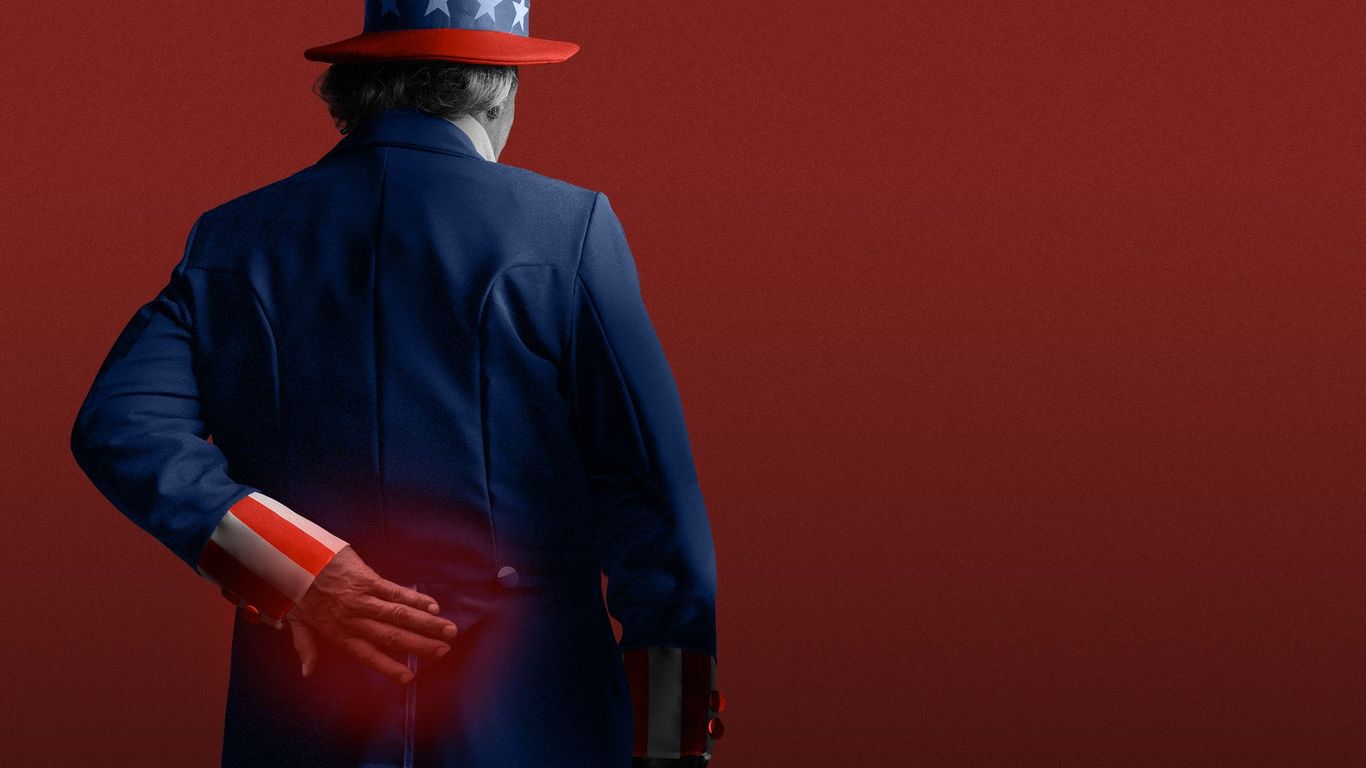

The Looming Recession: A Storm Brewing on Wall Street and Main Street

A palpable unease hangs heavy in the air, a disquiet felt not just in the hushed boardrooms of Wall Street, but also in the everyday conversations on Main Street. The economic landscape, once seemingly stable, now presents a picture of stagnation and uncertainty. The signs are unmistakable: economic growth has stalled, inflation is climbing, and consumer confidence is plummeting. This trifecta of troubling indicators points towards a potential recession, a storm gathering force on the horizon.

The flatlining of economic growth is perhaps the most alarming signal. After a period of, at best, tepid expansion, the engine of the economy seems to be sputtering. Businesses are hesitant to invest, hampered by uncertainty and rising costs. Job growth, while still positive in some sectors, is slowing, adding to the anxieties of workers and families. This stagnation is not merely a temporary blip; it’s a persistent trend, suggesting a deeper systemic issue.

Adding fuel to the fire is the persistent rise in inflation. The cost of everyday essentials – groceries, gas, housing – continues to climb, eroding the purchasing power of consumers. This inflationary pressure isn’t confined to specific sectors; it’s a broad-based increase affecting nearly every aspect of life. This means less disposable income for families, forcing them to cut back on spending, further dampening economic activity. The cycle is vicious: rising prices lead to decreased consumer spending, which in turn leads to slower economic growth and potentially further inflation.

Perhaps the most concerning element is the widespread expectation that things will only get worse. Consumers, sensing the economic headwinds, are becoming increasingly pessimistic. This pessimism is a self-fulfilling prophecy; if consumers believe the economy is heading for a downturn, they are more likely to reduce spending, thereby contributing to the very downturn they fear. This loss of confidence undermines the delicate balance of the economy, creating a downward spiral that can be difficult to reverse.

The impact of this brewing storm is felt across the entire economic spectrum. Wall Street, always sensitive to economic shifts, is already reacting. Stock markets are volatile, reflecting investors’ concerns about the future. Companies are bracing for potentially lower profits and are taking measures to cut costs, which may involve layoffs and reduced investment. The ripples extend beyond the financial sector, affecting businesses of all sizes, and ultimately, the livelihoods of ordinary Americans.

The coming months will be crucial in determining whether this economic slowdown transitions into a full-blown recession. Government policy will play a vital role, but the effectiveness of any intervention will depend on a multitude of factors, including global events and unpredictable market forces. For now, the uncertainty remains, a shadow cast over both Wall Street’s glittering towers and the everyday lives of those on Main Street. The best course of action for individuals and businesses alike is to carefully monitor the situation, plan for potential difficulties, and hope for a swift and effective response from policymakers to mitigate the impending economic storm.

Leave a Reply