Navigating the Choppy Waters of Retirement Savings: Why You Shouldn’t Panic

The stock market’s recent rollercoaster ride has undoubtedly left many feeling uneasy, especially those diligently saving for retirement. Seeing portfolio values fluctuate dramatically can trigger anxiety, prompting questions about long-term financial security and the wisdom of sticking to a long-term investment plan. But before you succumb to panic and make rash decisions, let’s take a deep breath and examine the bigger picture.

The truth is, market volatility is a normal, albeit sometimes unsettling, part of the investment landscape. Short-term fluctuations, even significant ones, don’t necessarily reflect the underlying strength or potential of the market in the long run. Think of it like the weather – there will be storms, but sunny days inevitably follow. Trying to time the market, jumping in and out based on short-term predictions, is often a losing game. Most experts agree that consistent, long-term investing is a far more effective strategy.

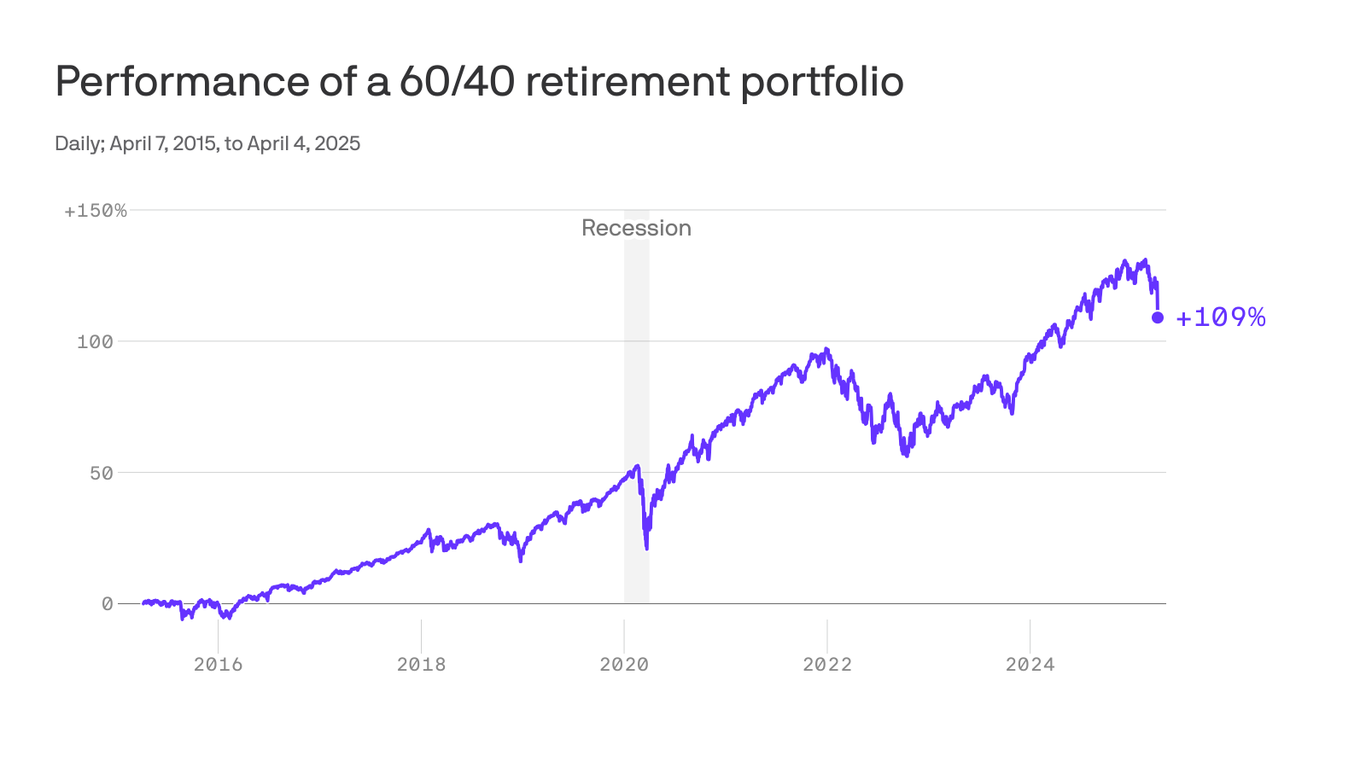

For those nearing retirement, the recent market downturn might feel particularly jarring. However, the impact depends heavily on individual circumstances. If your retirement savings are diversified across different asset classes – stocks, bonds, and perhaps real estate – the effect of the stock market downturn will be lessened. A well-diversified portfolio aims to mitigate risk by spreading investments across various sectors and asset types, reducing the overall vulnerability to market downturns.

Furthermore, the timeframe matters significantly. If retirement is still many years away, the current market fluctuations are less of a concern. The power of compounding over time allows investments to recover from temporary setbacks. Think of it as a marathon, not a sprint. Short-term dips are just bumps in the road on the path to long-term growth. Attempting to react to each bump often only results in lost potential gains.

For those closer to retirement, a more nuanced approach may be necessary. It’s crucial to review your retirement plan and assess your risk tolerance. If the volatility is causing significant stress, consulting with a financial advisor is highly recommended. They can help you tailor your investment strategy to your specific circumstances, timeline, and risk tolerance, potentially adjusting your asset allocation to align with your comfort level without compromising long-term goals.

Importantly, remember that retirement planning is a long-term endeavor. It’s not about chasing short-term gains or reacting to every market fluctuation. It’s about consistently contributing to your savings, maintaining a diversified portfolio, and staying the course, even during turbulent periods. Panicking and making impulsive decisions driven by fear can be detrimental to your long-term financial well-being.

Instead of focusing on the short-term noise, maintain a long-term perspective. Regularly review your investment strategy, but avoid making drastic changes based on short-term market movements. Consistent contributions, strategic diversification, and a long-term mindset are the cornerstones of successful retirement planning, allowing you to navigate market uncertainty with confidence and achieve your financial goals. Remember, professional guidance can be invaluable in these situations, providing personalized support and helping you maintain a clear path toward a secure retirement.

Leave a Reply