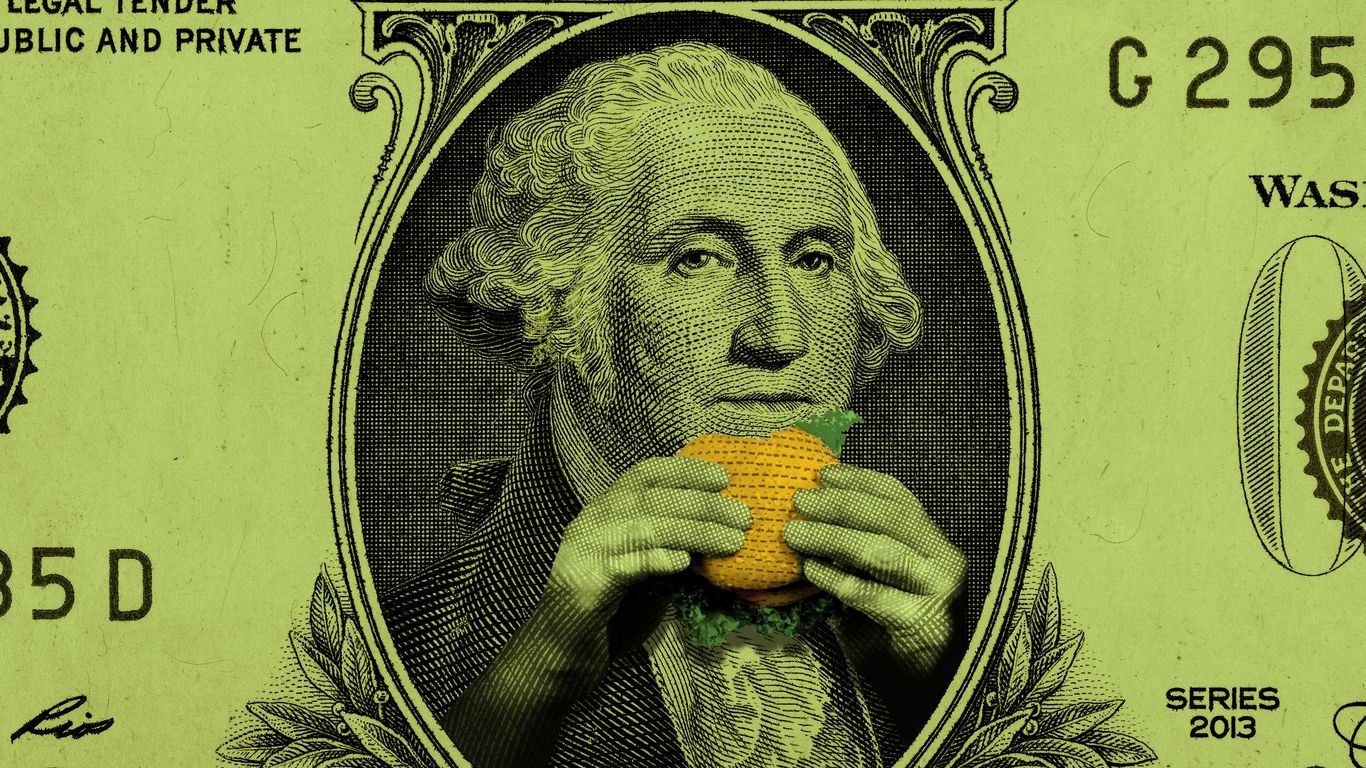

The Future of Food Delivery: Buy Now, Pay Later is Here

The way we pay for things is constantly evolving, and now, that evolution is extending to our late-night pizza cravings and midday burger runs. The convenience of food delivery apps has already revolutionized how we access our favorite meals, and now, a new payment option is set to further reshape the landscape: buy now, pay later (BNPL).

For those unfamiliar, BNPL services allow consumers to purchase goods and services and pay for them in installments over a short period, typically a few weeks or months. This payment method has gained immense popularity in recent years, offering a flexible alternative to traditional credit cards and immediate payment methods. Its appeal lies in its ease of use, often requiring only a quick registration and minimal credit checks.

Now, this increasingly popular payment option is making its way into the world of food delivery. Imagine this: you’re scrolling through your favorite food delivery app, eyeing that tempting gourmet burger or a family-sized pizza. Instead of needing to have the full amount readily available, you can opt to split the payment into smaller installments, spread over time. Suddenly, that indulgent treat feels much more accessible.

This integration marks a significant shift in the food delivery industry. For consumers, it opens up possibilities to enjoy meals they might otherwise forgo due to budget constraints. The immediacy of satisfying hunger pangs overrides the potential financial burden, making the decision to order much easier. This could lead to increased order frequency and higher average order values, benefiting both consumers and the delivery platforms.

However, this development isn’t without potential drawbacks. The convenience of BNPL comes with a risk of accumulating debt if not managed responsibly. The ease of splitting payments might encourage impulse purchases, leading to unforeseen financial burdens. While the initial payment amounts seem small, neglecting to track and repay installments on time can quickly lead to escalating fees and negative impacts on credit scores.

The rise of BNPL in food delivery also raises questions about its long-term effects on consumer spending habits and financial well-being. While offering short-term flexibility, it’s crucial for consumers to be mindful of their spending and to utilize these services responsibly. Understanding the repayment terms and avoiding overspending is paramount to preventing potential financial difficulties.

The food delivery companies themselves also face considerations. Integrating BNPL systems requires significant investment in infrastructure and security to ensure smooth transactions and protect user data. They must also balance the benefits of increased sales with the potential risks associated with consumer debt and potential regulatory scrutiny.

Ultimately, the integration of buy now, pay later into food delivery apps presents a fascinating case study of evolving consumer behaviour and the ever-changing financial landscape. While it offers enticing advantages in terms of access and convenience, it necessitates responsible usage and a clear understanding of its financial implications. Only time will tell the full extent of its impact on the food delivery industry and the financial habits of consumers. However, one thing is clear: the future of food ordering is undeniably intertwined with the ever-growing prevalence of flexible payment options.

Leave a Reply