The Future of Food: Buy Now, Pay Later Arrives at Your Doorstep

Convenience is king in today’s fast-paced world, and that extends to how we pay for our everyday purchases. Gone are the days of strictly cash or credit; innovative payment methods are constantly emerging to cater to our increasingly on-demand lifestyles. One such innovation is rapidly changing the landscape of food delivery: buy now, pay later (BNPL).

For those unfamiliar, BNPL services allow consumers to purchase goods and services immediately, then pay for them in installments over a short period, typically a few weeks or months, often with no interest charges. This model has gained immense popularity, particularly among younger generations, for its flexibility and ease of use. It allows for better budgeting control and avoids the immediate financial strain of larger purchases.

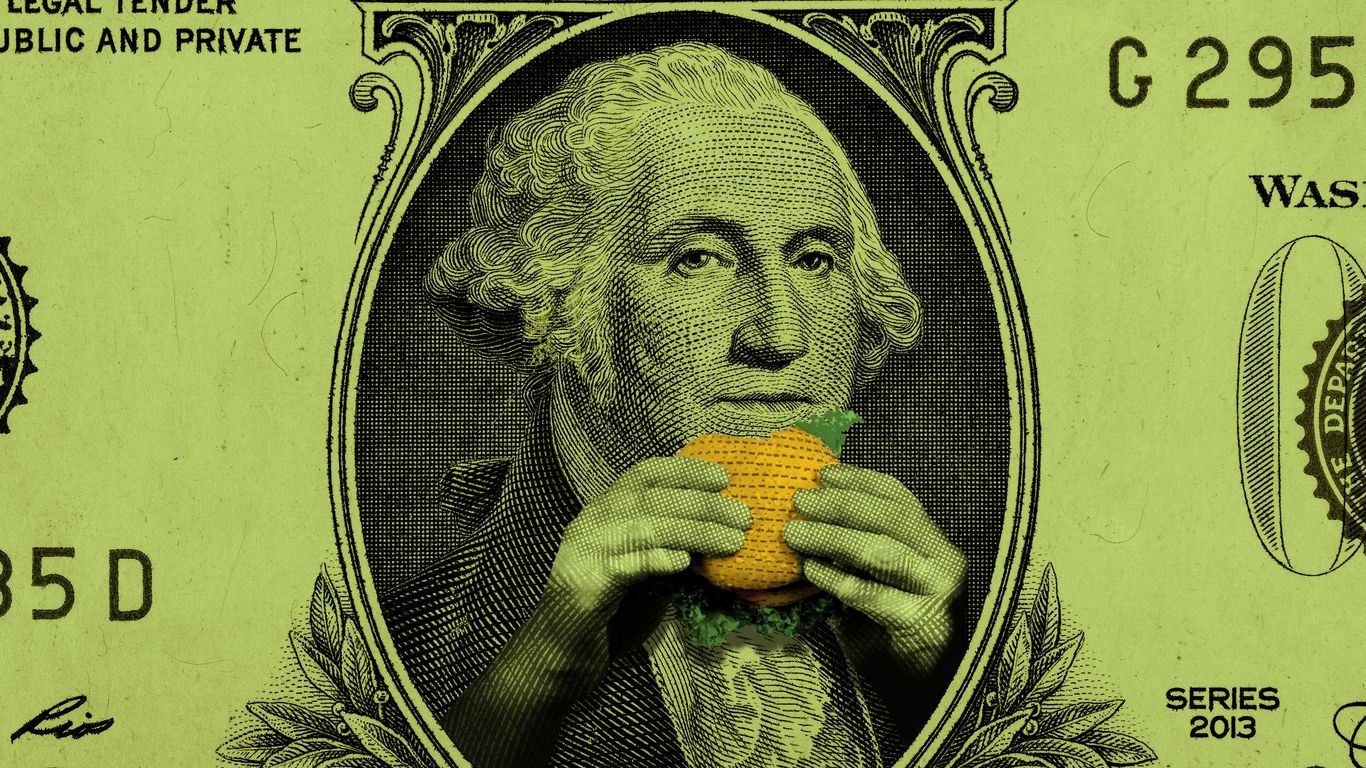

Now, the world of food delivery is embracing this trend in a big way. Imagine this: you’re craving a delicious burger from your favorite local joint, but your bank account is a little light. No problem! With the integration of a prominent BNPL provider into a major food delivery app, you can order that burger without delay. Enjoy your meal now, and spread the cost over a few weeks, making those impromptu cravings a little less stressful on your finances.

This partnership between a leading food delivery platform and a well-established BNPL company represents a significant shift in the industry. It signifies a growing acceptance of BNPL services, moving beyond larger purchases like electronics or furniture to encompass everyday expenses like restaurant meals. This integration is poised to significantly impact consumer behavior. The ease and convenience it offers could lead to increased spending on food delivery, potentially boosting sales for restaurants and delivery services alike.

However, like any financial innovation, it’s important to acknowledge the potential downsides. While the short-term appeal of interest-free installments is undeniable, it’s crucial to use BNPL services responsibly. Overusing these services and failing to track payments can quickly lead to debt accumulation, potentially resulting in late fees and a negative impact on credit scores. This underscores the need for financial literacy and mindful spending habits, even when presented with convenient payment options.

The integration of BNPL into food delivery also raises questions about the implications for restaurants and delivery companies. The increased transaction volume could provide a boost to their bottom lines, but it also introduces new risks related to payment processing and potential bad debts. Managing these risks and ensuring smooth payment operations will be crucial for their continued success.

In conclusion, the arrival of buy now, pay later options in food delivery marks a pivotal moment in the evolution of consumer payment methods and the food delivery industry itself. It presents both exciting opportunities and potential challenges. The convenience it offers to consumers is undeniable, but responsible usage and understanding of the financial implications remain vital. As this payment method becomes more prevalent, we can expect further innovations and adaptations within the food delivery ecosystem, shaping how we consume and pay for our meals in the years to come. The future of food, it seems, is now served in convenient installments.

Leave a Reply