The American Dream, long synonymous with homeownership, is increasingly out of reach for many. The relentless climb in housing costs is not just a matter of rising prices; it’s a complex crisis fueled by a perfect storm of factors, leaving countless individuals and families struggling to find affordable places to live.

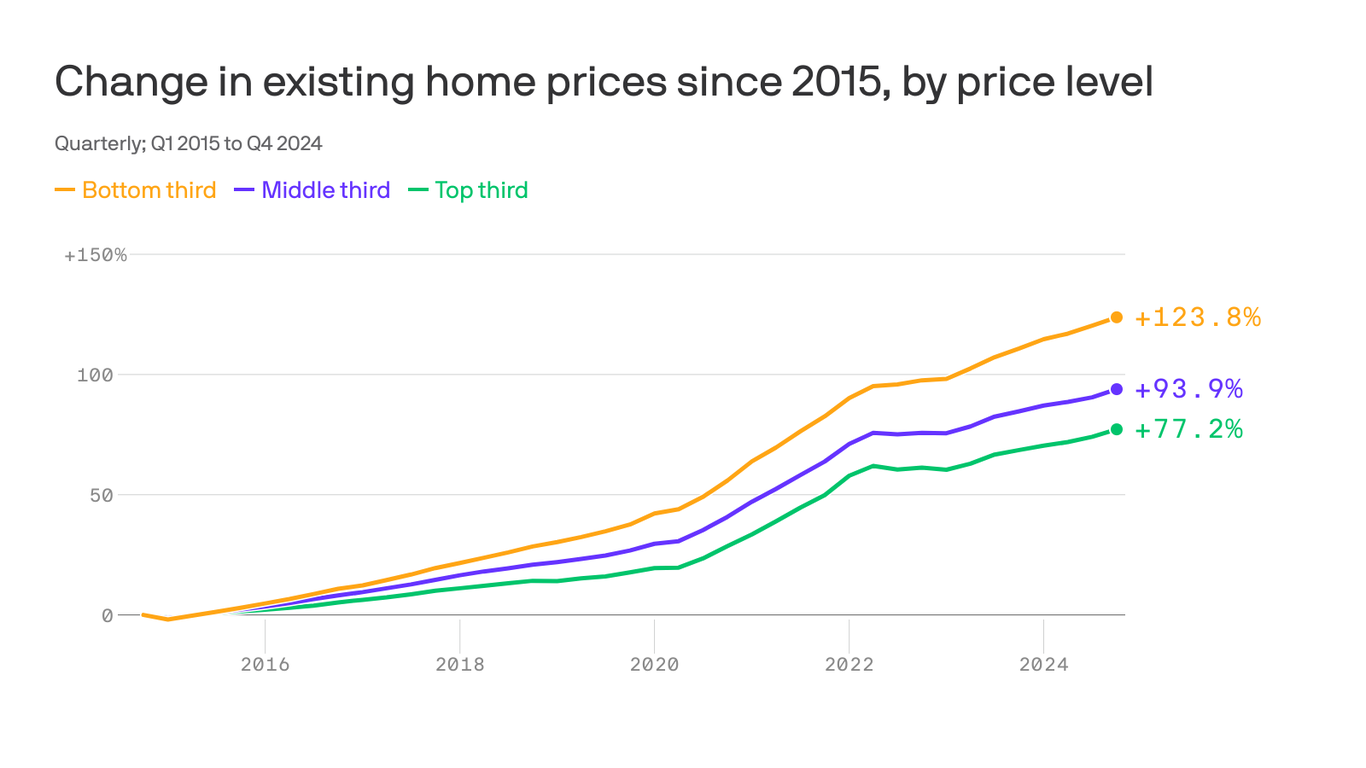

One of the most significant contributors is the stark shortage of affordable housing. Simply put, there aren’t enough homes available for those who need them most – those with lower to moderate incomes. This scarcity creates intense competition, driving up prices far beyond what many can reasonably afford. The problem isn’t limited to luxury homes; it’s the “affordable” homes that have experienced the most dramatic price increases, effectively pricing out those who previously might have qualified.

This shortage isn’t accidental. Decades of underinvestment in affordable housing initiatives have left a gaping hole in the market. Restrictions on zoning and land use regulations in many areas often favor larger, more expensive developments, limiting the construction of smaller, more budget-friendly homes. This creates a system where the supply of affordable options simply can’t keep pace with demand.

Furthermore, the financial landscape itself contributes significantly. Interest rates, while fluctuating, play a major role in affordability. Higher interest rates translate directly into higher monthly mortgage payments, pushing even modestly priced homes further out of reach. This is particularly impactful on first-time homebuyers, who often rely on loans and have limited savings.

The ripple effects extend far beyond the immediate housing market. The lack of affordable housing has a profound impact on economic mobility and social equity. When individuals spend an unsustainable portion of their income on rent or mortgage payments, they have less money available for other essential needs, such as food, healthcare, and education. This can trap families in a cycle of poverty, making it extremely difficult to improve their financial circumstances. Furthermore, it impacts community vibrancy, as families are forced to move further from their jobs, schools, and support networks, creating social isolation and straining infrastructure.

The issue is further compounded by factors like inflation and increasing material costs associated with building new homes. The cost of lumber, concrete, and labor has risen significantly, making new construction more expensive and contributing to the overall price escalation. This creates a vicious cycle; higher costs mean less affordable housing is built, leading to even greater scarcity and higher prices.

Addressing this complex crisis requires a multi-pronged approach. Increasing the supply of affordable housing through strategic zoning reforms, incentivizing the development of affordable units, and investing in public housing are crucial first steps. Additionally, exploring alternative housing models, such as co-housing and accessory dwelling units (ADUs), can provide innovative solutions. Finally, policymakers need to implement policies that protect renters and ensure that rent prices don’t spiral out of control, providing a safety net for those unable to afford homeownership. Without comprehensive and collaborative action, the dream of affordable housing will remain elusive for a growing number of Americans.

Leave a Reply