Navigating the Storm: Why You Shouldn’t Panic About Your 401(k)

The stock market’s recent rollercoaster ride has undoubtedly left many feeling uneasy, particularly those watching their retirement savings fluctuate. Trillions of dollars have seemingly vanished overnight, sparking understandable anxiety about the future. But before you succumb to panic and make rash decisions, let’s take a deep breath and look at the bigger picture. For most people, the current market volatility shouldn’t drastically alter their long-term retirement plans.

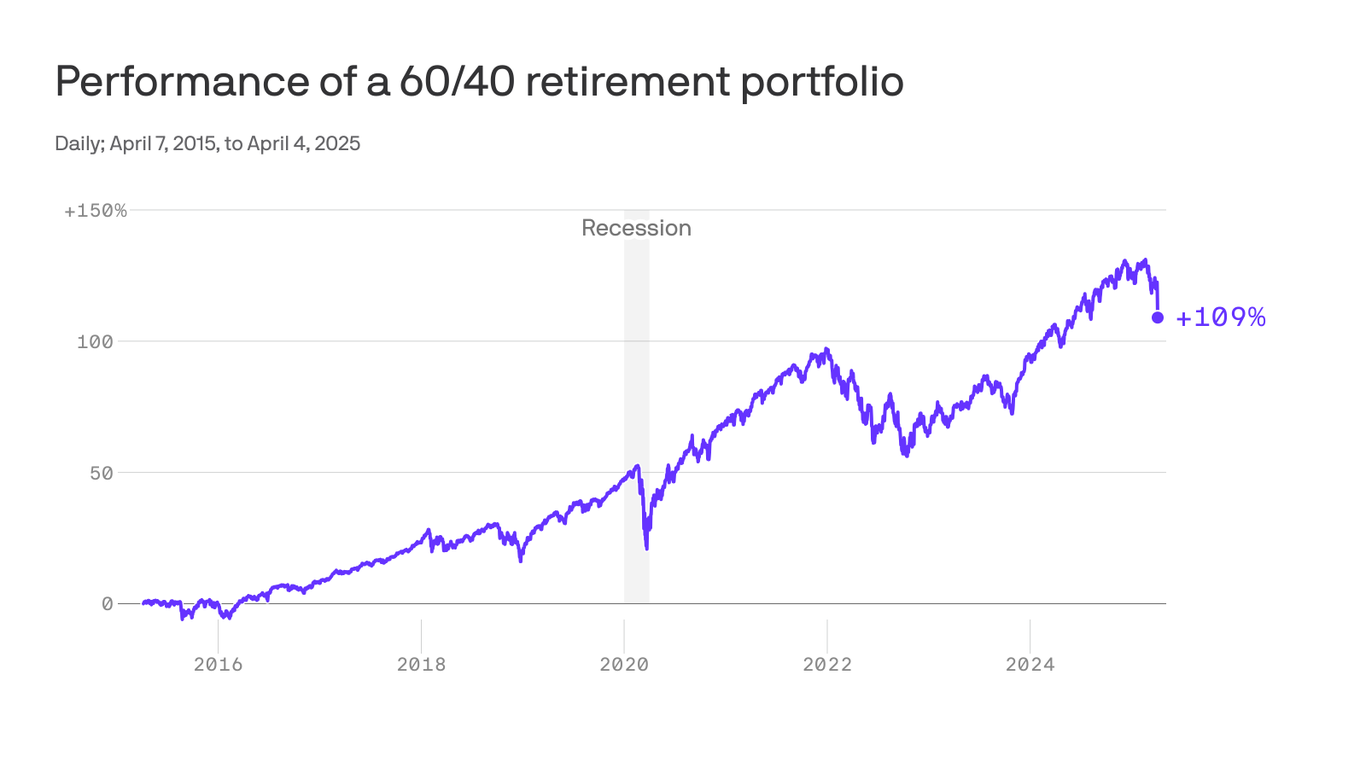

The truth is, market fluctuations are a normal, even expected, part of investing. Think of it like the weather; sunny days and storms are both inevitable. While the recent downturn feels significant, it’s crucial to remember that the market has always experienced periods of both growth and decline. History consistently demonstrates its resilience, bouncing back from even the most severe downturns.

The key to weathering these storms lies in understanding your investment timeline and maintaining a long-term perspective. Retirement investing isn’t a sprint; it’s a marathon. The impact of short-term market dips is significantly lessened when you’re investing decades ahead of retirement. Losses incurred today can be easily offset by future gains if you remain invested and avoid making impulsive decisions driven by fear.

For those nearing retirement, the situation may feel more pressing. However, even in this case, panic selling is rarely the best strategy. Instead, consider consulting a financial advisor to assess your risk tolerance and adjust your portfolio accordingly. Diversification is key; spreading your investments across different asset classes can help mitigate the impact of market volatility. Remember, a well-diversified portfolio is designed to withstand market fluctuations.

The temptation to react emotionally to market downturns is strong. We’re wired to avoid losses, and seeing your retirement savings shrink is undoubtedly unsettling. But remember, selling low only locks in those losses. By holding onto your investments during these periods, you give yourself the opportunity to ride out the storm and benefit from the market’s eventual recovery.

Furthermore, consider the broader economic context. While market downturns can be driven by various factors—from inflation to geopolitical events—they don’t necessarily signal an impending economic collapse. These are temporary setbacks within a larger, ongoing economic cycle. Maintaining a long-term perspective helps to keep these fluctuations in their proper context.

Many people hold a significant portion of their retirement savings in employer-sponsored 401(k) plans. While it’s understandable to be concerned about these fluctuations, it’s important to remember that these plans often offer various investment options, allowing you to tailor your portfolio to your risk tolerance and time horizon. If you’re unsure about your current allocation, consider reviewing your plan’s options or speaking with a financial advisor.

In conclusion, while the current market volatility is undeniably concerning, it shouldn’t trigger panic. For most individuals, the best course of action is to remain invested, maintain a long-term perspective, and resist the urge to make rash decisions. Remember, market fluctuations are normal, and history consistently shows the market’s ability to recover. Focus on your overall financial plan, consult with a professional if needed, and ride out the storm. Your future self will thank you.

Leave a Reply