The Resurgence of Live Events: StubHub’s IPO and the Future of Ticket Resale

The live events industry, after a period of unprecedented disruption, is showing signs of a powerful comeback. This resurgence is perhaps best exemplified by StubHub’s recent filing for an Initial Public Offering (IPO). This move isn’t just about a single company; it’s a significant indicator of investor confidence in the enduring appeal and robust potential of the live entertainment sector.

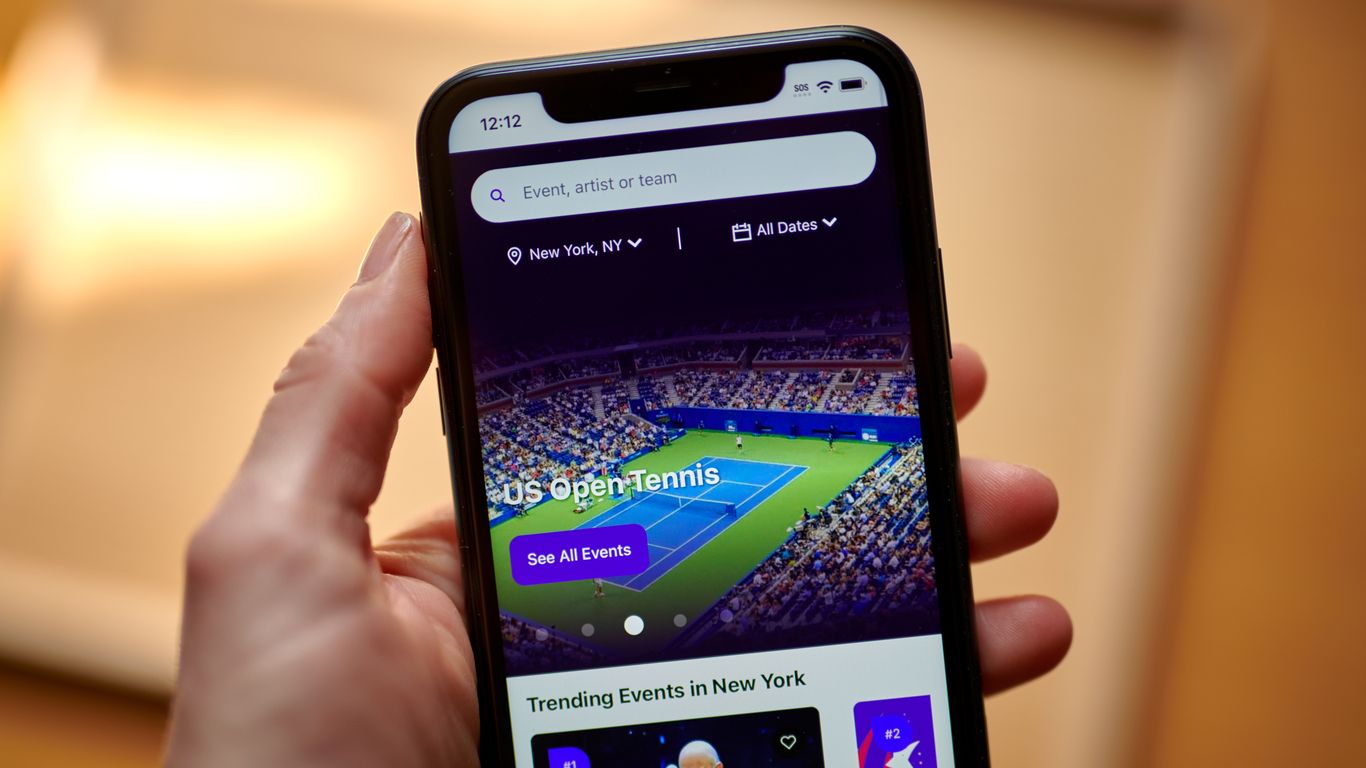

For years, the ability to easily buy and sell tickets to concerts, sporting events, and theatrical performances has been a cornerstone of the fan experience. The secondary market, where tickets are resold after the initial sale, provides a crucial level of flexibility for both buyers and sellers. It allows fans to snag tickets they might have missed during the initial sale, and it offers those who can no longer attend an event the opportunity to recoup some of their investment. Companies like StubHub have become central to this ecosystem, providing a platform for secure and streamlined transactions.

StubHub’s decision to pursue an IPO is a bold statement. It signals a belief that the demand for live experiences remains strong and that the secondary ticketing market is not only resilient but poised for continued growth. The company’s success will undoubtedly be linked to its ability to navigate a complex landscape that includes challenges like ticket fraud, price gouging, and the ever-evolving regulatory environment.

The IPO filing itself will provide a valuable window into the health of the live events industry. Investor response to the offering will act as a significant barometer, reflecting their assessment of the market’s future prospects. A successful IPO could trigger further investment in the sector, potentially leading to improved technology, enhanced security measures, and a more refined user experience for both buyers and sellers.

However, the road ahead is not without potential obstacles. The impact of economic uncertainty, inflation, and evolving consumer spending habits must be considered. Furthermore, the ongoing tension between primary ticket sellers and secondary market platforms continues to play a crucial role in shaping the overall landscape. The ongoing debate around fair pricing, the fight against bots and scalpers, and the implementation of dynamic pricing strategies are all factors that could significantly influence StubHub’s performance and the industry’s trajectory.

Despite these challenges, the fundamental appeal of live events remains undeniable. The shared experience, the energy of a live audience, and the emotional connection with performers are hard to replicate. These factors suggest a future where the demand for live entertainment remains high, driving the growth of platforms like StubHub. The outcome of StubHub’s IPO will not only determine the company’s fate, but also offer vital insights into the future trajectory of the entire live events industry, highlighting whether investors believe in the enduring power of in-person experiences. The coming months will be crucial in observing the market’s reaction and what it ultimately signifies for the future of live events and the secondary ticketing market.

Leave a Reply