The Return of Live: Is the Ticket Resale Market Ready for its Close-Up?

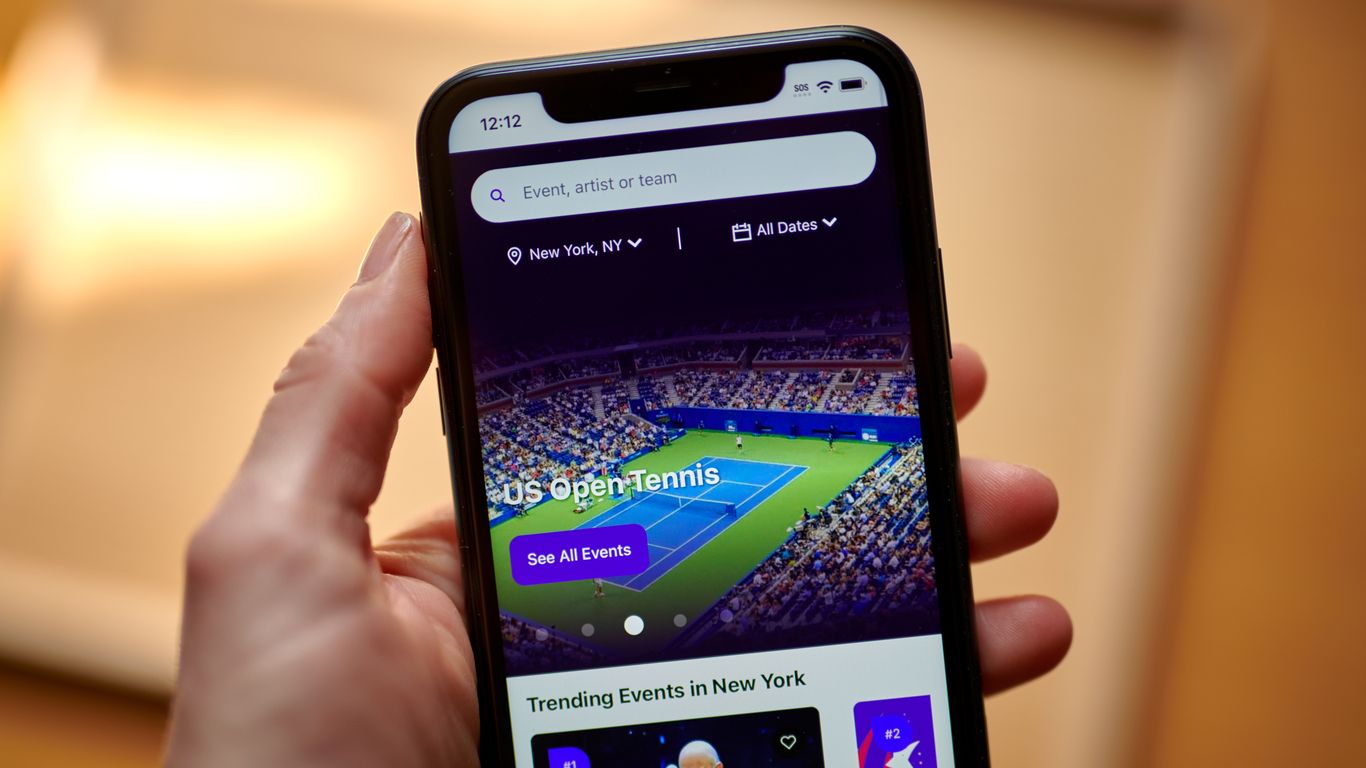

The live events industry, once a vibrant tapestry woven with the threads of shared experiences and unforgettable moments, endured a period of unprecedented dormancy. The pandemic’s shadow stretched long, silencing concerts, dimming the lights on Broadway, and leaving stadiums eerily empty. Now, as the dust settles and the roar of the crowd begins to resurface, a key player in this resurgence is stepping into the spotlight: the ticket resale market. A major player in this arena has recently filed for an Initial Public Offering (IPO), signaling a potential turning point in investor sentiment towards the entire live entertainment sector.

This move carries significant weight. It’s not just about one company’s financial ambitions; it’s a powerful indicator of broader market confidence. The decision to go public represents a bold bet on the future of live events. It suggests a belief that the demand for tickets, the desire for in-person experiences, has not only returned but is poised for sustained growth. The IPO itself will be carefully watched, acting as a barometer of investor optimism regarding the industry’s resilience and its capacity to recover from the significant setbacks of recent years.

Several factors contribute to this potential resurgence. The pent-up demand from individuals starved of live entertainment is undeniable. For many, attending a concert, sporting event, or theatrical production is not simply a form of leisure; it’s a vital social connection, a source of emotional release, and a shared cultural experience. This inherent human need, temporarily suppressed, is now driving a surge in ticket sales.

However, the success of this particular IPO, and indeed the overall health of the ticket resale market, is dependent on a number of factors. The ongoing economic climate will play a significant role. Inflation and economic uncertainty could potentially dampen consumer spending, impacting the demand for discretionary spending like event tickets.

Furthermore, the ongoing evolution of the live events landscape itself presents both opportunities and challenges. The rise of streaming services and virtual events has altered consumption habits, offering alternative forms of entertainment. The resale market will need to adapt and innovate to maintain its relevance in this evolving ecosystem. This might involve developing new technologies, enhancing customer experience, and perhaps even diversifying into related areas, such as offering bundled packages or enhanced experiences surrounding the events themselves.

The secondary market, the realm of ticket resale, offers a unique perspective on the demand for live entertainment. It’s a dynamic space, influenced by factors such as artist popularity, event location, and the overall economic climate. A successful IPO in this sector would not only validate the company’s business model but also serve as a powerful statement about the potential of the entire live events industry. It would suggest that investors see a future where concerts are packed, stadiums are roaring, and the shared experience of live entertainment thrives once more. The coming months will be critical in determining whether this optimism is justified and whether the resurgence of live events is truly sustainable. The IPO’s reception will provide a clear signal, offering valuable insights into the overall health and future prospects of an industry that holds a vital place in our culture and our lives.

Leave a Reply