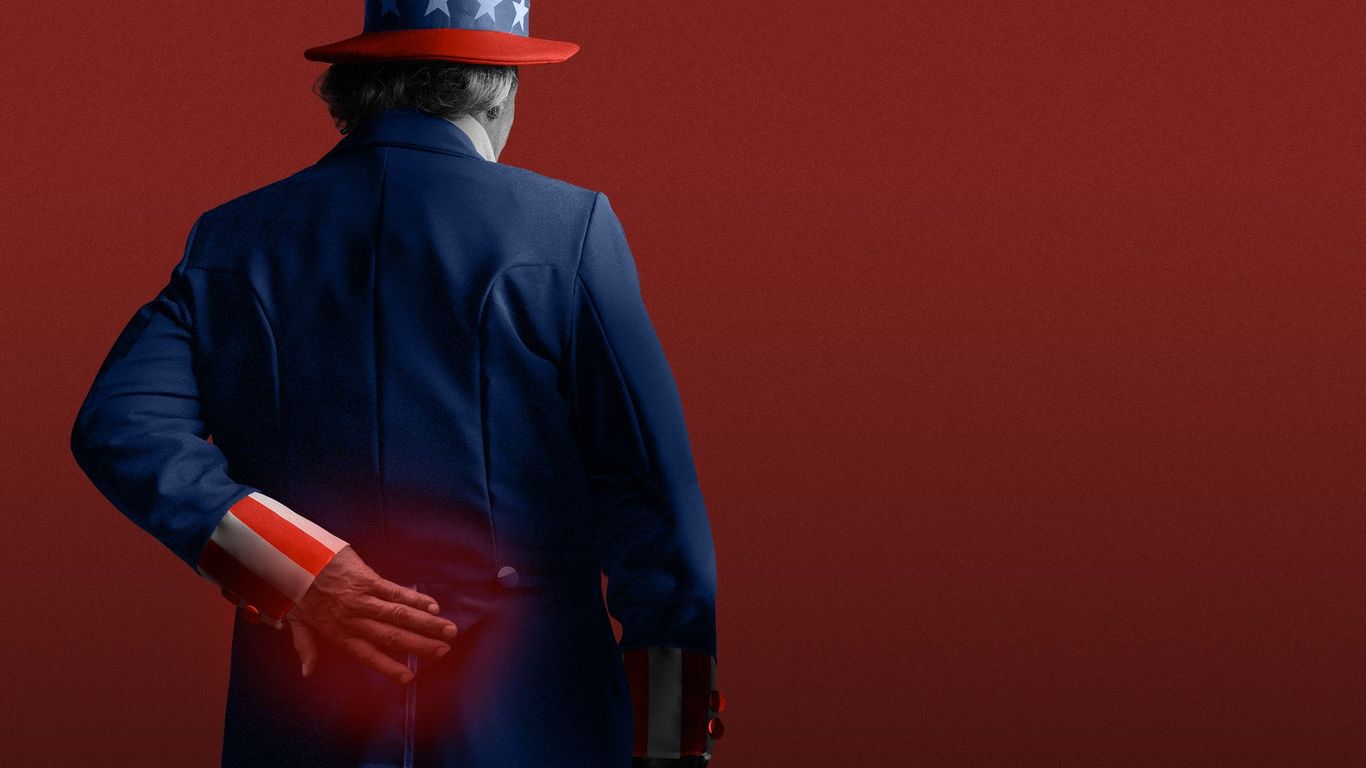

The Storm Clouds Gathering: A Looming Recession?

The economic landscape is shifting, and the prevailing mood is one of cautious concern, bordering on outright apprehension. The whispers are growing louder, the anxieties more palpable, and the dreaded “R-word”—recession—is starting to echo through boardrooms and kitchen tables alike.

The current economic climate presents a worrying picture. Growth, the lifeblood of any healthy economy, has essentially stagnated this year. Instead of the steady expansion we’ve come to expect, we’re experiencing a disconcerting flatline. This lack of forward momentum is particularly troubling given the persistent rise in inflation. Prices are climbing, squeezing household budgets and eroding purchasing power. This double whammy of stagnant growth and rising prices is a potent recipe for economic hardship.

The situation is further exacerbated by consumer sentiment. Surveys consistently reveal a growing pessimism among Americans. People anticipate worsening economic conditions in the coming months, expecting both inflation to remain stubbornly high and economic growth to stay sluggish, or even contract. This loss of confidence is a critical factor, as consumer spending is a major driver of the US economy. If consumers pull back on spending due to uncertainty and fear, it could trigger a downward spiral, further depressing economic activity.

Wall Street, the barometer of the national economic pulse, is mirroring this unease. Investors are reacting to the bleak outlook, exhibiting caution and uncertainty. Market volatility has increased, reflecting a growing nervousness about the future. This uncertainty is influencing investment decisions, impacting everything from stock valuations to corporate investment plans. The lack of confidence in the market translates to a reluctance to take risks, further hindering economic growth.

The confluence of these factors – stagnant growth, rising inflation, and declining consumer confidence – creates a perfect storm. The risk of a recession is becoming increasingly real. While economists debate the precise probability and timing of a potential downturn, the warning signs are undeniable. The combination of decreased consumer spending, reduced business investment, and a general sense of economic uncertainty paints a worrying picture.

The potential consequences of a recession are far-reaching and significant. Job losses would inevitably follow, leading to increased unemployment and financial hardship for many families. Government revenues would likely decline, limiting the government’s ability to address the crisis and provide social safety nets. Furthermore, a recession could exacerbate existing social and political tensions, creating further instability.

It’s crucial to note that predicting the future with certainty is impossible. Economic forecasts are inherently complex and subject to a multitude of variables. However, the current indicators are troubling enough to warrant serious attention and proactive measures. Policymakers need to carefully assess the situation and consider strategies to mitigate the risks of a recession. This could involve a range of measures, from fiscal stimulus to monetary policy adjustments, depending on the severity and nature of the economic downturn.

In the meantime, individuals and businesses need to prepare for potential economic headwinds. This might involve reviewing budgets, diversifying investments, and developing contingency plans to navigate potential financial difficulties. While panic is unproductive, informed preparedness is crucial in the face of mounting economic uncertainty. The future remains unclear, but the storm clouds are gathering, and we must be prepared to weather the potential economic tempest.

Leave a Reply