The Unexpected Weakness of the Dollar: A Conundrum of Tariffs and Trade

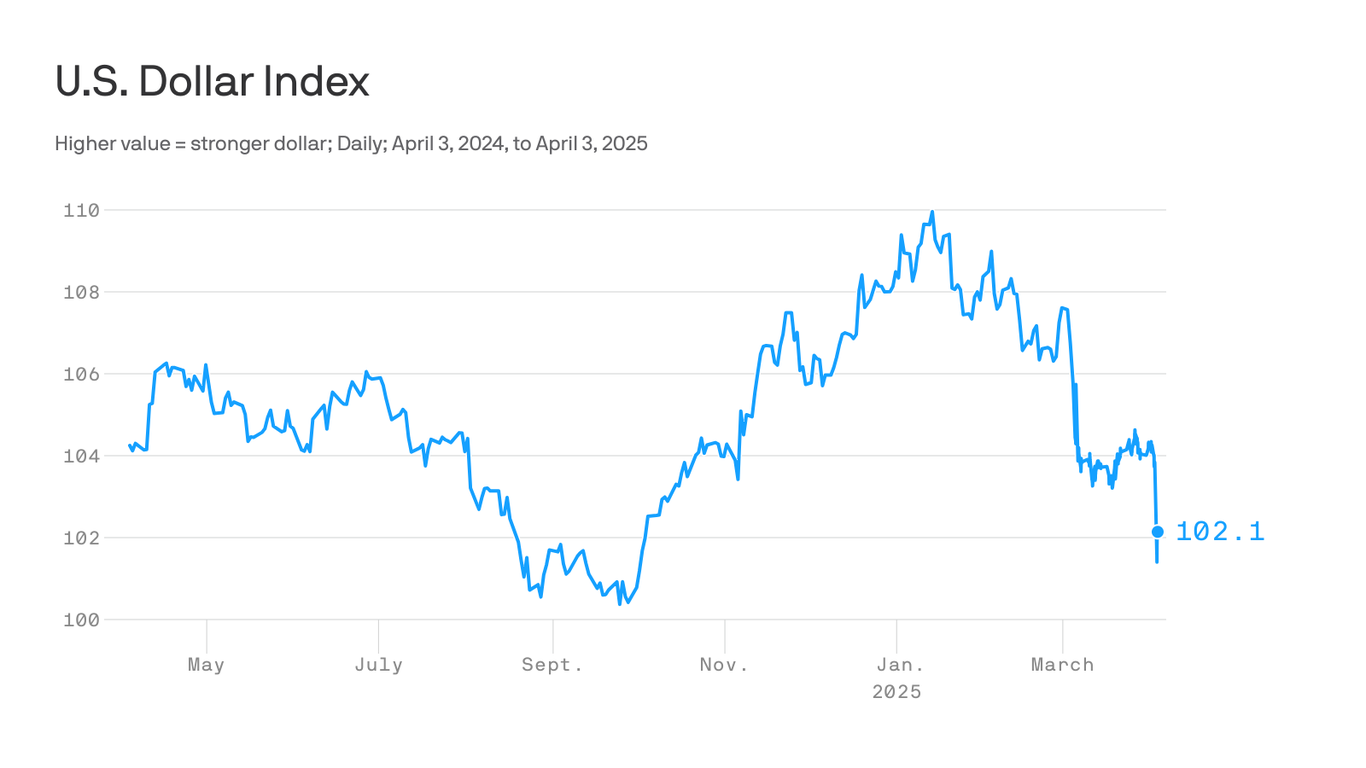

The US dollar, often seen as a beacon of stability in the global financial landscape, has recently exhibited behavior that contradicts established economic principles. This unexpected weakness, particularly in the face of significant tariff announcements, is a complex issue warranting closer examination. Conventional wisdom, rooted in basic economics, suggests that increased tariffs should lead to a strengthening of the domestic currency. However, recent events paint a different picture.

The prevailing economic theory posits that tariffs, by making imports more expensive, reduce the demand for foreign currencies. This reduced demand, in turn, should increase the relative value of the domestic currency, in this case, the dollar. Essentially, if it costs more to buy goods from abroad, people will buy fewer of them, decreasing the demand for foreign currencies needed to make those purchases. This should logically lead to a strengthening of the dollar.

Yet, the reality has been far more nuanced. Significant tariff announcements have, in certain instances, been followed by a weakening rather than a strengthening of the dollar. This discrepancy demands a deeper exploration of the factors at play beyond the simplistic supply and demand model of currency exchange.

One critical element is investor sentiment and market expectations. The imposition of tariffs can be interpreted as a sign of trade instability and potential disruptions to global supply chains. This uncertainty can trigger capital flight, as investors seek safer havens for their investments, reducing demand for the dollar and thus weakening its value. This flight to safety might outweigh the effect of reduced import demand.

Furthermore, the scale and scope of the tariffs play a crucial role. While small, targeted tariffs might have a limited impact, large-scale tariffs affecting a significant portion of trade can have broad consequences. These extensive measures could generate significant uncertainty, overshadowing any potential benefits from reduced import demand and ultimately leading to a negative market reaction.

Another contributing factor is the global economic landscape. If the global economy is experiencing weakness or uncertainty, the effect of tariffs on the dollar can be amplified. A weakening global economy can increase investor risk aversion, leading to a preference for safe-haven assets that are not necessarily correlated with trade policies.

The interconnected nature of the global financial system also complicates the picture. The reaction of other countries to US tariffs, their retaliatory measures, and the resulting ripple effects across global markets all contribute to the overall uncertainty surrounding the dollar’s performance. A trade war, for instance, could trigger a chain reaction of negative economic impacts, overwhelming any positive effects of the tariffs themselves.

Finally, the credibility and predictability of policy decisions also influence investor confidence. If tariff announcements are perceived as erratic or inconsistent, this can further undermine confidence in the dollar, leading to increased volatility and potential weakening.

In conclusion, while economic theory suggests a straightforward relationship between tariffs and currency values, the real-world dynamics are far more complex. Investor sentiment, global economic conditions, retaliatory measures, and the overall predictability of policy decisions all interact to shape the actual impact of tariffs on the dollar’s value. Understanding these intricate relationships is critical for navigating the complexities of the global financial market. The unexpected weakness of the dollar in the face of tariffs serves as a powerful reminder that simple economic models often fail to capture the full complexity of real-world phenomena.

Leave a Reply