The Economic Chill: Is Sentiment Turning into Reality?

A palpable shift has occurred in the economic landscape. The air, once filled with the optimistic buzz of recovery, now carries a distinct chill. Confidence, that crucial intangible driving force of economic activity, is waning, and the question on everyone’s mind is whether this shift in sentiment will translate into a tangible slowdown in actual economic performance.

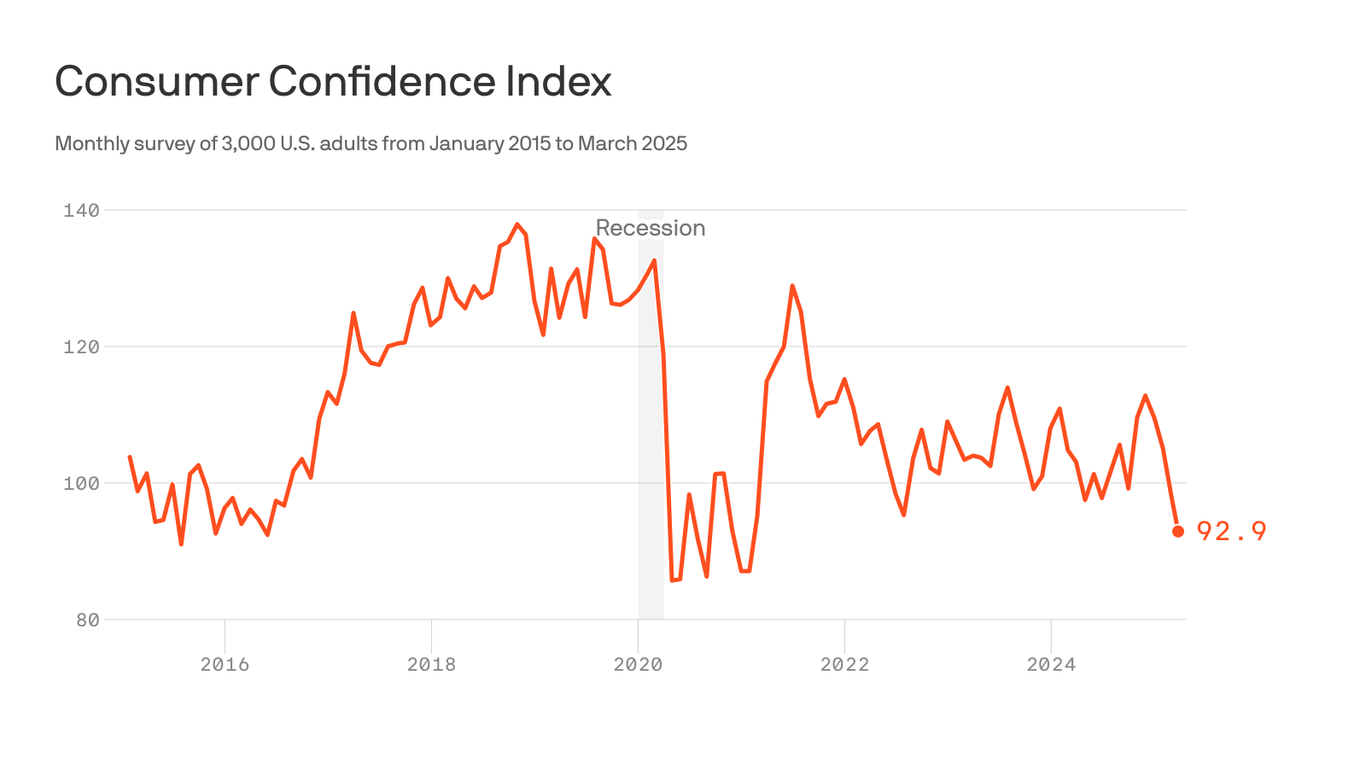

Recent weeks have witnessed a confluence of factors contributing to this growing unease. Consumer confidence, a key indicator of spending habits, has dipped noticeably. While some attribute this to seasonal fluctuations, others point to more persistent concerns: rising inflation, stubbornly high interest rates, and persistent geopolitical uncertainty all play a significant role. These factors combine to create a potent cocktail of anxiety, leaving consumers hesitant to spend and businesses hesitant to invest.

The impact extends beyond consumer behavior. Business leaders, faced with escalating costs and uncertain demand, are starting to adjust their strategies. Investment plans are being scaled back, hiring freezes are becoming more common, and expansion projects are being postponed. This cautious approach, driven by a lack of confidence in the future, is a significant drag on economic growth.

The financial markets are also reflecting this growing pessimism. Stock prices have experienced a period of volatility, with significant dips in key indices. The bond market, often considered a barometer of investor sentiment, is signaling similar concerns, with yields fluctuating in response to shifting expectations about future economic performance.

One of the key challenges in analyzing this situation is disentangling the correlation between sentiment and reality. A decline in confidence can, in itself, become a self-fulfilling prophecy. If consumers and businesses anticipate a downturn, they will likely adjust their behavior accordingly, potentially creating the very slowdown they feared. This feedback loop can amplify the initial dip in confidence, leading to a more pronounced and sustained economic contraction.

However, it’s crucial to avoid overreaction. While the current economic vibe is undeniably negative, it’s not necessarily indicative of an imminent crash. The economy is a complex system with many interwoven factors. While decreased confidence is a significant headwind, other factors, such as a robust labor market and ongoing technological innovation, could help mitigate the impact.

The coming weeks and months will be crucial in determining the true trajectory of the economy. Policymakers will be closely monitoring economic indicators, searching for clues to guide their responses. Central banks will need to carefully balance their efforts to control inflation with the need to avoid triggering a deeper recession. Businesses will need to adapt to the changing landscape, while consumers will need to navigate the challenges of rising costs and uncertainty.

Ultimately, the question of whether the current pessimistic sentiment translates into a tangible economic slowdown remains unanswered. The coming months will be a test of resilience, adaptation, and the ability of policymakers and businesses to navigate a period of heightened uncertainty. The economic outlook is, undeniably, cloudier than it has been in recent times, and careful monitoring and strategic adjustments will be essential to navigate the path ahead.

Leave a Reply