Navigating the Stormy Waters of the Stock Market: A Dip on the Horizon?

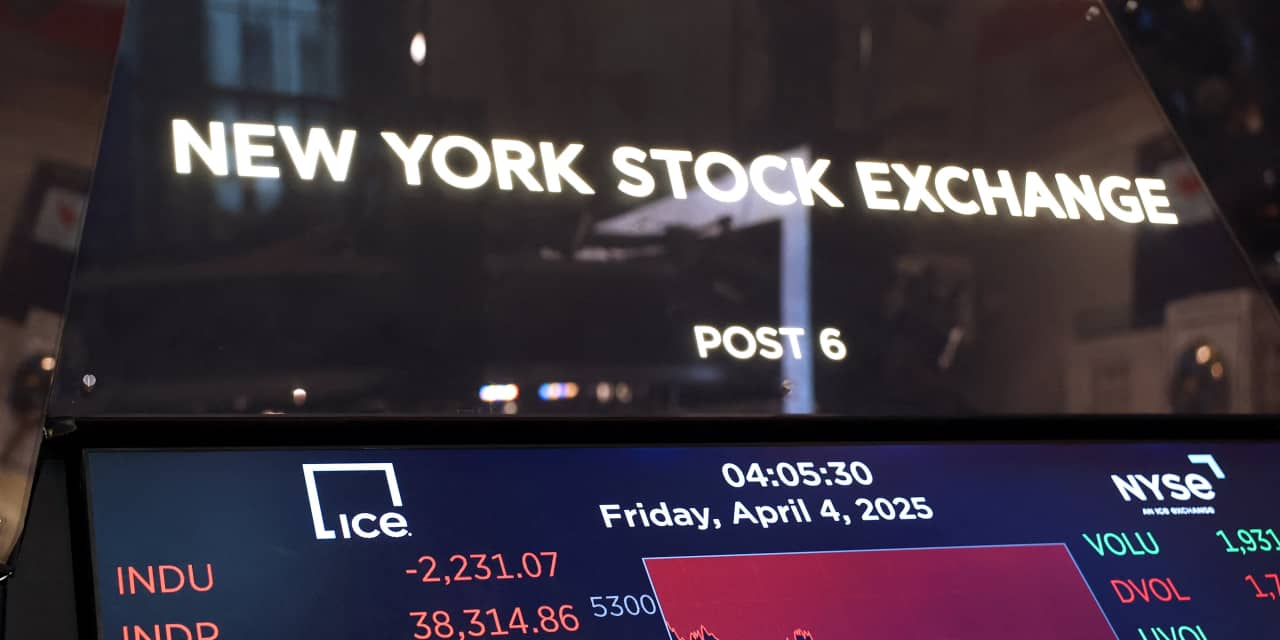

The stock market, a rollercoaster of highs and lows, is currently exhibiting signs that suggest a potential downturn. While predicting the future with absolute certainty is impossible, several indicators point towards a possible 7% to 8% drop in the S&P 500 index. This forecast isn’t born from panic, but rather a careful consideration of several key economic factors.

One of the primary concerns is the ongoing tension surrounding trade policies. The current climate of international trade disputes introduces significant uncertainty into the market. Businesses rely on predictable trade relationships for planning and investment, and persistent uncertainty can lead to reduced investment and slower economic growth. This hesitation to invest translates directly into lower stock prices as companies become less optimistic about future earnings.

Furthermore, the actions of the Federal Reserve (the Fed) play a crucial role in shaping market sentiment. The Fed’s monetary policy, including interest rate adjustments, directly impacts borrowing costs for businesses and consumers. If the Fed continues on its current path, potentially raising interest rates to combat inflation, it could further dampen economic activity and put downward pressure on stock prices. Higher interest rates make borrowing more expensive, hindering business expansion and potentially slowing consumer spending.

The interplay between these two factors – trade tensions and monetary policy – creates a perfect storm of uncertainty. Investors, inherently risk-averse, are likely to react to this uncertainty by pulling back from the market, triggering a sell-off. This sell-off, in a self-fulfilling prophecy, can accelerate the downward trend, leading to the projected 7-8% decline.

However, it’s not all doom and gloom. There’s a potential support level at around 4700 points for the S&P 500. This level represents a point where the market might find stability. If the market reaches this level, there’s a chance the downward momentum could stall, offering a buying opportunity for those with a long-term perspective. This support level is based on historical performance and technical analysis, suggesting a degree of resilience within the market.

It is vital, however, to understand that this support level is not guaranteed. If the negative economic factors intensify, or unforeseen events emerge, the market could break through this level and continue its descent.

The key takeaway for investors is to remain vigilant and informed. This isn’t a call to panic and sell everything, but rather a suggestion to carefully reassess portfolios and risk tolerance. A diversified investment strategy, incorporating a range of asset classes, can help mitigate the impact of a market downturn.

Furthermore, a long-term perspective is crucial. While short-term fluctuations are inevitable, the historical performance of the stock market demonstrates its long-term growth potential. Focusing on the long-term goals and maintaining a disciplined investment plan is key to weathering these market storms.

In conclusion, while a significant market correction appears likely, it’s essential to approach this prospect with a balanced perspective. Understanding the contributing factors, assessing your own risk tolerance, and maintaining a long-term investment strategy are the cornerstones of navigating these turbulent times. Remember, market corrections are a natural part of the economic cycle, and periods of decline often pave the way for future growth.

Leave a Reply