The Thrill of the Hunt: Is the Resale Market Ready for its Close-Up?

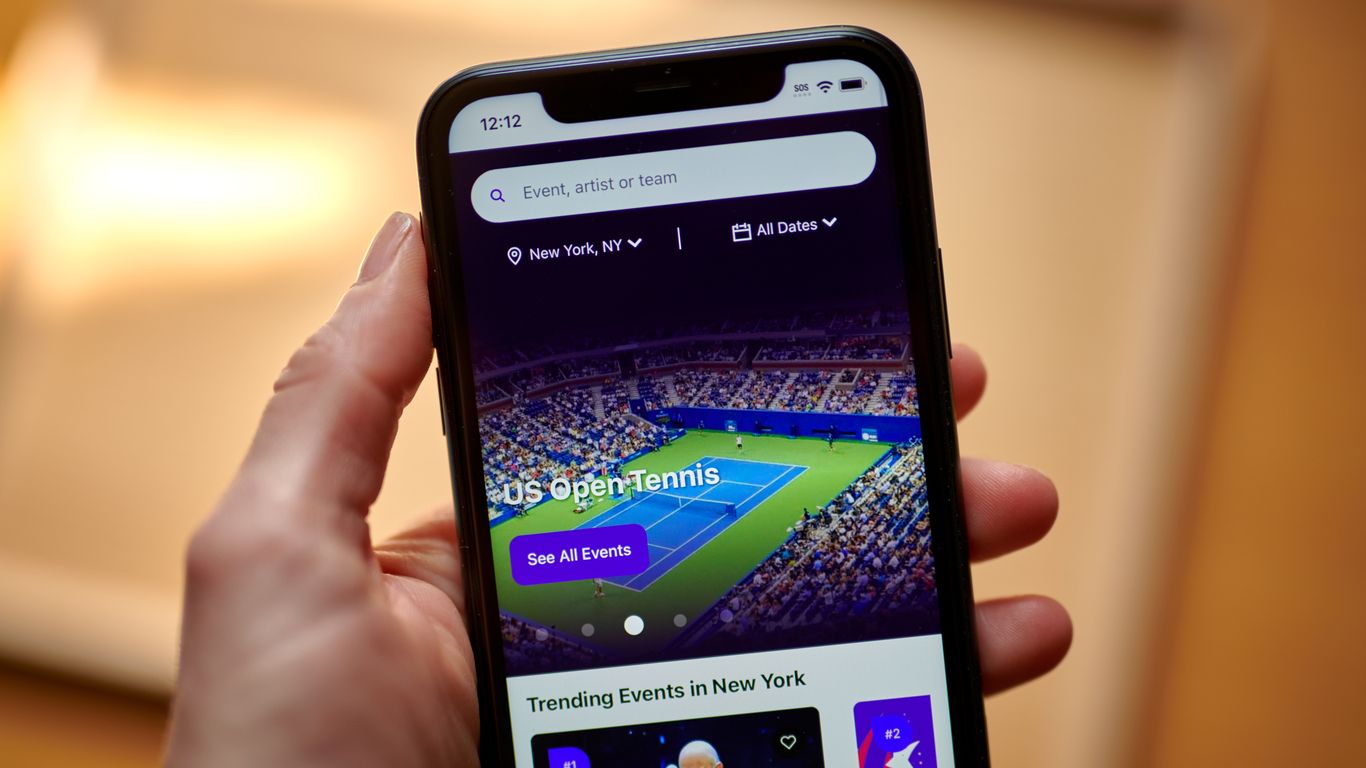

The live events industry – concerts, sporting events, theatre – it’s a world built on anticipation, excitement, and the fleeting nature of a perfect moment. Now, a crucial player in that world is stepping into the spotlight, preparing to test investor sentiment in a way that could reshape the landscape. A major player in the ticket resale market is preparing for an Initial Public Offering (IPO), a move that signals not just their own ambitions, but also a broader assessment of the health and future of the live entertainment sector.

For years, these secondary ticket marketplaces have operated somewhat in the shadows, a vital yet often controversial component of the events ecosystem. They cater to a diverse audience – those who missed out on the initial sale, those seeking better seats, and those willing to pay a premium for immediate access. Their existence, however, has sparked debate. Concerns around inflated prices, scalping, and the potential for fraud have frequently cast a shadow on the ease and convenience they provide.

This impending IPO throws these complex issues into sharp relief. The decision to go public is a bold one, a calculated gamble that hinges on a positive evaluation of several key factors. First, it demands confidence in the long-term viability and growth potential of the live events industry itself. Are investors truly convinced that post-pandemic, the appetite for in-person experiences remains strong and shows no signs of waning? Will attendance figures consistently meet, or even exceed, pre-pandemic levels? The answer to these questions is crucial for assessing the inherent risk associated with investing in a company so deeply intertwined with this sector.

Secondly, the success of this IPO will depend heavily on the company’s ability to present a compelling narrative – one that addresses the ethical considerations surrounding ticket resale. Transparency, robust anti-fraud measures, and a commitment to fair pricing will be critical in securing investor trust. Simply put, investors won’t back a company dogged by a reputation for contributing to inflated prices or facilitating scams. A successful IPO demands a demonstration of responsible business practices and a clear strategy for mitigating potential risks and addressing ethical concerns.

Beyond these immediate concerns, the IPO represents a larger conversation about the evolving relationship between technology, commerce, and entertainment. The platform itself acts as a sophisticated, technology-driven marketplace, facilitating transactions and connecting buyers and sellers on a global scale. This technological prowess is undeniably a significant asset, offering opportunities for innovation and expansion. However, it also necessitates ongoing investments in security, data protection, and user experience, all of which will impact profitability and growth.

Ultimately, this IPO is much more than a single company’s quest for capital. It’s a barometer gauging the broader investor confidence in the live events industry’s post-pandemic recovery and its future trajectory. The outcome will offer valuable insights into how the financial markets perceive the resilience and potential of this vital sector, shaping not only the future of this specific company, but also influencing the strategies and valuations of others operating within the same ecosystem. The thrill of the hunt for that perfect ticket, it seems, now extends to the world of finance.

Leave a Reply