The Resurgence of Live Events: StubHub’s IPO and the Future of Ticketing

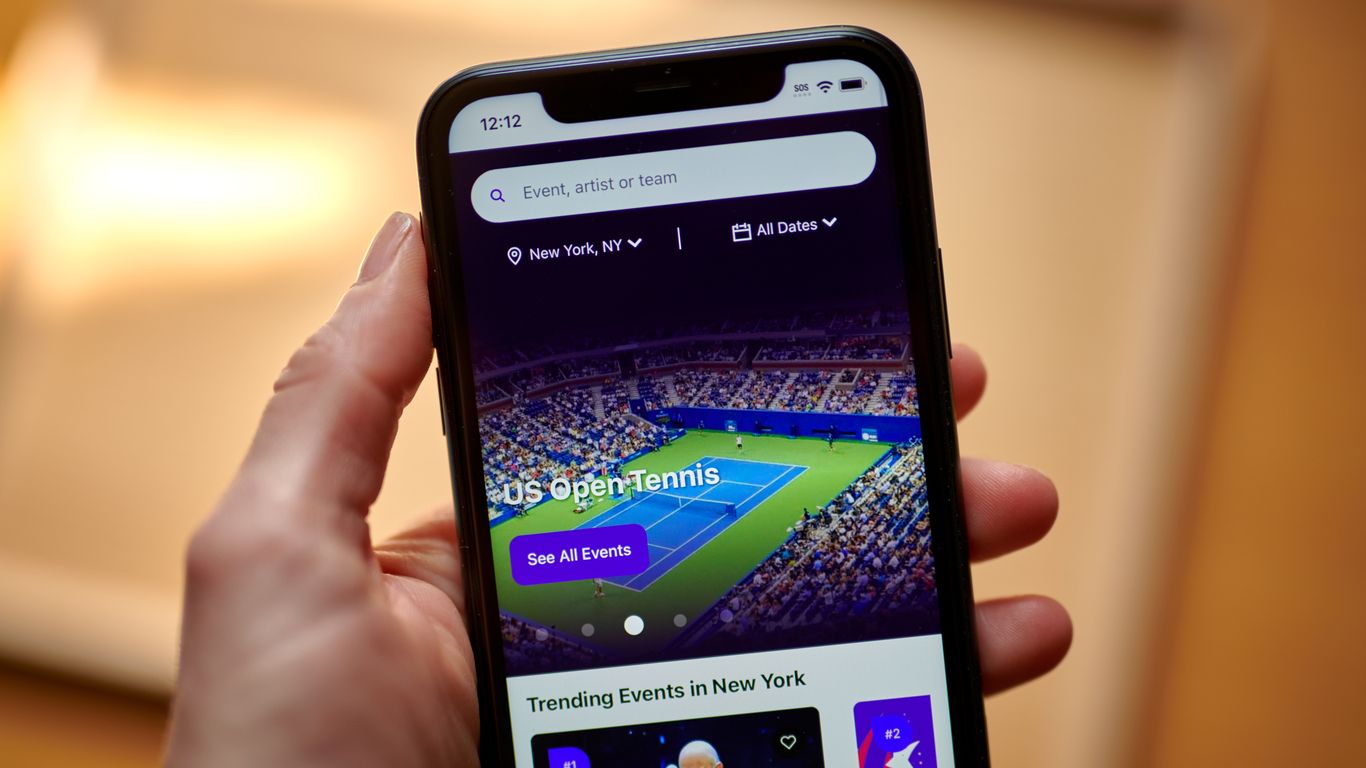

The live events industry, after a period of unprecedented disruption, is showing signs of a powerful comeback. This resurgence isn’t just anecdotal; it’s being reflected in the financial markets, with major players signaling confidence in the sector’s future. One such signal is the recent filing for an Initial Public Offering (IPO) by StubHub, a leading online ticket resale marketplace. This move is significant not just for StubHub itself, but for the entire live events ecosystem.

StubHub’s IPO signifies a crucial moment of validation. Investors, inherently risk-averse, are rarely willing to pour capital into industries perceived as unstable or facing long-term challenges. The fact that a company like StubHub, operating within the live events sphere, feels confident enough to pursue an IPO speaks volumes about the perceived health and growth potential of the sector. It suggests that investor confidence is returning, driven by a number of converging factors.

Firstly, the pent-up demand for live experiences is undeniable. After years of lockdowns and restrictions, people are eager to reconnect, to share experiences, and to engage with the entertainment they’ve been missing. Concerts, sporting events, theatrical performances – these are no longer just forms of entertainment; they are essential components of social life, and their resurgence is fueling a strong market recovery.

Secondly, the technological advancements within the ticketing industry itself have played a crucial role. Platforms like StubHub have refined their processes, enhancing security and transparency, mitigating some of the risks and anxieties associated with ticket resale. These advancements instill confidence in both buyers and sellers, contributing to a more robust and reliable marketplace. This increased trust, coupled with improved user experience, has significantly boosted both the volume and value of transactions.

However, the IPO is not without its complexities. The live events industry is still navigating uncertainties. Inflation, fluctuating economic conditions, and the ever-present possibility of unforeseen events (such as pandemics) remain significant factors. StubHub’s success following its IPO will depend on its ability to effectively manage these inherent risks and continue to adapt to the evolving landscape. The company’s performance will undoubtedly serve as a key indicator of future investment in the broader live events industry.

Furthermore, the IPO will likely influence the way other companies within the sector approach their own financial strategies. A successful listing for StubHub could trigger a wave of similar initiatives, fostering competition and innovation within the ticketing and resale market. It could also attract further investment into supporting technologies and infrastructure, ultimately contributing to a more sophisticated and efficient live events ecosystem.

In conclusion, StubHub’s IPO is more than just a financial transaction; it’s a powerful symbol of the live events industry’s recovery and a testament to its enduring appeal. The market’s response to this IPO will undoubtedly provide valuable insight into investor sentiment towards the future of live experiences, shaping the direction of the sector for years to come. It will be interesting to observe not only StubHub’s trajectory, but also the ripple effects of this pivotal moment on the broader industry.

Leave a Reply