The Silent Tax on the Everyday: How Tariffs Disproportionately Impact Low-Income Households

We often hear about economic policies discussed in broad strokes, as if they impact everyone equally. But the reality is far more nuanced. One area where this disparity is starkly evident is the impact of tariffs on different income brackets. While tariffs might appear to be a straightforward mechanism to protect domestic industries, their consequences are far-reaching and disproportionately burden those least equipped to handle them.

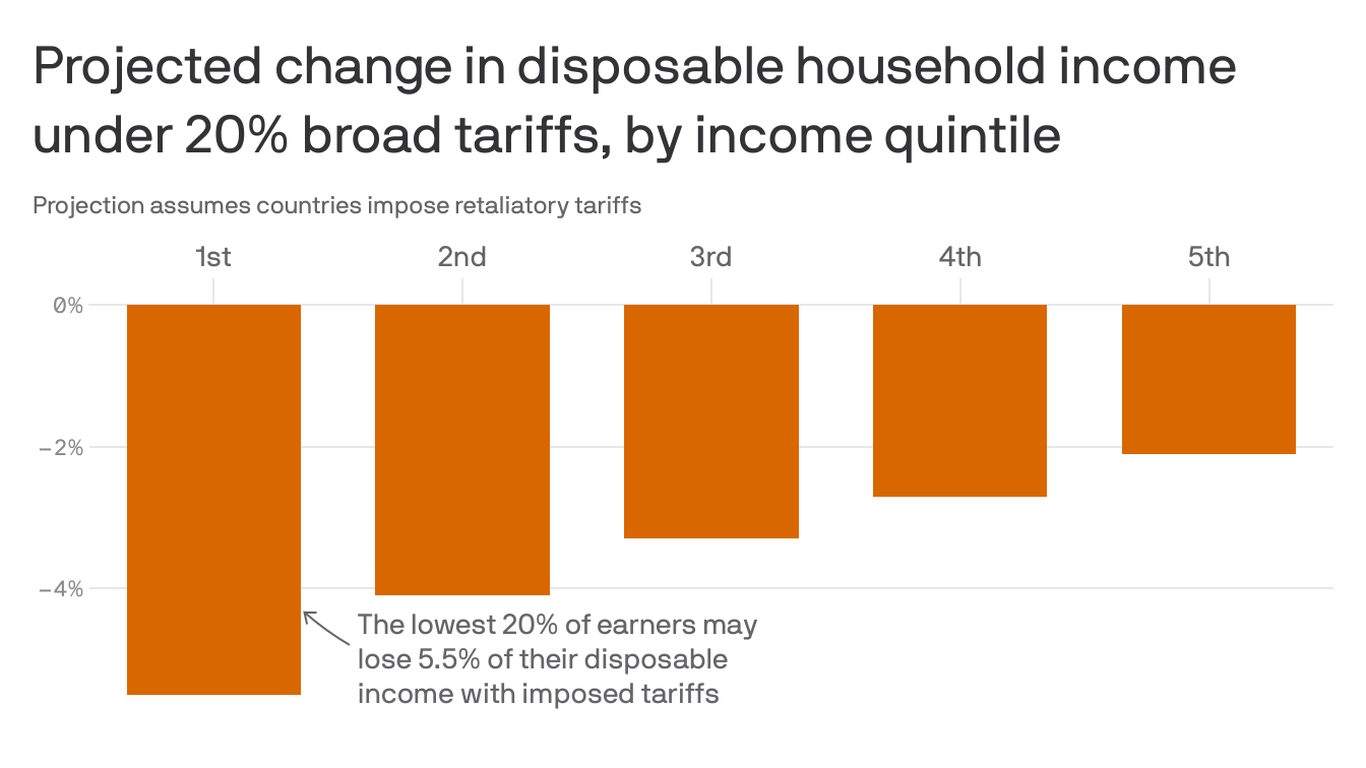

The core issue lies in the fundamental economics of consumption. Lower-income households typically spend a significantly larger portion of their disposable income on essential goods and services. This contrasts sharply with higher-income individuals who have a greater capacity to save and invest. When tariffs are imposed, leading to increased prices on imported goods, it directly squeezes the budgets of those already operating on thin margins.

Consider the everyday essentials: clothing, food, electronics – many of these items rely heavily on global supply chains and are thus susceptible to tariff increases. A modest increase in the price of imported clothing might be a minor inconvenience for a high-income earner, easily absorbed within their overall budget. For a low-income family, however, that same increase could mean sacrificing other necessities, potentially impacting their ability to afford groceries, childcare, or even transportation.

The argument often made in favor of tariffs centers on protecting domestic industries and creating jobs. While this objective might be laudable, the reality is often more complicated. The potential job creation in one sector might be offset by job losses in others due to higher input costs for businesses that rely on imported goods. Furthermore, the benefits of such job creation rarely reach the lower-income segments of the population, leaving them to bear the brunt of the price increases without any corresponding economic uplift.

The impact extends beyond direct price increases. Inflation, fueled by higher import costs, affects everyone, but its effects are amplified for lower-income individuals. As prices rise across the board, they have fewer resources to absorb these shocks and are forced to make difficult choices, potentially leading to reduced consumption, decreased savings, and even increased debt.

This unequal distribution of the burden of tariffs highlights a significant flaw in policies that fail to account for the diverse economic realities of their citizenry. A truly effective economic policy should not only consider the aggregate effects but also assess how its consequences are distributed across different income levels. Blindly implementing protectionist measures without considering their social impact risks exacerbating existing inequalities and creating a system where the most vulnerable are disproportionately penalized.

Moving forward, a more equitable approach is needed. A thorough cost-benefit analysis of tariffs, carefully considering their impact on various income brackets, is essential. Moreover, implementing complementary social safety nets and targeted support programs can help mitigate the negative consequences for low-income households. Ultimately, ensuring that economic policies benefit all citizens, not just a select few, requires a more nuanced and empathetic understanding of their societal impact. Ignoring the disproportionate effects of tariffs on lower-income families is not only economically unsound but also socially unjust.

Leave a Reply