Nvidia’s Unexpected Boost: A Geopolitical Shift and the Semiconductor Sector

The tech world witnessed a dramatic surge in Nvidia’s stock price recently, a jump so significant it sent ripples throughout the entire semiconductor industry. This unexpected leap wasn’t driven by a groundbreaking new product launch or a revolutionary technological advancement, but rather by a significant geopolitical shift impacting international trade relations.

The catalyst? A surprising announcement regarding trade policy between two global economic giants, significantly impacting the import and export landscape for crucial technological components, including those at the heart of Nvidia’s business. This announcement created a wave of optimism, lifting not only Nvidia, but also boosting confidence in the broader tech sector.

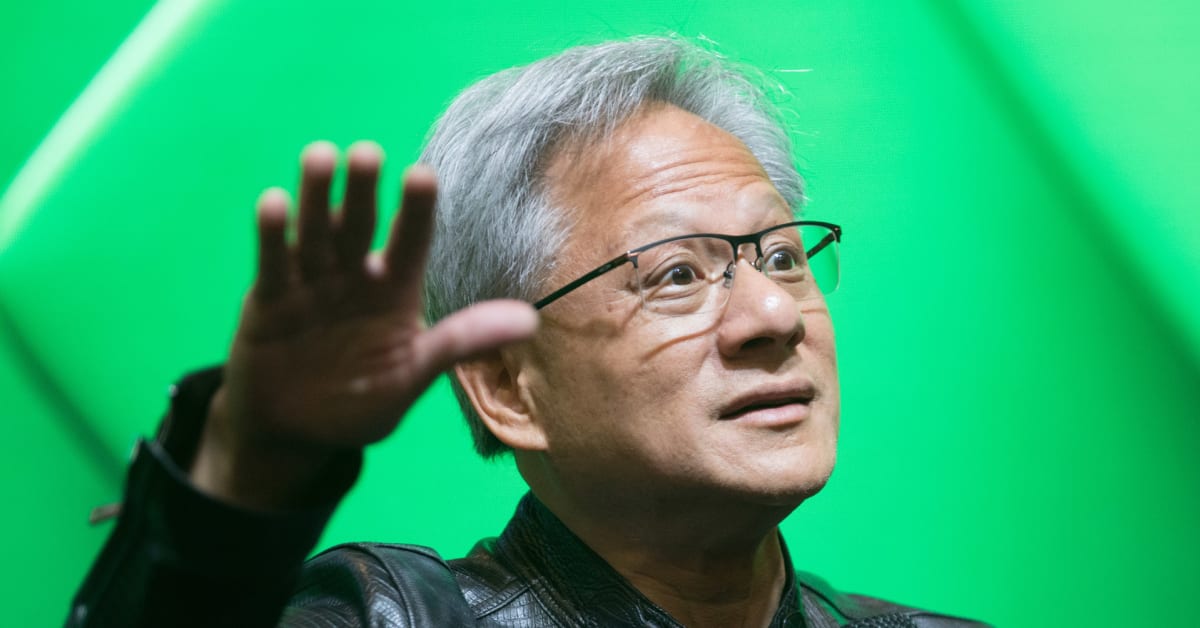

For those unfamiliar, Nvidia is a leading designer of graphics processing units (GPUs), processors known for their prowess in powering high-end gaming, artificial intelligence (AI) applications, and data center operations. The company’s fortunes are intrinsically linked to the global tech landscape, particularly the flow of goods and materials needed for manufacturing and distribution. Disruptions to this flow, such as those caused by international trade tensions, can have a profound effect on the company’s profitability and overall market position.

The recent positive development involved a temporary easing of trade restrictions. Previously, significant tariffs had been imposed, creating uncertainty and increasing costs for businesses involved in international trade. These tariffs disproportionately affected the semiconductor industry due to its complex global supply chains. Companies like Nvidia, heavily reliant on intricate networks of suppliers spanning multiple countries, faced substantial challenges navigating these increased costs and uncertainties.

The announced pause, a temporary reprieve in these trade tensions, effectively removed a significant layer of uncertainty hanging over the sector. This provided a much-needed sigh of relief for businesses like Nvidia, allowing them to plan with greater confidence and potentially reducing production costs. The immediate market response reflects this shift in sentiment. Investors, initially hesitant due to the ongoing trade tensions, are now perceiving a decreased level of risk, leading to a renewed confidence in Nvidia’s growth prospects.

This isn’t just a win for Nvidia; it’s a positive indicator for the broader semiconductor industry. The sector, vital to many aspects of modern life, has been grappling with trade-related headwinds for some time. This recent development offers a potential turning point, suggesting a path toward greater stability and predictability in the global technology marketplace.

The long-term implications remain to be seen, of course. The temporary nature of the trade policy shift underscores the ongoing fragility of the global economic landscape. However, in the short term, the positive news has undoubtedly injected a much-needed dose of optimism into the market, highlighting the profound impact geopolitical events can have on even the most technologically advanced companies. The Nvidia surge serves as a stark reminder of the intricate interplay between global politics, trade policy, and the performance of even the most innovative businesses. The coming months will be crucial in determining whether this is a fleeting moment of optimism or a significant turning point for the entire tech sector.

Leave a Reply