The Roar of the Crowd: Is the Live Events Industry Ready for its Close-Up?

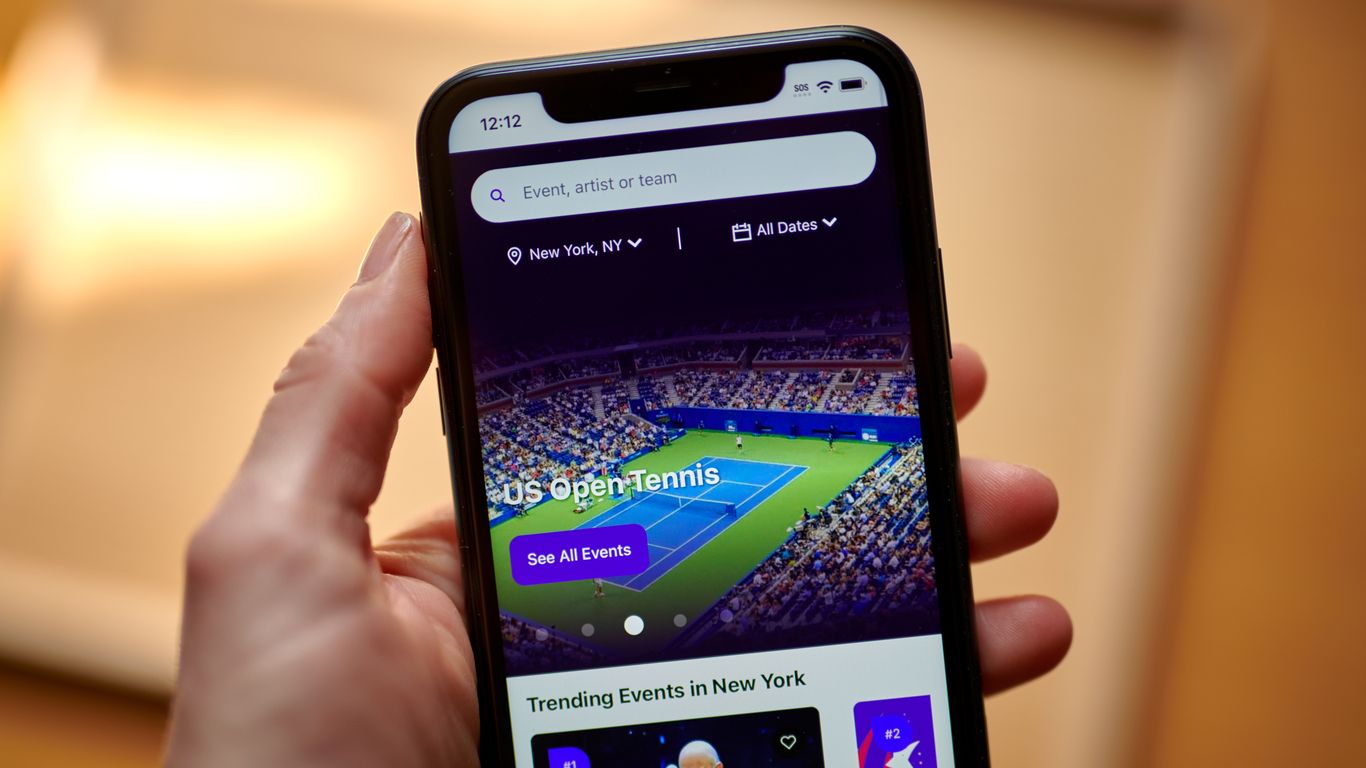

The live events industry, a vibrant tapestry woven with the threads of music, theatre, sports, and countless other experiences, has always pulsed with energy. But the recent filing of a major player in the ticket resale market for an Initial Public Offering (IPO) suggests a significant shift in how investors perceive this dynamic sector. This move could signal a turning point, offering a crucial barometer for the industry’s health and future potential.

For years, the secondary ticket market has operated in a somewhat shadowy realm. While providing a crucial avenue for fans to acquire tickets when primary sales are exhausted, it’s also been fraught with concerns about inflated pricing and the potential for fraud. The entry of a major player into the public market signifies a desire for greater transparency and legitimacy. This move could serve as a catalyst for much-needed industry-wide reform. It suggests a potential shift towards stricter regulation and a greater focus on consumer protection. Imagine a future where the buying and selling of tickets is more streamlined, secure, and equitable for both buyers and sellers.

The IPO itself acts as a powerful statement about the perceived resilience and growth potential of the live events sector. Investors are, essentially, placing a significant bet on the enduring appeal of live experiences. They are wagering that, despite the rise of streaming and virtual entertainment, the human desire for shared, in-person experiences will continue to thrive. This confidence in the long-term prospects of the industry is particularly noteworthy given the challenges it has faced recently. The pandemic dramatically disrupted the sector, forcing cancellations, postponements, and a widespread shift in consumer behavior.

However, the success of this IPO will be far from guaranteed. The financial health of the live events industry remains intricately linked to various factors, including macroeconomic conditions, consumer spending habits, and the ever-present threat of unforeseen events. The pricing of tickets, the accessibility of events, and the overall fan experience will all play crucial roles in determining the long-term viability and attractiveness of the industry to investors. Furthermore, the company’s ability to navigate the complexities of the secondary market, including concerns around price gouging and counterfeit tickets, will be vital for its future success.

This IPO is more than just a financial transaction; it’s a referendum on the health and future of the live events industry. It reflects a belief that the intrinsic value of live experiences – the energy of a crowd, the connection with performers, the shared memory – will continue to draw people together, regardless of technological advancements. The success or failure of this venture will provide invaluable insights into the industry’s prospects, potentially shaping future investments and influencing the evolution of the live events landscape for years to come. The curtain is rising on a new chapter, and the world is watching to see if the show will go on, and indeed, thrive.

Leave a Reply