Navigating the Choppy Waters of Retirement Savings: Why You Shouldn’t Panic

The recent market downturn has understandably left many feeling anxious about their retirement savings. Seeing significant drops in portfolio values can be jarring, triggering a natural impulse to panic and make rash decisions. However, before you succumb to fear, let’s take a deep breath and examine the bigger picture. For most individuals, particularly those with a long-term investment horizon, the current volatility shouldn’t necessitate drastic changes to their retirement strategy.

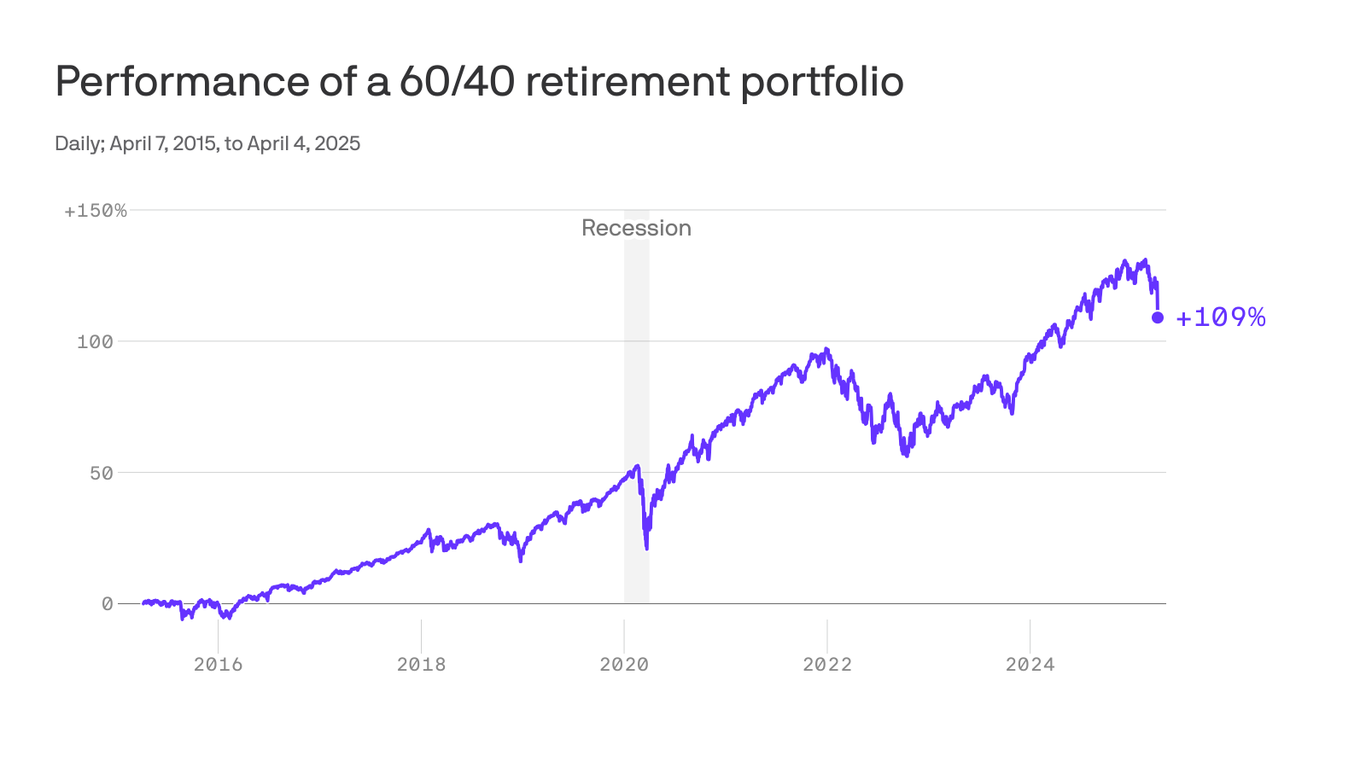

The truth is, market fluctuations are a normal, albeit sometimes unsettling, part of the investment landscape. Stocks, by their very nature, are subject to ups and downs. While short-term losses are undeniably painful, focusing solely on these short-term dips ignores the power of long-term growth. Remember, retirement investing is a marathon, not a sprint. The goal is to steadily accumulate wealth over decades, weathering the inevitable storms along the way.

For those nearing retirement, the current market conditions might seem particularly daunting. However, even for those in the later stages of their investing journey, a well-diversified portfolio, properly aligned with their risk tolerance and time horizon, can help mitigate the impact of market downturns. A financial advisor can be an invaluable resource during these times, offering personalized guidance and helping to create a plan that balances risk and reward based on your specific circumstances and retirement goals.

One common mistake during market volatility is emotional investing – making decisions based on fear rather than a rational assessment of your long-term strategy. Selling investments in a panic can lock in losses and potentially derail your retirement plan. Remember, your retirement savings are intended to support you through decades of life, not just the next few months or years. Trying to time the market – buying low and selling high – is notoriously difficult, even for seasoned professionals. Consistent, disciplined investing, staying true to your long-term plan, often yields better results than attempting to outsmart the market.

Many factors contribute to market fluctuations, ranging from geopolitical events and economic indicators to shifts in investor sentiment. It’s impossible to predict these shifts with certainty, which underscores the importance of a diversified investment portfolio. Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) reduces the impact of losses in any single area. A well-structured portfolio can act as a buffer against market shocks, limiting the overall damage to your savings.

Furthermore, the current market conditions shouldn’t deter those still actively contributing to their retirement accounts. Continuing to contribute regularly, even during periods of market volatility, is crucial for leveraging the power of compounding. Regular contributions, especially when the market is down, allow you to purchase more shares at lower prices, potentially increasing your returns in the long run. This strategy effectively “buys low” without the guesswork of trying to time the market.

Finally, it’s important to remember that retirement planning is a long-term endeavor that requires patience and discipline. The key is to establish a well-defined plan aligned with your financial goals and risk tolerance, and stick to it. Seek professional advice if needed, but avoid making impulsive decisions based on short-term market fluctuations. Your long-term financial well-being depends on it. The current market downturn is a temporary challenge, not a reason to abandon your retirement goals. Stay focused, stay disciplined, and remember the power of long-term investing.

Leave a Reply