The American Dream, often envisioned as a cozy suburban home with a picket fence, is increasingly out of reach for many. The persistent and worsening housing affordability crisis is not a new problem, but its severity demands immediate attention. It’s a complex issue woven from a tapestry of factors, each pulling the dream further from grasp.

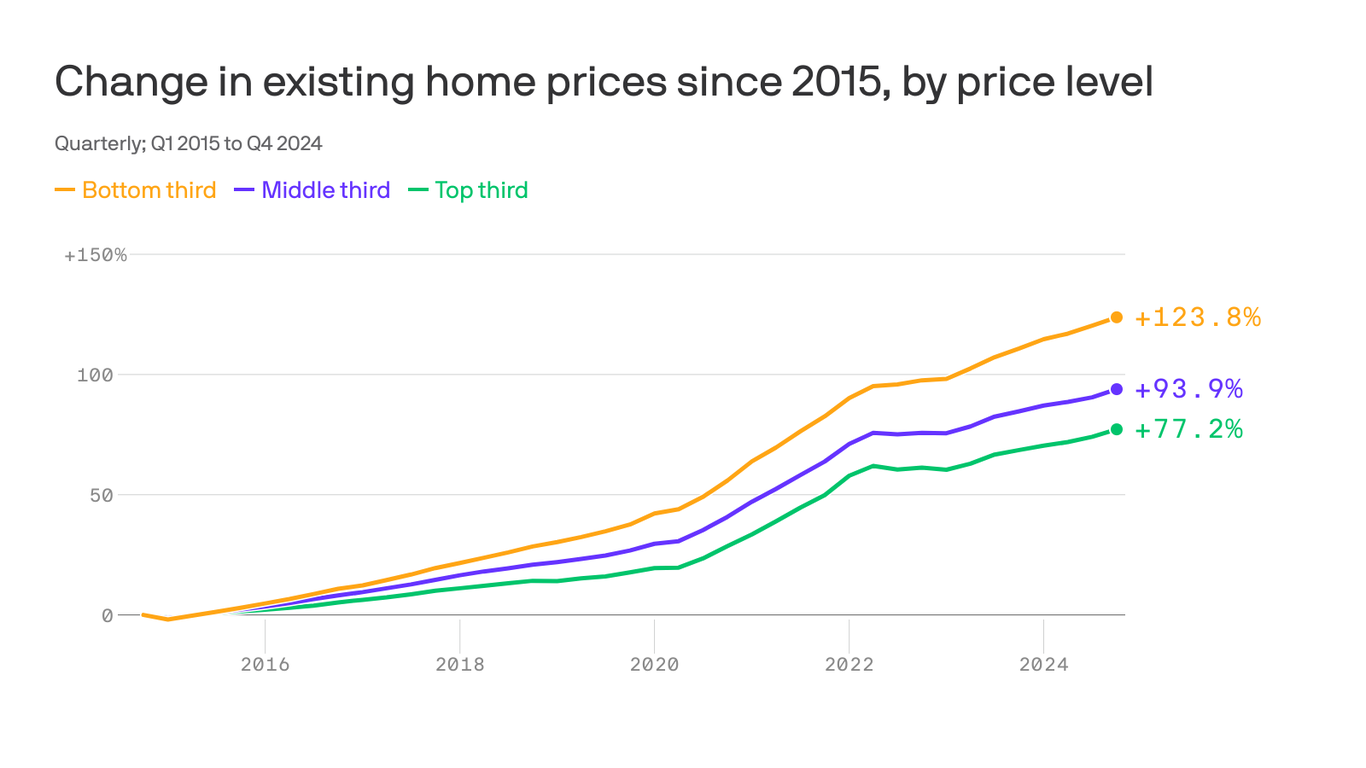

One of the most glaring culprits is the dramatic increase in home prices over the past decade. This isn’t just a general rise; the most affordable homes – those typically targeted by first-time buyers and lower-income families – have experienced the most significant price hikes. This disproportionate increase leaves a widening gap between what people can afford and what’s available on the market. It creates a vicious cycle, pricing out potential homeowners and further diminishing the supply of affordable housing.

The shortage of affordable homes itself is a key driver of rising prices. Simple economics dictates that when demand outstrips supply, prices climb. The lack of sufficient housing inventory, especially in desirable locations near jobs and amenities, fuels this upward pressure. This shortage isn’t solely a matter of construction lagging behind population growth. It’s also influenced by restrictive zoning regulations, lengthy permitting processes, and a lack of investment in affordable housing initiatives. These policies often inadvertently favor higher-end development, further exacerbating the scarcity of affordable options.

Beyond the immediate impact on homeownership, the crisis significantly affects the rental market. As more people are priced out of homeownership, the demand for rental properties surges. This increased demand, combined with limited rental inventory, leads to skyrocketing rents. This pushes even more individuals and families into precarious financial situations, where a significant portion of their income goes towards housing, leaving little for other essential needs. The consequences extend beyond individual hardship; it affects economic stability and social well-being. Individuals struggling with housing insecurity are less likely to participate fully in the workforce and their communities, creating a ripple effect with wider societal impacts.

Addressing this complex challenge requires a multi-pronged approach. Simply increasing the supply of homes isn’t enough; those homes must be genuinely affordable. This necessitates a shift in policy, encouraging the development of affordable housing through incentives and regulations. Relaxing restrictive zoning laws that limit density and variety in housing types can significantly expand the supply. Streamlining the permitting process and investing in infrastructure to support new construction can help accelerate the development of more affordable housing options.

Furthermore, innovative financing models are needed to make homeownership more accessible. Expanding down payment assistance programs, promoting shared equity programs, and developing creative rental assistance options can help bridge the affordability gap for vulnerable populations. Investing in community land trusts and other non-profit housing initiatives can ensure that affordable housing remains permanently affordable.

Ultimately, solving the housing affordability crisis demands a collaborative effort from policymakers, developers, community organizations, and individuals. Only through a comprehensive strategy that addresses both the supply and demand sides of the equation can we hope to rebuild the American Dream of homeownership and create thriving, equitable communities for everyone.

Leave a Reply