Navigating the Storm: Why Your 401(k) Might Be Just Fine

The recent stock market downturn has understandably left many feeling uneasy. Watching your investment portfolio shrink can be alarming, especially when headlines scream about trillions of dollars lost. It’s easy to panic, to feel like you’ve made a terrible mistake, and to be tempted to make rash decisions. But before you react impulsively, take a deep breath. For most people, the current market volatility shouldn’t drastically change their long-term financial plans.

The truth is, market fluctuations are a normal part of the investment cycle. Think of it like the weather – there are sunny days and stormy days. No one can predict the weather with perfect accuracy, and similarly, no one can accurately predict the short-term movements of the stock market. Trying to time the market – buying low and selling high – is notoriously difficult, even for professional investors. More often than not, attempts to time the market result in missed opportunities and poorer overall returns.

The key to weathering market storms lies in understanding your investment timeline. If you’re decades away from retirement, the current downturn is unlikely to significantly impact your long-term financial goals. Market dips provide opportunities to buy assets at lower prices. While it might feel counterintuitive to invest more when the market is down, this is precisely when your contributions can have the biggest impact. Over time, the market tends to recover and even surpass previous highs. Your younger years offer a longer time horizon to allow for market recovery and growth.

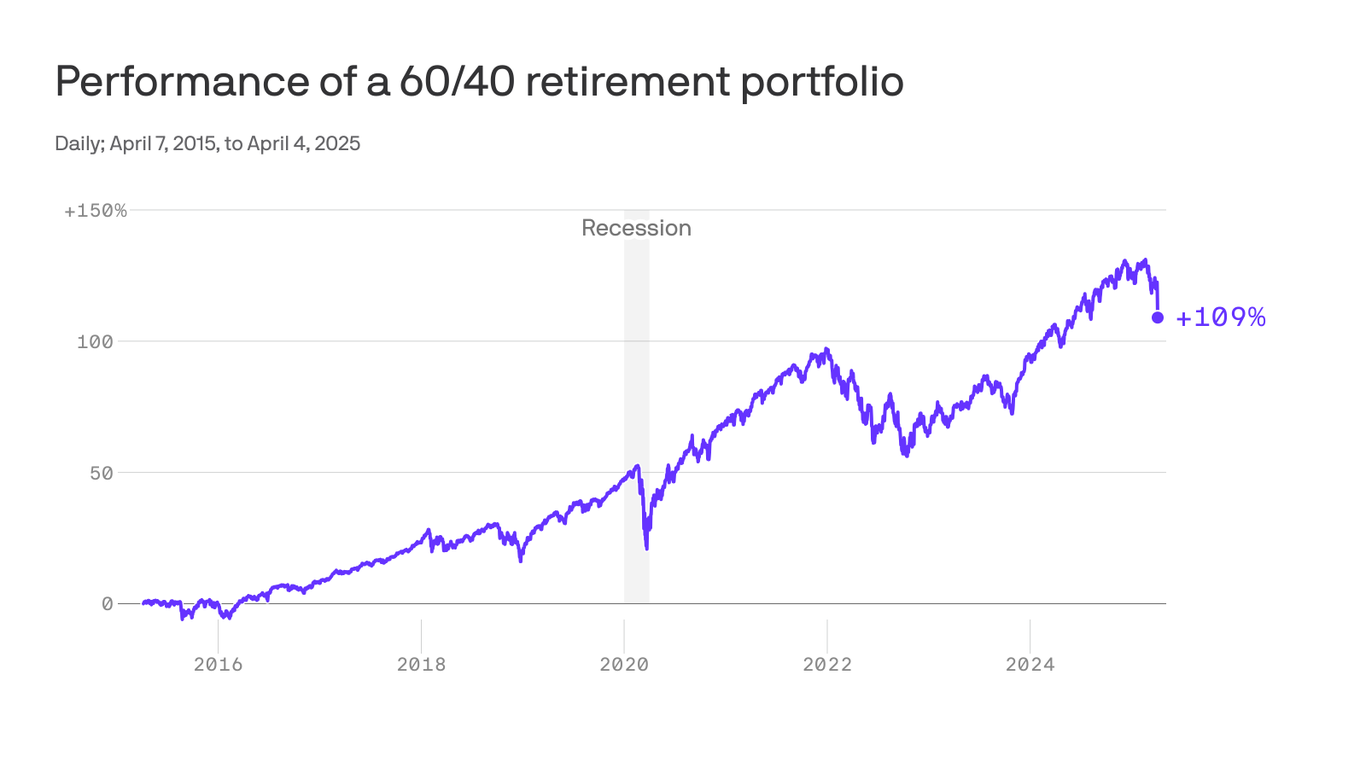

For those closer to retirement, the situation is slightly different, but not necessarily cause for alarm. A well-diversified portfolio, spread across various asset classes, should help mitigate the impact of market downturns. Diversification is crucial; it’s about not putting all your eggs in one basket. Having a mix of stocks, bonds, and potentially other assets reduces the overall risk associated with any single investment’s performance.

Furthermore, it’s important to remember that your 401(k) is likely just one part of your overall financial picture. You probably have other savings, assets, and potential income streams to consider. Don’t let the short-term fluctuations of the stock market overshadow your broader financial health.

Resist the urge to make emotional decisions. Avoid knee-jerk reactions like withdrawing your investments during a downturn. Selling at a loss locks in those losses, and you miss out on the potential for future growth. Instead, focus on your long-term goals and stick to your investment strategy. If you have a well-defined plan, review it with a financial advisor if needed, but generally, stay the course.

The current market volatility is a reminder that investing involves risk. There will be ups and downs, but long-term growth is still possible, even probable, with a strategic approach. Don’t let short-term fear dictate your long-term financial security. Stay informed, stay diversified, and remember that consistent contributions and a long-term perspective are your best allies in navigating market fluctuations.

Leave a Reply