A Chill Wind Blows Through the Economic Landscape

The air is thick with uncertainty. For several weeks now, a palpable shift has occurred in the overall economic sentiment. A sense of unease, a waning confidence, is spreading like wildfire through markets and boardrooms alike. The question hanging heavy in the air is whether this deterioration in “economic vibes,” as some are calling it, will translate into a tangible slowdown in actual economic activity.

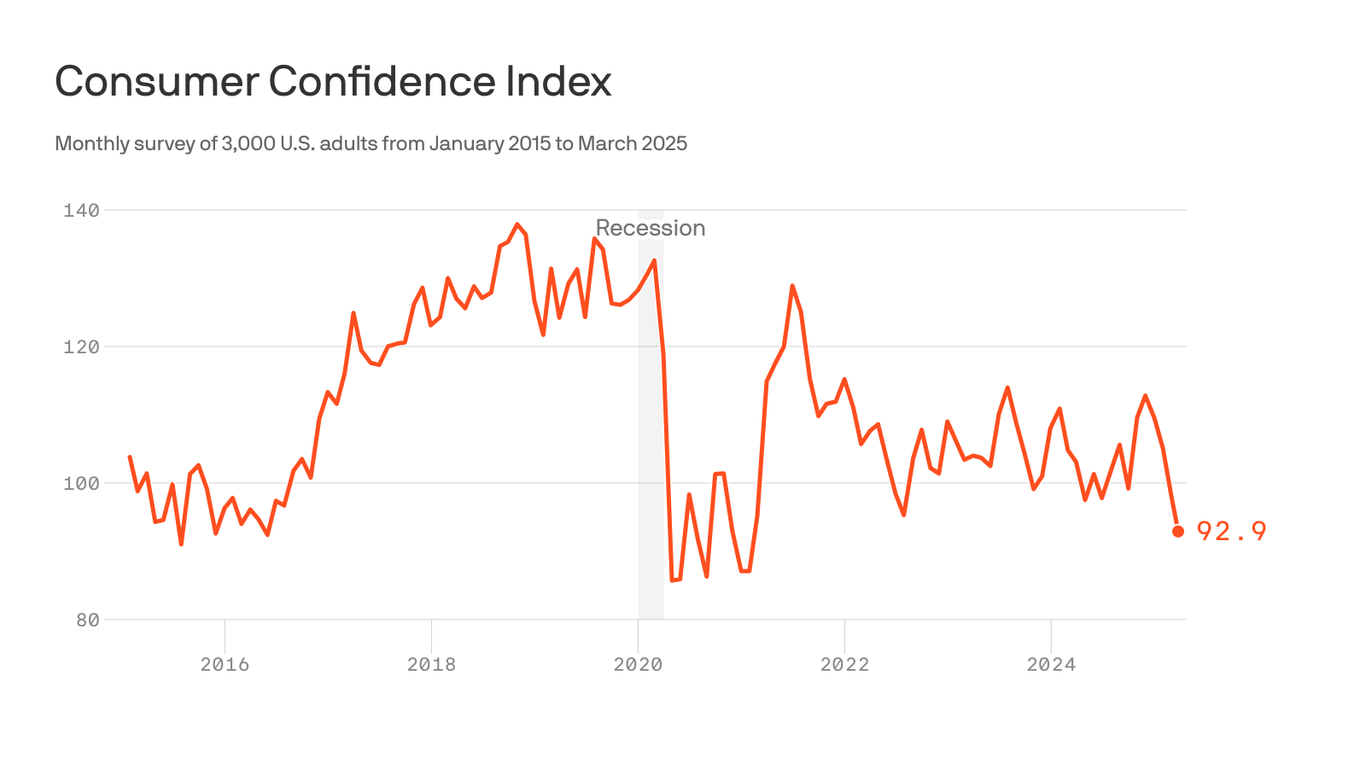

The evidence of this shift is multifaceted and concerning. Consumer confidence indices, those crucial barometers of spending intentions, are dipping. Businesses, once optimistic about future growth, are now exhibiting more cautious behavior. Investment plans are being scrutinized more rigorously, with some projects put on hold pending clearer economic signals. This hesitancy isn’t merely a matter of perception; it’s leading to real-world consequences.

One of the most significant factors contributing to this downturn in confidence is inflation. While recent data suggests a potential plateauing, the lingering effects of persistent price increases continue to erode purchasing power and dampen consumer spending. High interest rates, implemented to combat inflation, further exacerbate the problem, increasing borrowing costs for businesses and individuals alike. This makes expansion more expensive and less attractive, potentially leading to reduced hiring and investment.

The global economic landscape also plays a significant role. Geopolitical instability, ongoing supply chain disruptions, and the lingering impact of the pandemic continue to cast a long shadow over economic forecasts. These interconnected global challenges create uncertainty, making it difficult for businesses to plan effectively and for consumers to feel secure about the future.

Furthermore, the labor market, while still relatively robust in many sectors, shows signs of potential softening. While unemployment remains low in many regions, there are hints of a slowdown in job creation. This could be an early warning sign of a broader economic contraction, as reduced hiring often precedes more significant economic downturns.

The impact of this shift in economic sentiment is far-reaching. It can affect everything from consumer spending and investment decisions to government policy and international trade. A prolonged period of low confidence can create a self-fulfilling prophecy, leading to a decline in actual economic activity as businesses and consumers pull back from spending and investment.

However, it’s crucial to avoid excessive pessimism. The current situation isn’t necessarily indicative of an imminent recession. Economic indicators are complex and often lag behind shifts in sentiment. Many economists believe that the current slowdown is a correction rather than a catastrophic collapse. The resilience of the consumer and the ongoing strength of certain sectors offer some reasons for cautious optimism.

Ultimately, the coming weeks and months will be critical in determining the trajectory of the economy. Close monitoring of key economic indicators, such as GDP growth, inflation rates, and consumer spending, will be essential. The actions taken by governments and central banks will also play a significant role in shaping the outcome. The path ahead remains uncertain, but understanding the current shifts in economic sentiment is the first step toward navigating the challenges that lie ahead. The question of whether the current feeling of unease will translate into a tangible economic downturn remains unanswered, a crucial question that will define the economic landscape in the near future.

Leave a Reply