Nvidia: Navigating the Choppy Waters of Global Trade

The tech world is buzzing, and not just because of the latest innovative gadget. A storm is brewing, and it’s impacting one of the biggest players in the semiconductor industry: Nvidia. The recent escalation of global trade tensions has sent ripples through the market, creating uncertainty for investors and forcing companies to adapt to a rapidly changing landscape. The key question on everyone’s mind: how will Nvidia weather this economic tempest?

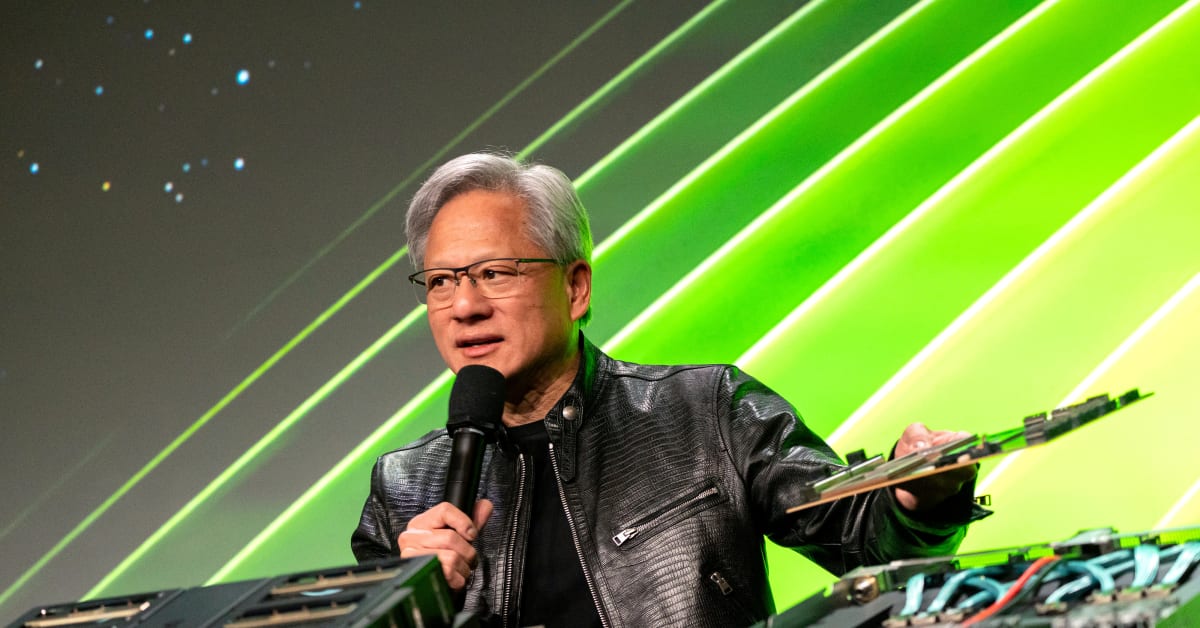

Nvidia’s success story is largely tied to its powerful graphics processing units (GPUs), crucial components in everything from gaming PCs and data centers to self-driving cars and artificial intelligence. This broad market reach, while a strength in normal times, makes it particularly vulnerable to shifts in global demand. Tariffs, by their very nature, increase the cost of goods, potentially impacting the affordability and competitiveness of Nvidia’s products in both domestic and international markets.

One significant area of concern is the impact on data center sales. Nvidia’s GPUs are powering the next generation of AI and cloud computing, and any disruption to the global supply chain could severely impact these crucial markets. Increased tariffs on components or finished products could make Nvidia’s solutions more expensive compared to competitors, potentially leading to lost sales and reduced market share. This is particularly relevant considering the already fierce competition in the data center space.

The automotive sector presents another potential challenge. Nvidia’s technology is central to the development of autonomous driving systems, a field currently experiencing rapid growth but also significant regulatory hurdles and unpredictable market forces. Tariffs could add to the complexity and cost of producing and deploying these complex systems, impacting the timeline of adoption and potentially slowing down the growth trajectory.

However, it’s not all doom and gloom. Nvidia’s long-term prospects remain strong. The fundamental demand for high-performance computing continues to grow exponentially, driven by advancements in AI, machine learning, and the increasing reliance on data-driven decision-making. Moreover, Nvidia has a track record of innovation and adaptation, consistently pushing the boundaries of technology and finding new applications for its GPUs.

The company’s strategy likely involves a multi-pronged approach. This could include diversifying its supply chain, exploring alternative manufacturing locations, and potentially absorbing some of the increased costs to maintain its competitive edge. Furthermore, leveraging its strong brand reputation and focusing on building long-term relationships with key customers will be crucial.

The current economic climate demands agility and strategic planning. While the uncertainty surrounding global trade remains a significant headwind, Nvidia’s robust technology, strong market position, and proven ability to innovate suggest it has the tools to navigate these choppy waters. While the immediate future may hold challenges, the long-term outlook for Nvidia remains compelling, contingent upon successfully mitigating the impact of global trade tensions. The coming months will be critical in observing how the company adapts its strategy and navigates these uncertain times. Investors, however, should brace themselves for potential volatility in the short term.

Leave a Reply