Market Jitters and the Secretary’s Reassurance: A Necessary Correction?

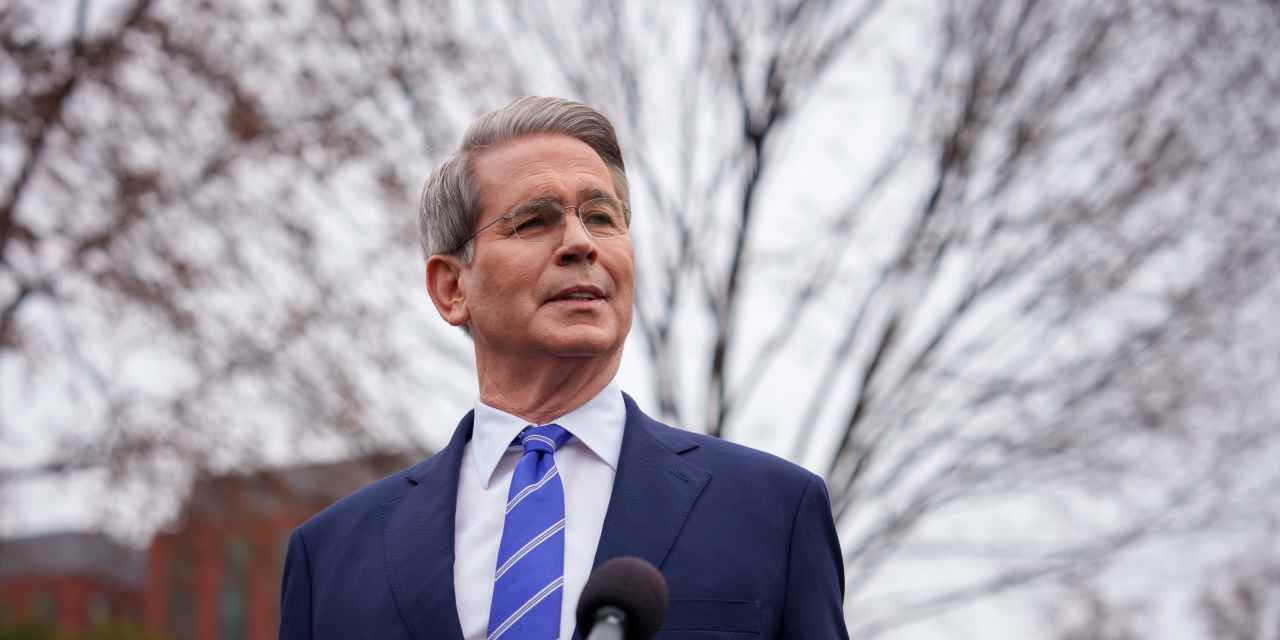

The stock market, that ever-volatile beast, is once again exhibiting signs of unease. Futures pointed downward recently, reflecting a palpable sense of anxiety among investors. This follows a period of significant losses on Wall Street, leaving many questioning the stability of the current economic landscape. However, a prominent figure has stepped forward to offer a calming voice amidst the storm: the Treasury Secretary, who has downplayed the concerns, suggesting that the recent downturn is merely a healthy correction.

This assertion – that the market’s dip is a necessary and even beneficial adjustment – is a crucial point to consider. While frightening for those directly invested, corrections can be an integral part of a healthy market cycle. Think of it like pruning a tree; removing weaker branches allows the stronger ones to flourish. Similarly, a market correction can weed out overvalued assets and pave the way for more sustainable growth in the long term. It’s a process of recalibration, allowing prices to reflect more accurately the underlying value of companies and the overall economic outlook.

The Secretary’s confidence stems, in part, from the administration’s proactive measures to prevent a larger financial crisis. These measures, although not publicly detailed, presumably involve strategies to bolster market confidence and address underlying economic vulnerabilities. The implication is that the current downturn is not a symptom of a deeper, systemic problem, but rather a temporary setback within a larger framework of stability.

However, this optimistic viewpoint doesn’t necessarily negate the anxieties felt by many investors. The recent market performance has indeed been far from stellar, causing real and significant losses for some. Fear is a powerful motivator, and the uncertainty surrounding future economic trends can lead to panic selling, further exacerbating the downturn. The Secretary’s assurance, while intended to soothe these fears, may not be enough to convince everyone. The market, after all, is driven by a complex interplay of factors, many of which are beyond the control of any single individual or institution.

The Secretary’s comments raise important questions about the nature of market interventions and the role of government in influencing investor sentiment. While a hands-off approach has often been advocated, the potential for government action to stabilize markets during times of crisis is undeniable. The line between appropriate intervention and undue interference is always a delicate one to tread, requiring careful consideration of both economic realities and the potential unintended consequences of policy decisions.

Furthermore, the Secretary’s perspective highlights the inherent tension between short-term market volatility and long-term economic growth. While the immediate concern might be the current losses and the fear of further declines, the long-term view often paints a different picture. History has shown time and again that market corrections, while painful in the short-term, often precede periods of renewed expansion and prosperity. The challenge lies in maintaining perspective and resisting the urge to react emotionally to short-term fluctuations.

In conclusion, the market’s recent decline, while concerning, is not necessarily cause for widespread alarm. Whether the Secretary’s reassurances will effectively quell market anxieties remains to be seen. However, it’s crucial to remember that the market is a complex and dynamic system, subject to both periods of growth and correction. Understanding this inherent volatility, and maintaining a balanced perspective between short-term anxieties and long-term growth potential, is key to navigating the unpredictable waters of the investment world.

Leave a Reply