Market Volatility: Understanding the Rollercoaster and Predicting the Next Move

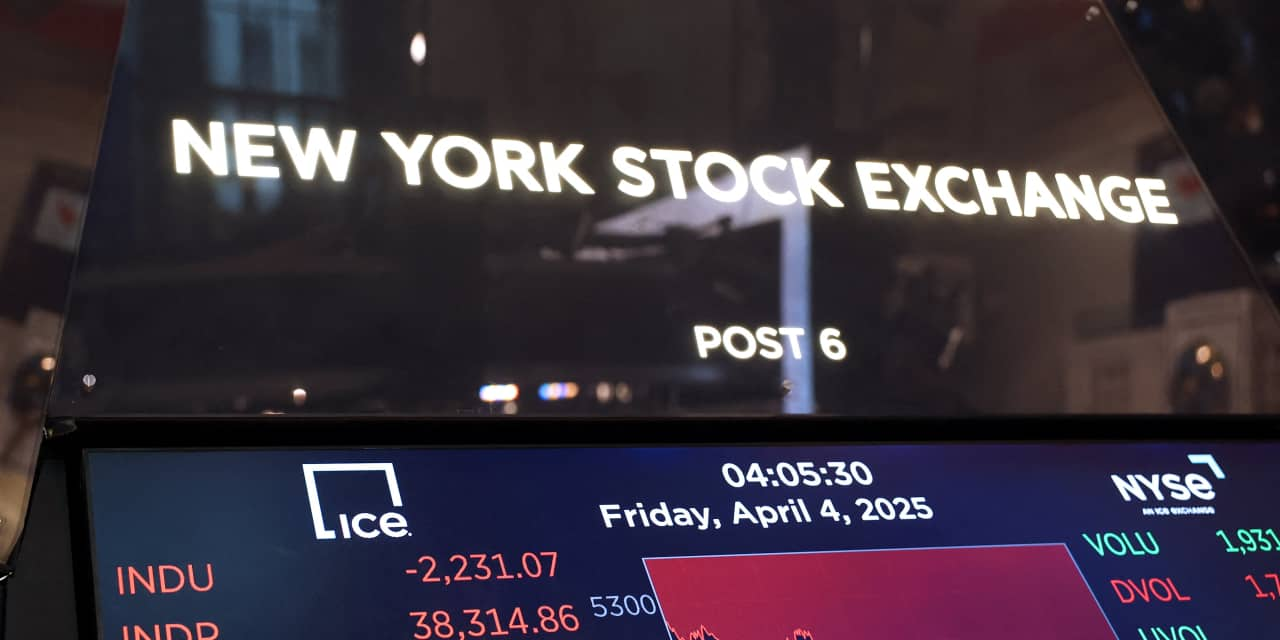

The stock market can feel like a terrifying rollercoaster at times, a dizzying ascent followed by a stomach-churning plunge. Recently, we’ve witnessed a significant sell-off, leaving many investors wondering what’s next. The sharp decline has understandably sparked concerns, but history offers some clues to help navigate this turbulent period.

One of the most important things to remember about market corrections – significant drops in stock prices – is that they are a normal part of the economic cycle. They are not necessarily indicative of an impending crash, but rather a natural response to various economic factors. These factors can include geopolitical events, unexpected economic data releases, shifts in investor sentiment, or even just a period of profit-taking after a prolonged period of growth. In essence, the market corrects itself, often quite dramatically, to reflect a more accurate valuation of assets.

While predicting the market’s exact movements is impossible, historical data suggests a fascinating pattern: sometimes, the sharper the fall, the quicker the rebound. This isn’t a guaranteed outcome, of course. The speed and magnitude of a recovery depend on a multitude of factors, including the underlying reasons for the initial sell-off. However, a significant drop often triggers a wave of bargain hunting. Investors, seeing prices significantly below what they believe to be the intrinsic value of the assets, begin to step in and purchase stocks, driving prices back up. This phenomenon, often fueled by pent-up demand and a desire to capitalize on low prices, can lead to a swift reversal of the downward trend.

It’s crucial to distinguish between short-term fluctuations and long-term trends. While daily or even weekly market movements can be dramatic and unnerving, they don’t necessarily reflect the overall health of the economy or the long-term prospects of individual companies. Focusing on the long-term perspective is essential for navigating these periods of volatility. Investors with a long-term horizon should generally avoid making impulsive decisions based on short-term market swings. Instead, they should stick to their investment strategy, remaining disciplined and focused on their overall financial goals.

What should investors do during these periods of uncertainty? The first step is to remain calm and avoid panic selling. Panicked decisions, driven by fear and emotion, often lead to significant losses. Instead, investors should take the opportunity to review their portfolio, ensuring it aligns with their risk tolerance and long-term goals. This is a time for careful consideration, not hasty action.

Diversification plays a crucial role in mitigating risk during periods of market instability. A well-diversified portfolio, spread across various asset classes and sectors, is less vulnerable to significant losses caused by market downturns. Understanding your risk tolerance is key – some investors are more comfortable with higher risk and potentially higher returns, while others prioritize capital preservation.

In conclusion, while recent market declines are undoubtedly concerning, it’s crucial to maintain a long-term perspective and to avoid making emotional decisions. History suggests that sharp falls can sometimes be followed by swift rebounds, but the market is complex and unpredictable. A disciplined approach, focusing on diversification, risk management, and a long-term strategy, is the best way to navigate the inevitable ups and downs of investing. The key is to understand that market corrections are a normal part of the process, and to use them as an opportunity to reassess and refine your investment plan.

Leave a Reply