The End of the Social Security Paper Check: A Generational Shift and its Potential Impact

For generations, the arrival of a Social Security check in the mail has been a familiar ritual, a tangible symbol of financial security for millions of Americans. But that familiar ritual is facing a significant change, with the potential to disrupt the lives of a substantial number of recipients. A recent government initiative aims to eliminate paper checks entirely, shifting all payments to direct deposit. While proponents argue this modernization is efficient and secure, the transition raises crucial concerns about accessibility and potential hardship for a vulnerable population.

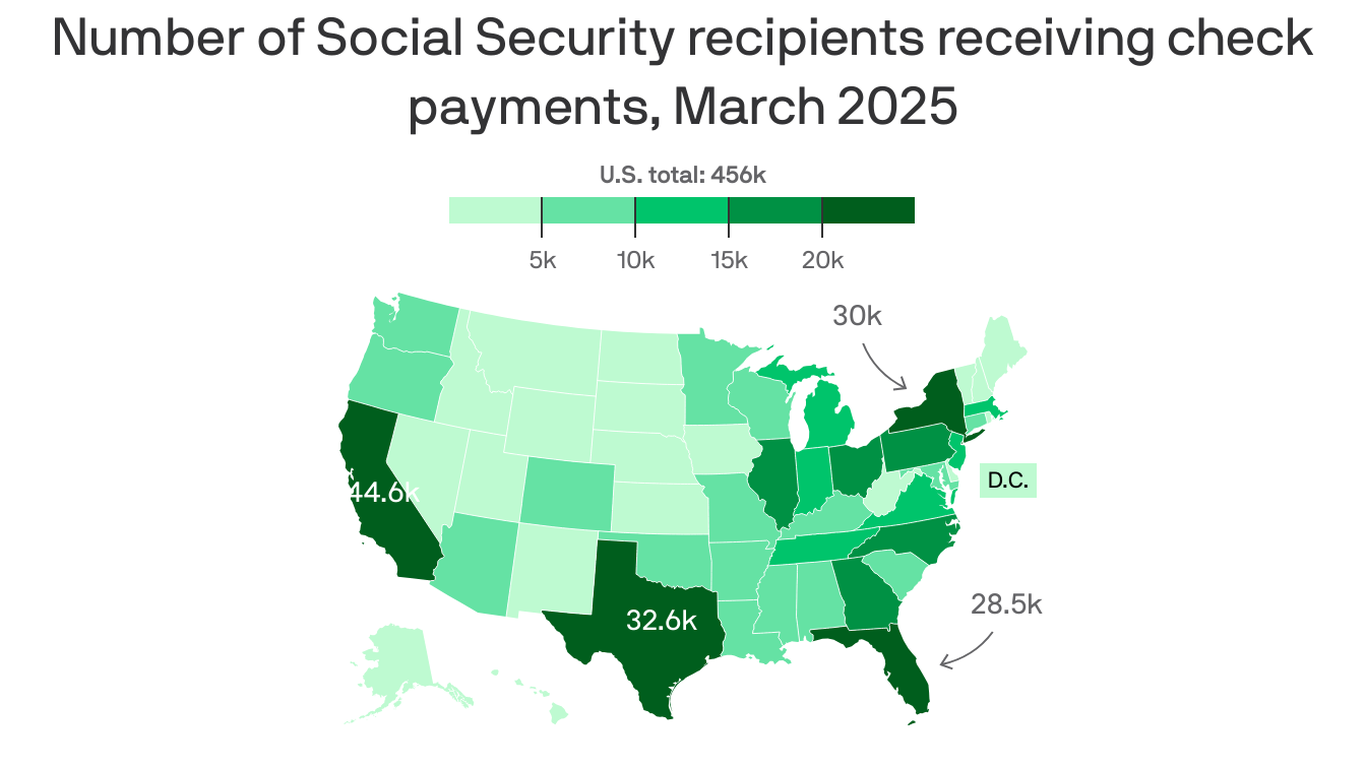

The sheer number of individuals affected underscores the magnitude of this shift. Estimates suggest that nearly half a million Americans currently receive their Social Security benefits via paper check. This represents a significant segment of the population, many of whom may be elderly, technologically challenged, or lacking access to banking services. For these individuals, the paper check isn’t simply a method of payment; it’s a vital lifeline, a predictable and reliable source of income that allows them to manage their finances and maintain their independence.

The transition to direct deposit, while seemingly simple, presents a considerable hurdle for those accustomed to the familiar process of receiving a physical check. For some, opening a bank account might be an insurmountable task, requiring navigation of complicated paperwork, understanding unfamiliar banking terminology, and potentially incurring fees that further strain their limited budgets. Others might reside in areas with limited access to banking facilities, making the switch impractical, if not impossible. Furthermore, the reliance on technology inherent in online banking presents a challenge for those with limited digital literacy.

The potential for errors and delays during the transition also deserves attention. The process of updating records and ensuring accurate direct deposit information requires meticulous attention to detail. Any mistakes could result in delayed or missed payments, creating significant financial hardship for those already living on a tight budget. The potential for fraud, while reduced with direct deposit, is not eliminated entirely. The transition requires a robust system to prevent identity theft and ensure the safety of sensitive financial information.

Beyond the immediate logistical challenges, this change reflects a larger societal trend – the gradual erosion of traditional methods of payment and the increasing reliance on digital technologies. While this digital shift brings efficiency and security for many, it disproportionately affects those who lack the resources or the skills to adapt. The government has a responsibility to ensure a smooth and equitable transition, recognizing the unique needs and vulnerabilities of the population affected. This responsibility extends beyond merely issuing directives; it necessitates proactive measures to assist and support those who need help navigating this change. Initiatives aimed at improving financial literacy, expanding access to banking services, and providing personalized assistance during the transition are critical to mitigate the potential negative impacts on these individuals and their financial well-being.

The end of the Social Security paper check marks a significant moment, not just in the evolution of government payments, but also in highlighting the digital divide and the challenges faced by those left behind in the rapid advancement of technology. A carefully managed and supportive transition is not just desirable—it’s essential for ensuring the continued financial security of a significant portion of the American population.

Leave a Reply