China’s Stock Market: A Resurgence on the Horizon?

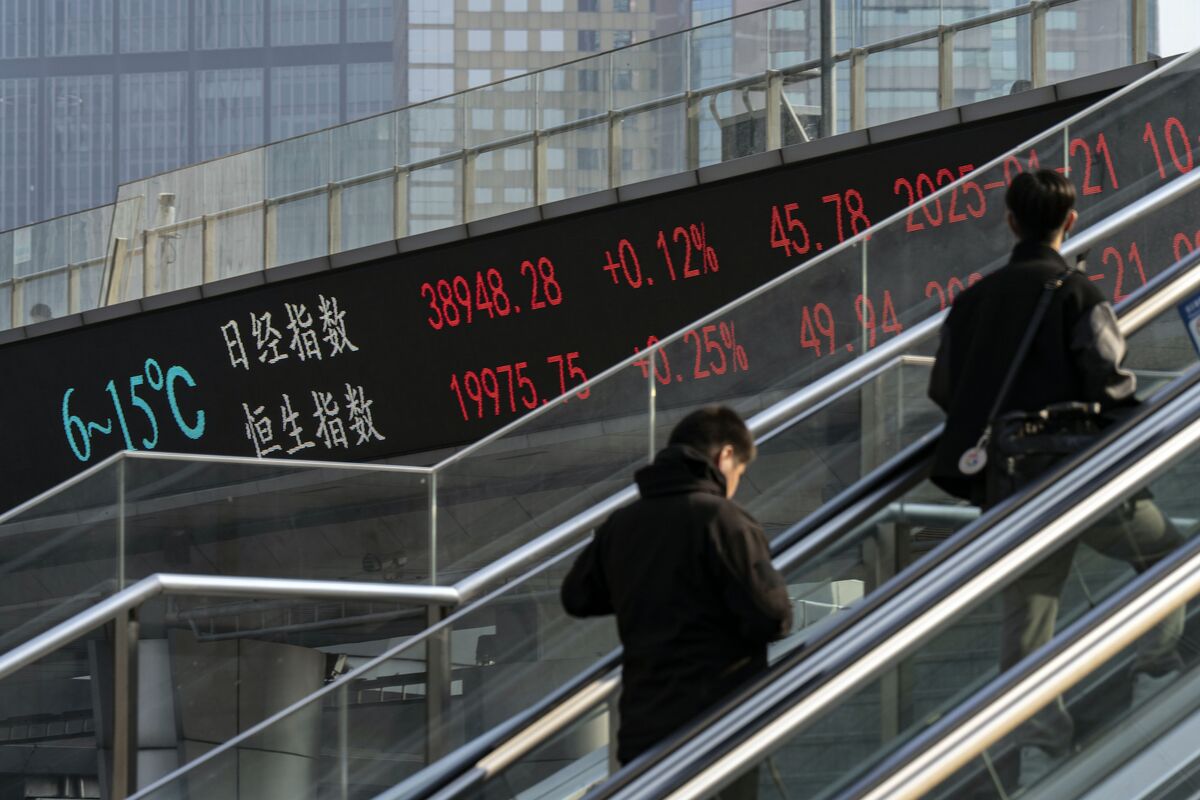

The Chinese stock market has been making headlines recently, with analysts expressing renewed optimism about its future performance. Several prominent financial institutions have significantly revised their forecasts upwards, pointing to a confluence of factors suggesting a period of robust growth. This surge in confidence isn’t just a fleeting trend; it’s based on tangible improvements in the economic landscape and a reassessment of underlying valuations.

One of the key drivers behind this positive outlook is the strengthening earnings outlook for Chinese companies. After a period of uncertainty and adjustment, businesses are demonstrating resilience and, in many sectors, experiencing impressive growth. This improved profitability is a significant factor in driving up stock prices. Analysts are increasingly confident that this isn’t a temporary blip, but a sustainable trend fueled by robust domestic demand and a gradual recovery in global trade.

The reassessment of valuations is another crucial element. For some time, Chinese stocks were considered relatively undervalued compared to their international peers. The recent upward revisions reflect a growing belief that the market has not fully priced in the potential for future earnings growth. This undervaluation, coupled with the improving fundamentals, presents a compelling investment opportunity for many.

Beyond the purely financial indicators, a shift in government policies is also contributing to the optimism. While specific details would require further analysis, a general consensus exists that regulatory changes are aimed at fostering a more stable and predictable business environment. This increased clarity reduces uncertainty for investors and encourages greater long-term investment. This, in turn, further strengthens the underlying health of the market.

Of course, no investment is without risk. Geopolitical uncertainties and potential global economic headwinds remain factors to consider. However, the current positive momentum is noteworthy. The combination of improved earnings projections, revised valuations, and a supportive policy environment paints a picture of a market poised for significant growth.

It’s important to remember that market forecasts are inherently uncertain, and past performance is not necessarily indicative of future results. However, the weight of evidence currently suggests a cautiously optimistic view of the Chinese stock market. This optimism is not based solely on speculation but on a solid foundation of improved company earnings, corrected valuations, and a generally improved economic outlook.

This renewed confidence represents a significant shift in sentiment, and investors are encouraged to carefully assess the situation, conduct thorough due diligence, and make informed decisions based on their individual risk tolerance and investment goals. The current trends suggest a compelling opportunity for growth, but it’s crucial to approach the market with a well-defined strategy and a realistic understanding of the inherent risks involved. The potential rewards might be substantial, but responsible investing remains paramount.

Leave a Reply