Navigating the Choppy Waters of Retirement Savings: Why You Shouldn’t Panic

The recent market downturn has undoubtedly sent ripples of anxiety through many retirement savers. Watching your 401(k) balance fluctuate dramatically can be unsettling, especially when headlines scream about market crashes and potential economic woes. But before you succumb to panic and make rash decisions, let’s take a deep breath and look at the bigger picture. For most people, the current market volatility shouldn’t significantly alter their long-term retirement plans.

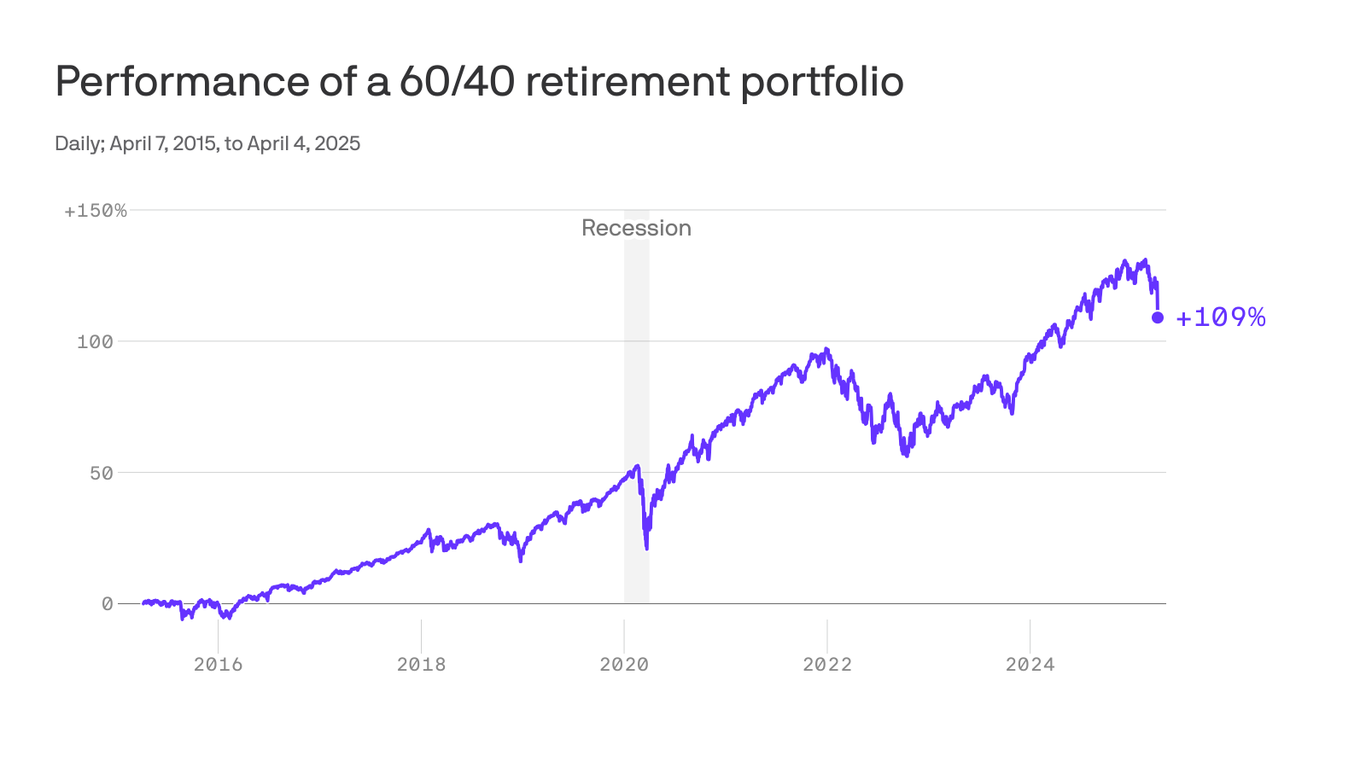

The truth is, market fluctuations are a normal part of the investment cycle. Think of it like the tide – there are ebbs and flows, highs and lows. While the recent downturn may feel exceptionally sharp, it’s crucial to remember that the stock market has historically recovered from even the most significant dips. Focusing on short-term losses can be detrimental to your long-term financial health.

The key to weathering these storms lies in understanding your investment strategy and timeline. If you’re decades away from retirement, the current market dip is less of a crisis and more of a temporary setback. Over the long term, the market’s upward trajectory tends to outweigh any short-term declines. Consider it an opportunity to buy low – a chance to acquire more shares at a reduced price, ultimately boosting your overall returns when the market inevitably rebounds.

For those closer to retirement, the situation is understandably more complex. However, even in this scenario, panic selling is rarely the optimal strategy. Liquidating your assets during a downturn essentially locks in your losses, preventing you from benefiting from future market growth. A well-diversified portfolio, spread across various asset classes, can help mitigate risk and reduce the impact of market volatility.

What constitutes a well-diversified portfolio? This is a question best answered with the help of a qualified financial advisor. They can help you assess your risk tolerance, time horizon, and financial goals to create a customized investment strategy that aligns with your individual circumstances. This strategy should account for your age, risk tolerance, and retirement goals. A younger investor, for example, can typically afford to take on more risk than someone nearing retirement.

Remember that your 401(k) is a long-term investment, not a get-rich-quick scheme. It’s designed to grow steadily over time, providing you with a comfortable retirement. While it’s natural to experience anxiety during periods of market instability, succumbing to emotional decision-making can be financially devastating.

Instead of panicking, consider using this time to review your investment strategy. Are you appropriately diversified? Do you understand your risk tolerance? Are your goals still aligned with your current plan? If you have any doubts or uncertainties, seeking professional guidance from a financial advisor is highly recommended.

In short, while the recent market volatility is undeniably concerning, it’s crucial to maintain perspective. Don’t let short-term fluctuations derail your long-term retirement plan. Focus on your overall strategy, stay disciplined, and consider seeking expert advice if needed. Your future self will thank you for it. The market’s ups and downs are a natural part of the process; ride them out with a well-defined strategy and you’ll be well-positioned for a secure retirement.

Leave a Reply