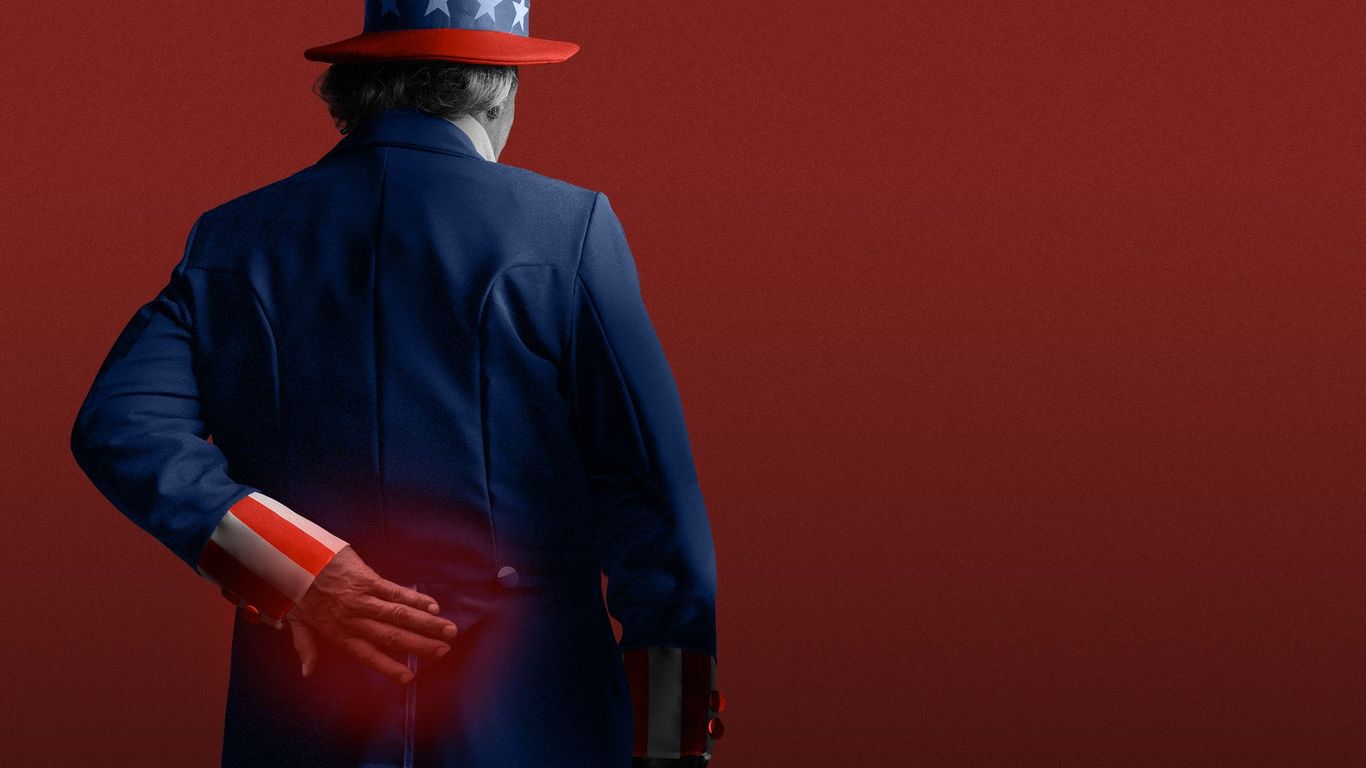

The Storm Clouds Gathering: A Looming Economic Slowdown?

The air is thick with uncertainty. Economic indicators are flashing warning signs, painting a picture far less rosy than the optimistic forecasts of just a few months ago. Growth, once a steady engine driving our prosperity, has sputtered to a near standstill, leaving many wondering what the future holds. Simultaneously, the insidious creep of inflation continues, eroding purchasing power and casting a long shadow over household budgets.

This unsettling combination of stagnant growth and rising prices is a potent cocktail, one with the potential to sour the economic outlook significantly. For months, economists predicted a “soft landing”—a scenario where inflation gradually cools without triggering a recession. However, recent data suggests this optimistic prediction may be increasingly unrealistic.

The stagnation of economic growth is particularly concerning. Businesses, hesitant to invest in expansion amidst the uncertainty, are holding back, contributing to a slowdown in job creation and overall economic activity. This sluggish growth directly impacts consumers, who are already feeling the pinch of rising prices.

Inflation, the relentless enemy of economic stability, is exacerbating the problem. The cost of everyday essentials – from groceries to gasoline – continues to climb, forcing families to make difficult choices and tightening their already stretched budgets. This reduced consumer spending further dampens economic activity, creating a vicious cycle where slow growth fuels inflation, and inflation further stifles growth.

The anxieties aren’t confined to the world of high finance. The unease is palpable on Main Street, where individuals are grappling with the real-world consequences of this economic slowdown. Surveys reveal a growing pessimism among consumers, many of whom anticipate a further deterioration in both economic conditions and their personal financial situations. This lack of confidence translates into decreased spending and investment, further fueling the downward spiral.

The implications of this situation are far-reaching. Continued slow growth could lead to higher unemployment, impacting families and communities across the country. Persistent inflation erodes savings and reduces the purchasing power of wages, potentially exacerbating social inequality. The uncertainty itself is damaging, hindering investment, delaying crucial decisions, and undermining business confidence.

Policymakers face a complex challenge. They must navigate the delicate balancing act between combating inflation and stimulating growth without exacerbating existing economic vulnerabilities. The tools at their disposal – interest rate adjustments, fiscal policy interventions – are powerful but not without potential downsides. Misjudging the situation could lead to unintended and potentially severe consequences.

The path forward requires careful consideration and decisive action. Transparency and clear communication are crucial to maintaining public confidence. Effective policies, tailored to address the specific challenges of this moment, are necessary to steer the economy towards a more stable and sustainable trajectory. The coming months will be critical in determining whether we can weather this economic storm or find ourselves adrift in a more turbulent sea. The current climate demands vigilance, careful analysis, and a proactive approach to ensure a brighter economic future.

Leave a Reply