The Dollar’s Unexpected Dip: A Conundrum of Trade and Confidence

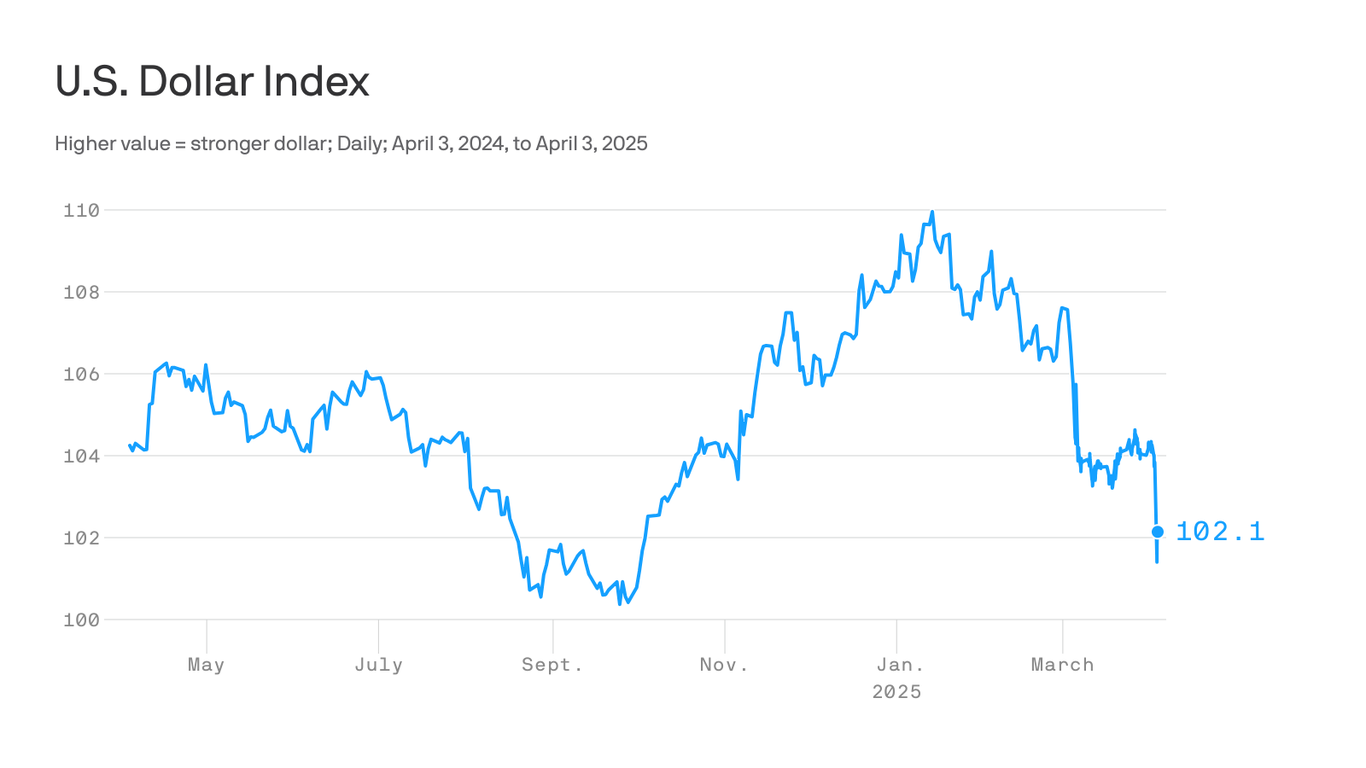

The US dollar, typically viewed as a safe haven asset, has recently exhibited behavior defying traditional economic principles. While increased tariffs are generally expected to strengthen a nation’s currency, the recent imposition of significant trade barriers has, counterintuitively, led to a decline in the dollar’s value. This unexpected trend highlights a complex interplay of factors beyond simple supply and demand dynamics.

The conventional wisdom, rooted in basic economic theory, suggests that tariffs should boost a currency. Higher tariffs make imported goods more expensive, reducing demand for foreign currencies needed to purchase them. This decreased demand, in theory, should increase the relative value of the domestic currency. However, the reality is far more nuanced.

The recent tariff announcements, while aiming to protect domestic industries, have instead sparked concerns about their broader economic impact. Investors are weighing the potential benefits of reduced reliance on foreign goods against the significant risks associated with retaliatory tariffs and trade wars. Uncertainty is a potent force in financial markets, and the current trade climate is riddled with it.

The perceived negative impact on global trade is a key driver of the dollar’s weakness. The tariffs are not merely affecting specific sectors; they’re fostering a climate of apprehension about the future of international commerce. This uncertainty discourages investment, both domestic and foreign, and leads to a flight from the dollar as investors seek safer alternatives. This capital outflow weakens the dollar’s demand, contributing to its decline.

Beyond the immediate effects of the tariffs, the broader implications for global growth are also playing a significant role. If the trade disputes escalate, hindering global economic growth, it could negatively impact demand for the dollar as a reserve currency. Many international transactions are conducted in dollars, and a slowdown in global trade directly translates to reduced demand for the currency. This further exacerbates the downward pressure on the dollar.

Furthermore, the credibility of economic policy itself is being questioned. The unpredictable nature of trade policy undermines investor confidence. Businesses hesitate to make long-term investment decisions in an environment characterized by fluctuating tariffs and uncertain trade relations. This uncertainty reduces investment, impacting economic growth and, subsequently, the demand for the dollar.

In essence, the dollar’s current trajectory is less about the immediate impact of tariffs on import-export balances and more about a broader shift in investor sentiment. The fear of escalating trade wars, the uncertainty surrounding future policy decisions, and the potential for a slowdown in global economic growth are outweighing the theoretical strengthening effects of the tariffs themselves. The dollar’s decline serves as a stark reminder that economic models, while valuable, cannot fully capture the complexities of human behavior and the unpredictable nature of geopolitical events in a globalized marketplace. The situation underscores the need for a more holistic understanding of the intricate interplay between trade policy, investor confidence, and the performance of global currencies.

Leave a Reply