Navigating the Choppy Waters of Retirement Savings: Why You Shouldn’t Panic

The stock market’s recent volatility has understandably sent ripples of anxiety through many Americans’ lives. Seeing portfolio values fluctuate dramatically can be unnerving, particularly when those investments are tied to long-term financial goals like retirement. But before you succumb to panic and make rash decisions, let’s take a deep breath and examine the bigger picture. For most people, the current market turbulence shouldn’t trigger drastic changes to their retirement savings strategies.

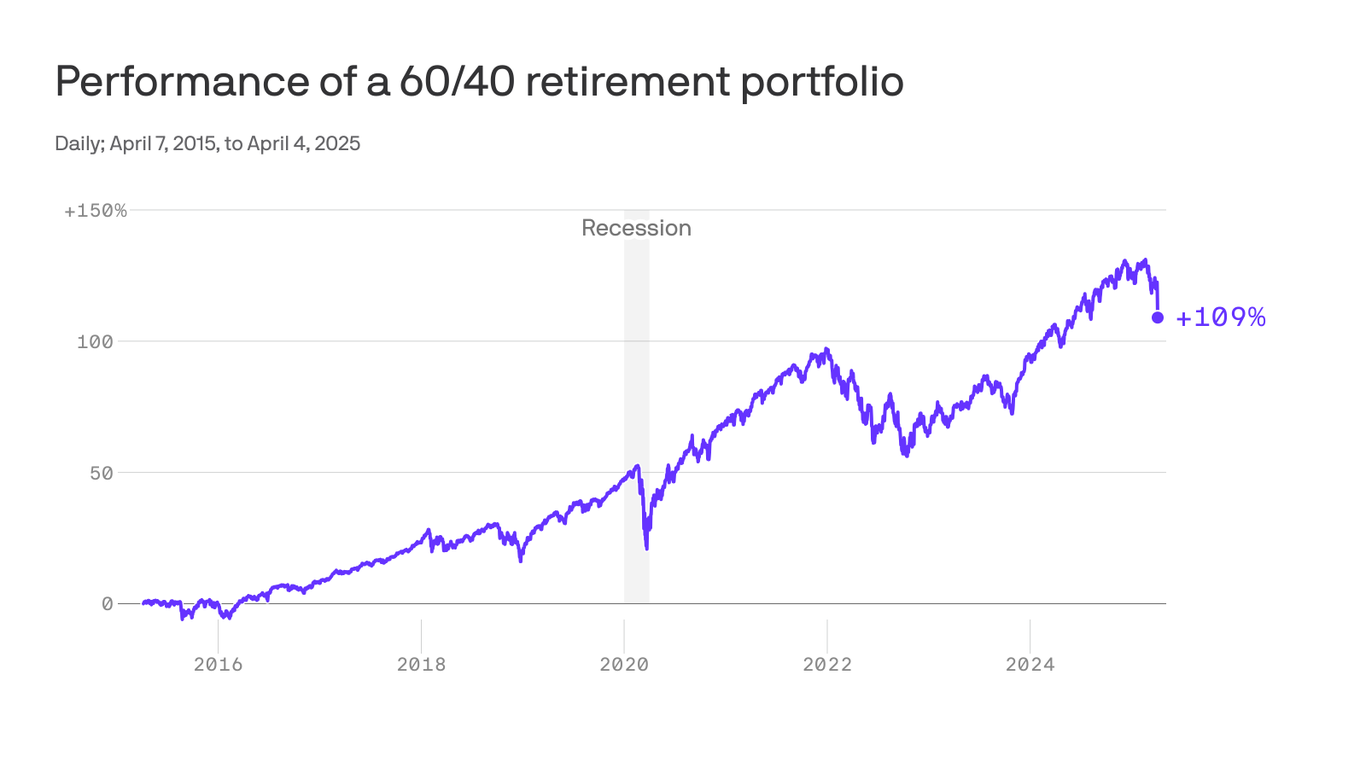

The truth is, market fluctuations are a normal, even expected, part of the investment landscape. While the recent sell-off felt significant, and indeed represented a substantial loss of paper value for many, it’s crucial to remember that investing is a long-term game. The short-term dips and surges often smooth out over time, especially when viewed through the lens of decades rather than weeks or months.

Think of it like a rollercoaster. The steep drops are undeniably thrilling (or terrifying!), but the ride doesn’t end there. There are climbs and plateaus to come, and the ultimate destination—reaching the top of the hill representing a comfortable retirement—remains the same. Focusing solely on the immediate dips can lead to impulsive reactions that could ultimately hinder your long-term progress.

For those nearing retirement, the concern might be more acute. However, even in this case, immediate drastic changes aren’t usually the best course of action. Well-diversified portfolios, carefully crafted to balance risk and reward over a long timeframe, should be able to weather these storms. A sudden shift in strategy might inadvertently expose your portfolio to even greater risk, potentially jeopardizing your retirement security.

Instead of reacting emotionally, now is the time for reassessment, not panic. Review your investment strategy with a financial advisor if you haven’t already. They can help you understand your risk tolerance and adjust your portfolio accordingly, ensuring it’s appropriately aligned with your timeline and goals.

Remember, your retirement savings are likely diversified across different asset classes, including stocks, bonds, and potentially real estate. This diversification helps to mitigate the impact of any single market sector’s downturn. While stocks may experience volatility, bonds often provide a degree of stability during periods of uncertainty.

It’s also important to resist the urge to time the market. Trying to predict the market’s ebbs and flows is notoriously difficult, even for seasoned professionals. More often than not, attempting to time the market leads to missed opportunities and suboptimal returns. A consistent, long-term investment strategy remains the most reliable path to retirement success.

Finally, consider your overall financial picture. Do you have an emergency fund in place to cover unexpected expenses? This is crucial, regardless of market conditions, providing a buffer against unforeseen circumstances and preventing the need to dip into your retirement savings prematurely.

In conclusion, while the recent market turmoil is undoubtedly unsettling, it doesn’t necessitate drastic changes to your retirement plan for the vast majority of people. Maintain a long-term perspective, review your strategy with a professional if needed, and resist the urge to make impulsive decisions based on short-term market fluctuations. The ride may be bumpy, but your destination remains within reach.

Leave a Reply