The Economy’s Tightrope Walk: Tariffs, Recessions, and the Shifting Sands of Trade

The current economic climate is a precarious tightrope walk, balanced precariously between the potential benefits of protectionist trade policies and the very real threat of a looming recession. A significant contributing factor to this tension is the ongoing debate surrounding tariffs – those taxes imposed on imported goods. While proponents argue that tariffs protect domestic industries and jobs, critics warn of their potential to spark inflationary pressures, disrupt global supply chains, and ultimately trigger a widespread economic downturn.

The historical perspective is crucial here. Previous administrations have generally approached trade with a focus on fostering international collaboration and free market principles. The prevailing wisdom was that open markets stimulate competition, lower prices for consumers, and lead to overall economic growth. This approach valued the interconnectedness of the global economy and sought to avoid actions that could disrupt this delicate balance.

However, a recent shift in approach has injected a new level of uncertainty. A more protectionist stance, emphasizing the prioritization of domestic industries through tariffs and other trade barriers, has been adopted. The core argument centers on the idea that these measures will revitalize domestic manufacturing, create jobs, and bolster national economic strength. The underlying assumption is that the short-term pain of potentially higher prices and disrupted trade will be offset by long-term gains in domestic production and employment.

This strategy, however, runs counter to the prevailing wisdom among many economists and market analysts. They warn that tariffs can lead to a domino effect of negative consequences. Firstly, higher prices on imported goods can translate directly into increased inflation, squeezing consumers’ purchasing power and potentially dampening overall consumer demand. Secondly, tariffs can disrupt global supply chains, leading to shortages of essential goods and components, further hindering economic activity. Businesses may face increased production costs, reducing their competitiveness and potentially leading to job losses, contradicting the very goal of the tariffs themselves.

Furthermore, the retaliatory actions often triggered by protectionist measures can further escalate the situation. If countries respond to tariffs with their own, a trade war can ensue, leading to a substantial reduction in global trade and a significant drag on global economic growth. This can easily tip the scales towards a recession, with widespread negative consequences for employment, investment, and consumer confidence.

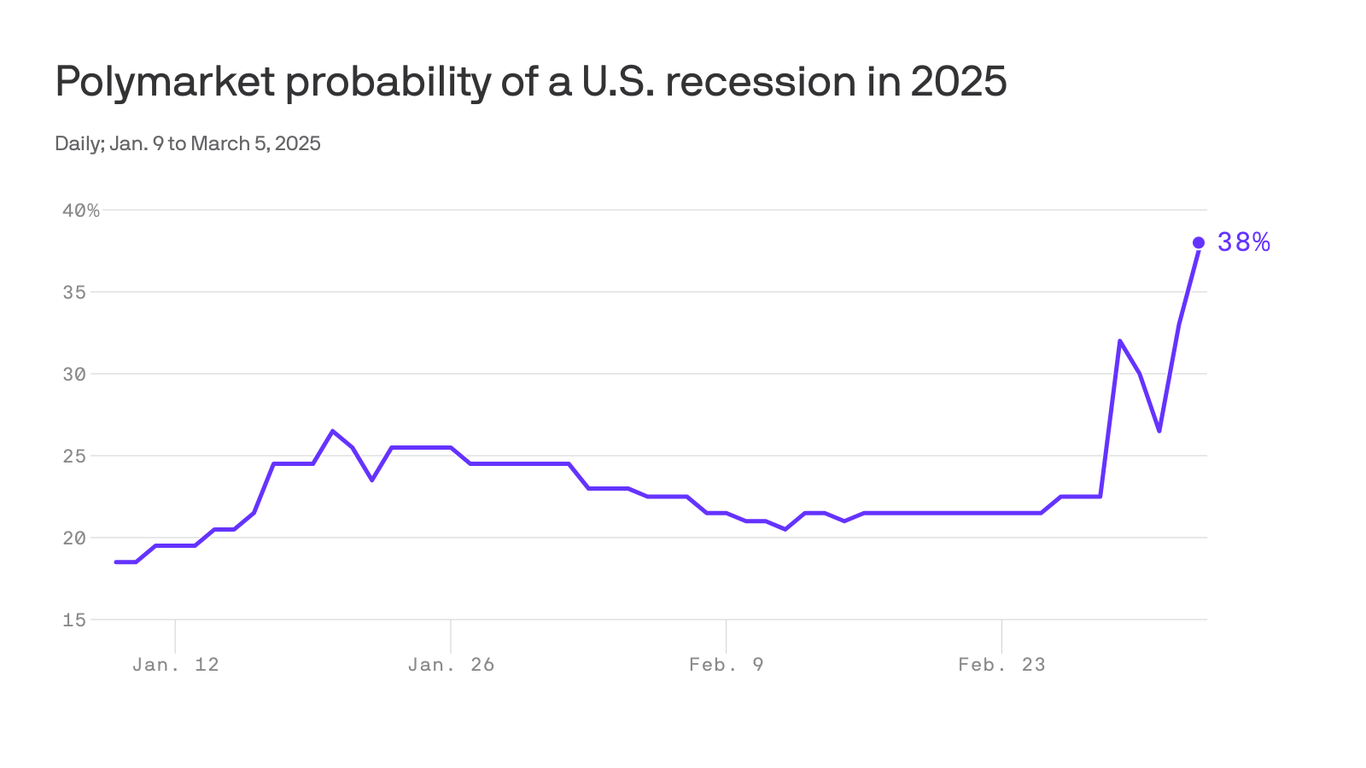

The market’s reaction to these trade policies often serves as a barometer of investor sentiment and reflects concerns about the potential economic ramifications. A decline in stock markets, increased volatility, and a flight to safer assets can be interpreted as a signal of growing anxiety about the economic outlook. This highlights the intricate interplay between trade policy and overall economic health. The potential for a recession is not just a theoretical concern; it’s a real and present danger that needs to be carefully considered. The challenge lies in finding a balance between protecting domestic industries and safeguarding the overall health of the global economy – a delicate balancing act with potentially significant consequences.

Leave a Reply