The Emperor’s New Clothes: Wall Street’s Trumpian Tumble

The markets have been a rollercoaster lately, a stomach-churning descent from dizzying highs to unsettling lows. Trillions have evaporated, leaving investors reeling and prompting soul-searching across the financial world. This isn’t just a correction; it’s a reckoning, a harsh lesson learned about the unpredictable nature of politics and the dangers of betting on a specific political outcome.

For years, a significant portion of Wall Street operated under the assumption that a certain political figure’s policies would be a boon to the economy. This wasn’t a quiet, whispered hope; it was a deeply ingrained belief that shaped investment strategies, fueled mergers and acquisitions, and drove billions of dollars in trading activity. The prevailing wisdom suggested that certain tax cuts and deregulation would unlock unprecedented economic growth, creating a lucrative environment for investors.

The narrative was seductive. It promised a simple equation: support this administration, reap the rewards. Hedge fund managers, investment bankers, and even seemingly cautious institutional investors bought into the narrative hook, line, and sinker. The belief permeated every level, from the boardroom to the trading floor. Massive investments were made, often with little consideration for alternative scenarios or potential downsides. This wasn’t about careful risk assessment; it was about riding a presumed wave of prosperity.

But the tide has turned, and the wave has crashed. The reality has proven far more complex than the simplistic narrative suggested. The promised economic boom, while initially showing some signs of life, has failed to materialize in the way many predicted. Instead, we’ve witnessed a confluence of unforeseen circumstances: economic uncertainty, shifting global dynamics, and unexpected policy shifts.

The painful truth is that the market’s faith was misplaced. The assumption that a particular political agenda would automatically translate into predictable market gains proved profoundly naive. This wasn’t a question of market manipulation or unforeseen external shocks; it was a fundamental miscalculation of the intricate relationship between politics and economics.

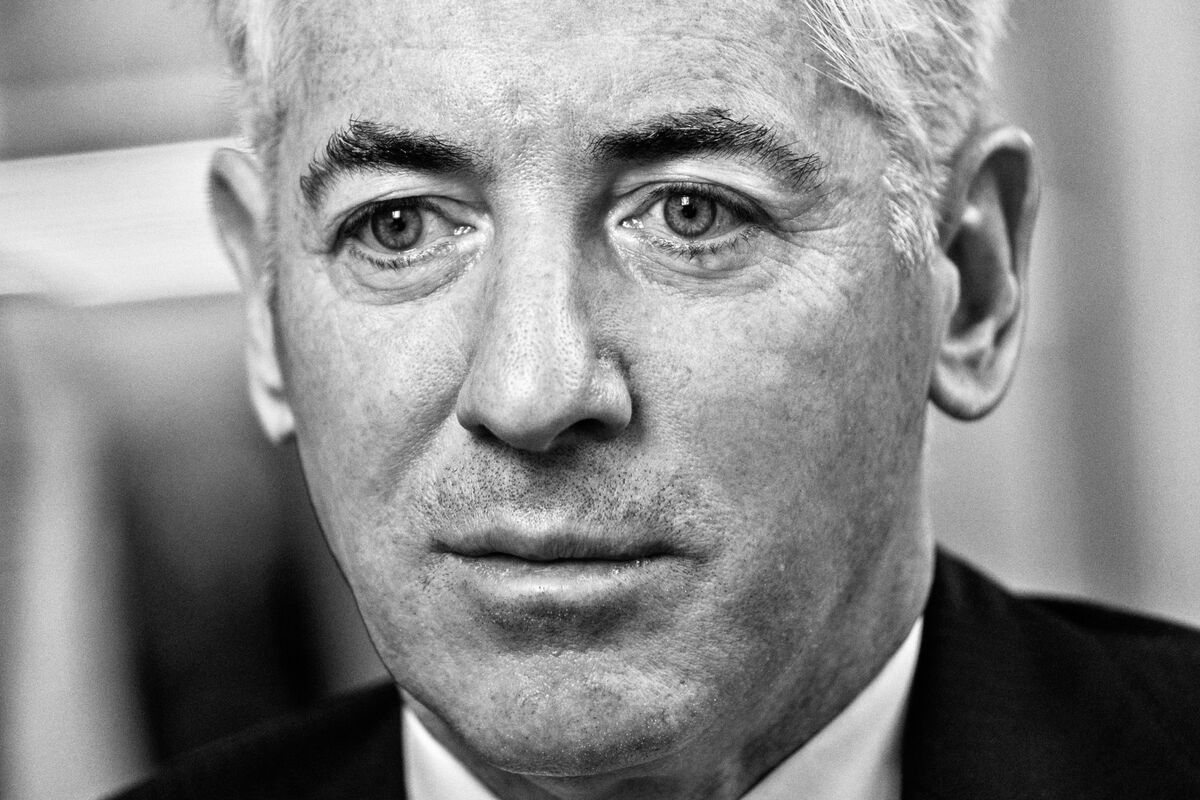

The fallout has been dramatic. High-profile investors who staked their reputations and fortunes on this belief are now publicly admitting their mistakes, swallowing their pride and acknowledging the flawed premise on which their strategies were built. These are not inexperienced newcomers; these are the so-called “smart money,” the individuals and firms who pride themselves on sophisticated analysis and shrewd predictions. Their humbling experience serves as a cautionary tale for the entire financial industry.

This isn’t about assigning blame; it’s about learning from a costly error. The episode highlights the crucial need for diversification, robust risk management, and a more nuanced understanding of the complex interplay between political landscapes and economic realities. The temptation to bet on a single political horse, to predict the future with the certainty of a soothsayer, is alluring. However, the market’s recent volatility should serve as a stark reminder that such predictions are inherently unreliable.

The current market correction is more than a simple fluctuation; it’s a wake-up call. It’s a reminder that even the most sophisticated financial minds can be wrong, and that the allure of a simple, politically-driven narrative can lead to disastrous consequences. The road to recovery will require a reassessment of strategies, a more cautious approach to political forecasting, and a renewed commitment to fundamental financial principles. The emperor may have been naked all along, but it took a significant market crash to reveal the truth.

Leave a Reply