The Thrill of the Hunt, the Risk of the Investment: StubHub’s IPO and the Future of Live Events

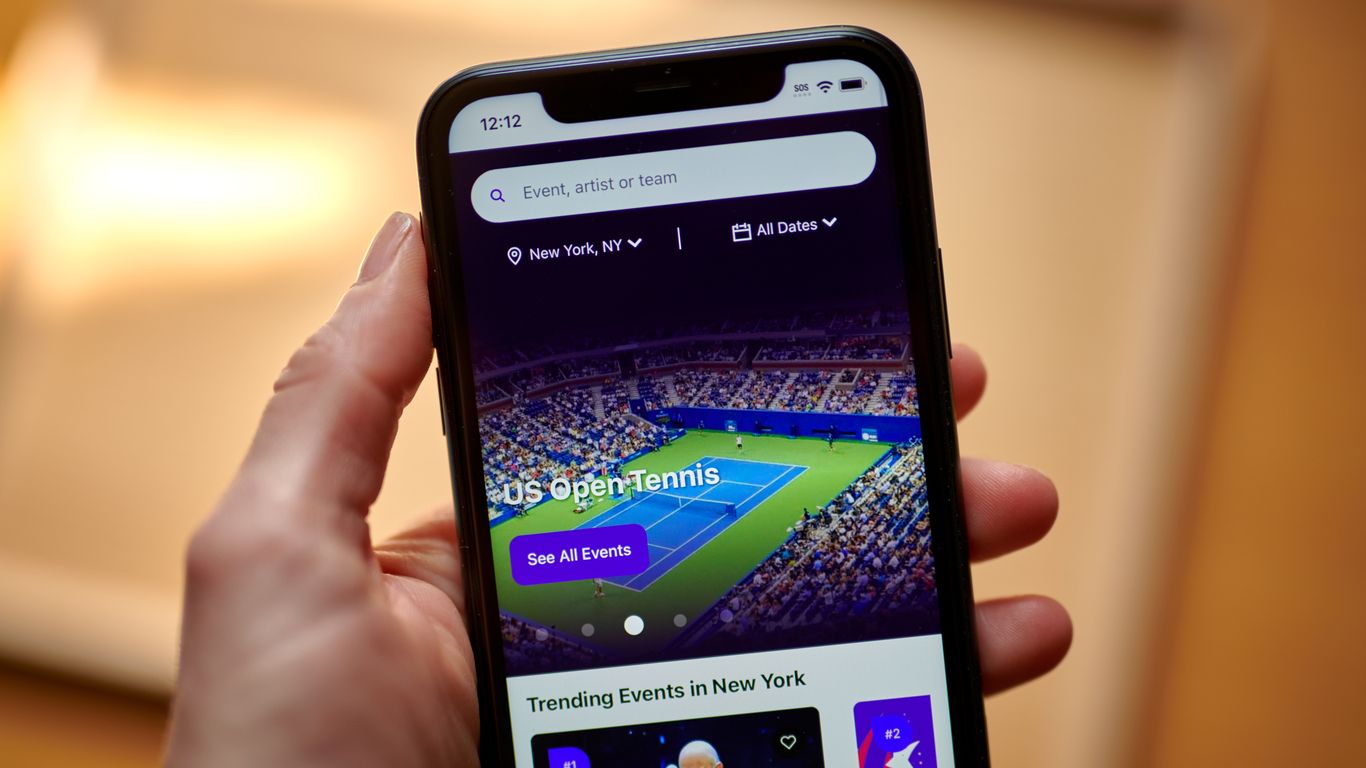

The world of live events – concerts, sporting matches, theatrical performances – thrives on anticipation, excitement, and, increasingly, the secondary market. For years, StubHub has been a major player in this secondary market, connecting buyers and sellers of tickets long after official sales have ended. Now, the company is taking a significant leap, filing for an Initial Public Offering (IPO), signaling a potential turning point not just for StubHub itself, but for the entire live events industry.

StubHub’s decision to go public is a bold move, fraught with both opportunity and risk. Its success hinges on the broader investor sentiment towards the live events sector, a sector that has faced its share of challenges in recent years. The pandemic, for example, brought the industry to a near standstill, forcing cancellations, postponements, and leaving many event organizers and related businesses struggling to survive. The resulting economic fallout deeply impacted ticket sales, both primary and secondary.

However, the industry is showing signs of a strong recovery. The pent-up demand for live experiences is undeniable. People are eager to reconnect, to share in collective moments of joy and excitement, and to experience the unique energy that only a live event can provide. This resurgence in demand is reflected in the increasing ticket prices and the persistent activity on platforms like StubHub.

StubHub’s IPO, therefore, acts as a significant barometer of investor confidence in this resurgence. A successful IPO would not only provide StubHub with the capital it needs for future growth and expansion but also serve as a powerful endorsement of the entire live events ecosystem. It would signal to other businesses in the sector – from ticketing companies to venue operators – that the future is bright and that investment is warranted.

Conversely, a less-than-successful IPO could cast a shadow on the industry’s recovery. It could send a message that investors remain hesitant about the long-term viability of live events, potentially hindering future investment and hindering growth. This uncertainty underscores the significance of StubHub’s IPO – it’s not just about a single company; it’s about the health and future trajectory of an entire industry.

The success of StubHub’s IPO will depend on a number of factors, including its financial performance, its growth strategy, and the overall market conditions. But perhaps the most critical element is the continued recovery and growth of the live events industry itself. The company’s ability to navigate the ongoing challenges of the industry – including issues of ticket fraud, pricing volatility, and evolving consumer preferences – will also play a critical role.

In essence, StubHub’s IPO represents more than just a financial transaction; it represents a vote of confidence (or a lack thereof) in the enduring appeal of live experiences. It is a powerful statement about the resilience of the industry and its potential for continued growth in the years to come. The coming weeks and months will reveal not only the financial success of StubHub’s IPO but also offer valuable insights into the investor sentiment towards the future of live events – a sector that holds a special place in our culture and continues to captivate millions worldwide.

Leave a Reply