The Unprecedented Wall Street Rebuke of a Cabinet Member

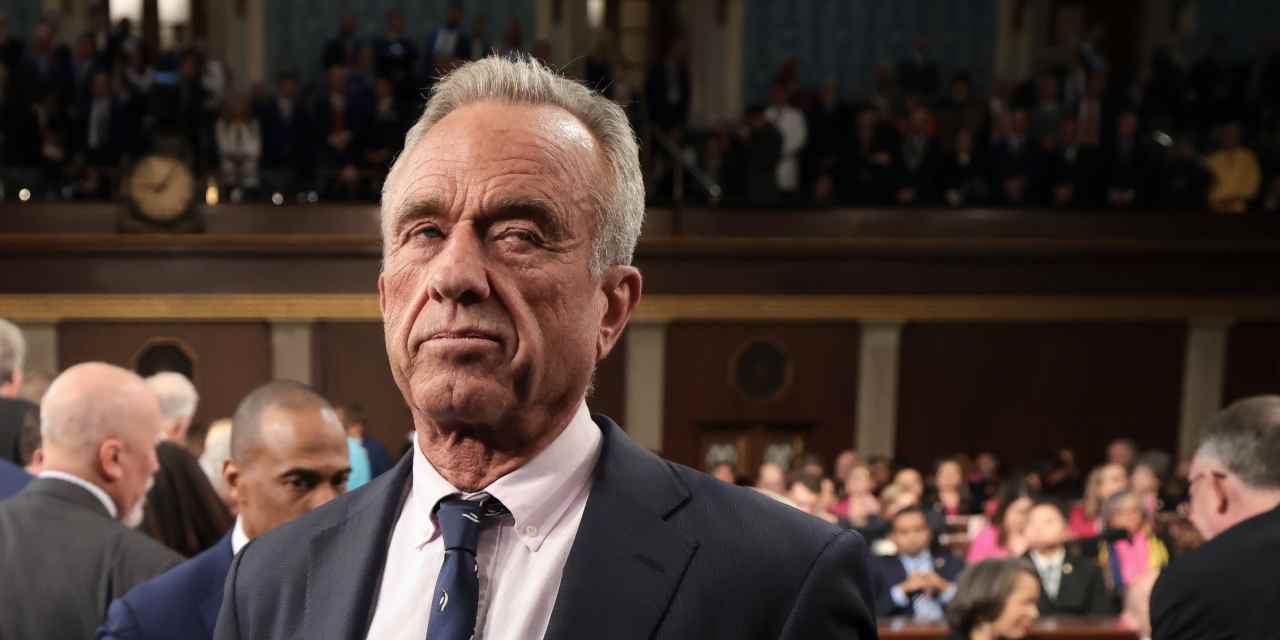

A ripple of unease, unusual in its directness, is spreading through the usually reserved world of Wall Street. Two prominent analysts have publicly called for the dismissal of a high-ranking government official, a move that signifies a significant departure from the typical cautious approach of financial commentators. Their target? A cabinet secretary whose recent pronouncements and actions have apparently crossed a line, prompting this unprecedented level of public criticism.

The analysts, hailing from the respected firm Cantor Fitzgerald, haven’t minced words. They describe the official’s behavior as a significant departure from what’s expected, using the pointed analogy of someone venturing “far outside of their swim lane.” The implication is clear: this individual’s actions are not only inappropriate but also potentially damaging to the very fabric of the government they serve. The call for removal, encapsulated in the blunt phrase “It’s time to take him out of the pool,” underscores the seriousness of their concerns.

While the analysts haven’t explicitly outlined every single point of contention, the underlying message is one of serious professional and ethical misgivings. It suggests a pattern of behavior, a series of decisions or public statements, that have raised significant alarms within the financial sector. This isn’t just about policy disagreements; it implies a level of incompetence or disregard for established norms that threatens to negatively impact the economy and the public trust.

The financial industry’s relationship with the government is complex and often characterized by a delicate balance of influence and accountability. While analysts frequently offer commentary on government policies and their potential economic consequences, directly advocating for the dismissal of a cabinet member is extremely rare. This act, therefore, carries significant weight and speaks volumes about the depth of the analysts’ concerns.

Their intervention raises critical questions about accountability and the potential consequences of unchecked influence within the government. The analysts’ concerns likely stem from a perceived lack of competence or even potentially harmful actions that could have significant long-term repercussions on the economy. The specific nature of these actions remains undisclosed, but the intensity of the reaction suggests something far beyond simple policy disagreements.

This situation highlights a fascinating intersection of politics, finance, and public perception. The public’s trust in both government and financial institutions is crucial for economic stability. When influential figures from the financial world openly criticize a cabinet member, it suggests a breakdown in this trust, a potentially destabilizing factor.

The ensuing debate will likely focus on the balance between political ideology and the practical realities of economic governance. Will the administration heed the warnings of these analysts, or will they dismiss them as partisan attacks? The coming days and weeks will be crucial in determining the extent of the fallout and the long-term implications of this unprecedented intervention from Wall Street. The unusual severity of the criticism suggests that the situation is far from ordinary, and the stakes are undeniably high. The episode serves as a stark reminder of the intricate and often unpredictable interplay between the worlds of finance and politics.

Leave a Reply