weakens the dollar, outweighing the theoretical strengthening effect of the tariffs themselves.

Secondly, the global interconnectedness of markets cannot be ignored. Tariffs imposed by one country inevitably impact other economies, leading to retaliatory measures and trade disputes. These trade wars can disrupt global supply chains, increase uncertainty, and negatively impact economic growth – all of which contribute to dollar weakness. The ensuing uncertainty discourages investment, leading to a decrease in demand for the dollar.

Thirdly, the specific nature and magnitude of the tariffs matter significantly. If the tariffs are targeted at specific sectors, their impact on the overall economy might be limited, failing to generate the expected surge in demand for the dollar. Conversely, broad-based tariffs can significantly disrupt trade flows and hurt economic growth, leading to the weakening observed.

Furthermore, the reaction of central banks and other global players influences currency valuations. Central banks may adjust monetary policies in response to tariff-induced economic changes, further impacting the dollar’s exchange rate. These policy responses are often unpredictable and can exacerbate or mitigate the effects of the tariffs.

The dollar’s current behavior serves as a stark reminder that economic models, while useful, cannot fully capture the intricate dynamics of global markets. The interplay of confidence, global interconnectedness, specific tariff designs, and central bank reactions creates a complex web of factors that ultimately determine the behavior of currencies. The seemingly simple relationship between tariffs and currency valuation becomes far more complex when considering these wider economic forces. The unexpected weakening of the dollar under the weight of tariffs highlights the need for a more sophisticated understanding of the intricate forces that shape the global financial landscape. It compels a reassessment of traditional economic models and a deeper consideration of the multifaceted nature of international trade and its impact on currency valuation.

Leave a Reply