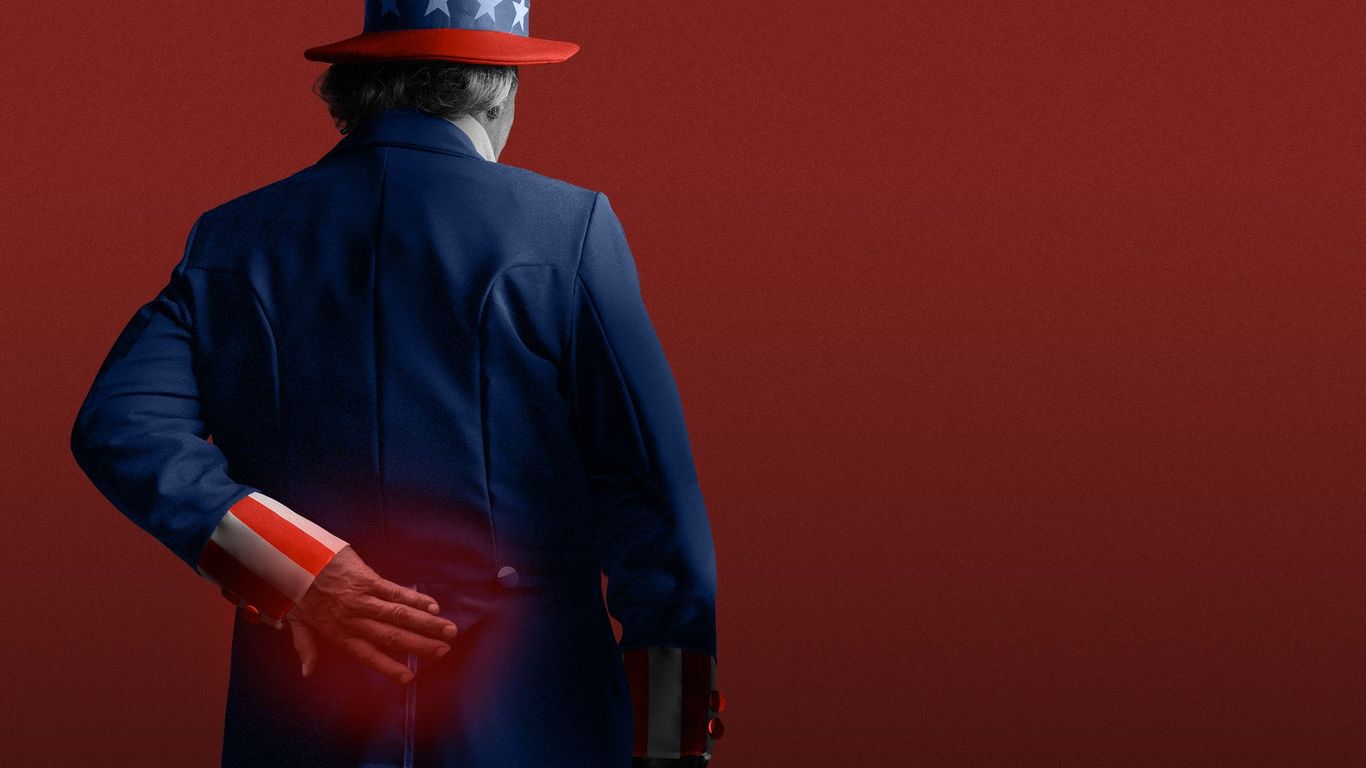

The Stagnant Economy: A Looming Storm on the Horizon?

The air is thick with unease. Not the nervous energy of a burgeoning market, but a quiet, persistent anxiety that’s spreading from Wall Street boardrooms to Main Street dinner tables. The economy, once a vibrant engine of growth, is sputtering, and the implications are far-reaching.

The numbers tell a concerning story. Economic growth has essentially ground to a halt this year. While some might point to temporary setbacks or seasonal fluctuations, the reality is more ominous. This stagnation isn’t a minor hiccup; it’s a persistent trend that reflects a deeper malaise within the system. This lack of forward momentum is worrying, especially considering the other significant factor at play: inflation.

Inflation, that insidious thief of purchasing power, has been steadily climbing. The cost of everyday essentials – food, housing, transportation – is increasing at an alarming rate, squeezing household budgets and eroding consumer confidence. This isn’t just about higher prices at the grocery store; it’s about the erosion of long-term financial security. People are struggling to make ends meet, and the future feels increasingly uncertain.

What’s truly alarming is the collective expectation that things will only get worse. Consumer sentiment, a key indicator of economic health, is plummeting. People are anticipating further economic slowdown and even higher inflation in the months to come. This self-fulfilling prophecy is a dangerous dynamic, as reduced consumer spending can further dampen economic growth, creating a vicious cycle of decline.

The ripple effects of this economic stagnation are being felt across all sectors. Wall Street is bracing for impact, with market volatility increasing as investors grapple with the uncertainty. Businesses are hesitant to invest, fearing reduced consumer demand and shrinking profit margins. Job growth, while still positive in some areas, is slowing, adding to the overall sense of precariousness.

The causes of this economic downturn are multifaceted and complex, encompassing global supply chain issues, geopolitical instability, and the lingering effects of previous economic shocks. However, the consequences are clear: a growing sense of financial insecurity among individuals and a palpable sense of unease within the business community.

This is not simply a matter of economic statistics; it’s a crisis of confidence. When people lose faith in the economy’s ability to provide for them, the consequences are profound. It leads to reduced spending, delayed investments, and a general sense of pessimism that can be difficult to overcome.

Addressing this situation requires a multifaceted approach. Policymakers need to carefully consider measures to stimulate economic growth while also tackling inflation. This delicate balancing act will require careful consideration and potentially difficult choices. Businesses need to adapt to the changing economic landscape, focusing on efficiency and innovation to remain competitive. And individuals need to prioritize financial planning and resilience in the face of uncertainty.

The path forward is unclear, but one thing is certain: ignoring the warning signs will only exacerbate the problem. The time for proactive measures is now, before the current unease escalates into a full-blown economic crisis. The “s-word,” stagnation, is not just a buzzword on Wall Street; it’s a serious threat that demands immediate and concerted action. The future of the economy, and the well-being of millions, hangs in the balance.

Leave a Reply