Nvidia: From AI Darling to… What’s Next?

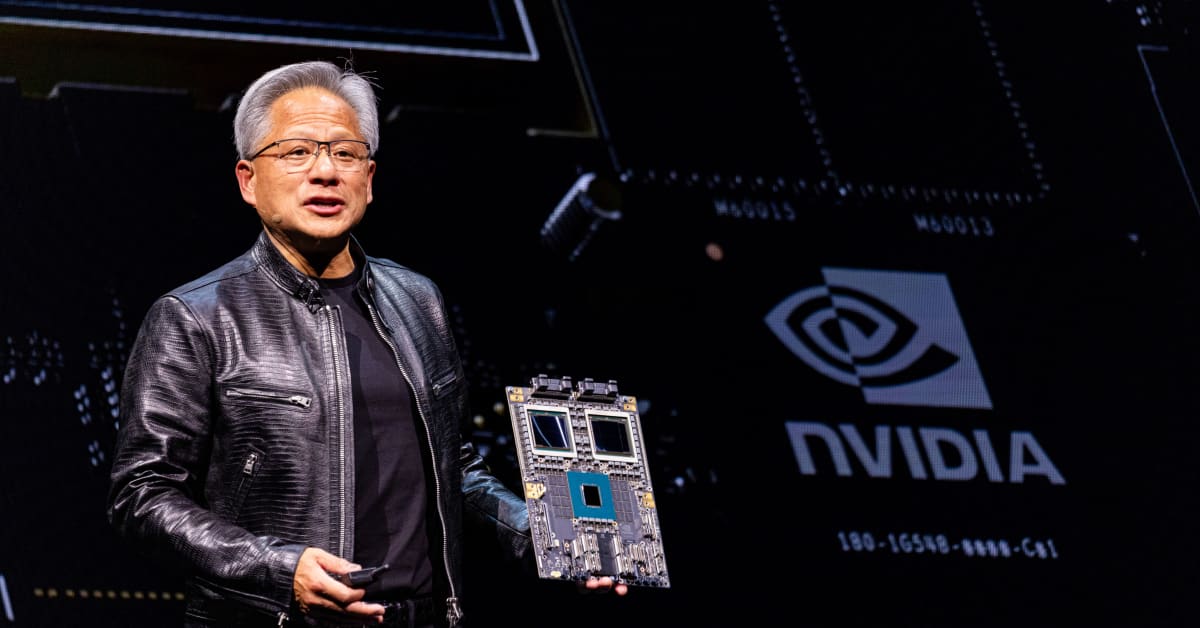

Nvidia’s meteoric rise has captivated the financial world. The company, once primarily known for its graphics processing units (GPUs) in gaming, has become synonymous with the explosive growth of artificial intelligence. The surge in AI development, fueled by the likes of ChatGPT and the ensuing rush to build and train powerful AI models, has transformed Nvidia into a tech titan. Its stock price has reflected this dramatic shift, soaring to unprecedented heights. But as the dust settles on this initial AI gold rush, the question on everyone’s mind is: what’s next for Nvidia?

The recent frenzy around generative AI has been undeniably beneficial for Nvidia. The company’s GPUs, with their superior parallel processing capabilities, are perfectly suited for the computationally intensive tasks involved in training large language models and other AI applications. This has created a massive surge in demand, driving significant revenue growth and fueling the stock’s impressive performance. However, this rapid growth raises concerns about sustainability. Can Nvidia maintain this momentum?

Experienced market analysts are beginning to revise their predictions, acknowledging the inherent volatility of the tech sector and the potential for market corrections. While the long-term prospects for AI remain incredibly promising, the immediate future might present a more nuanced picture. Some analysts predict a period of consolidation, where growth may slow down compared to the explosive gains of the past year. This doesn’t necessarily signal a downturn, but rather a more realistic expectation of growth that’s less dramatic but still robust.

Several factors could influence Nvidia’s trajectory. One is the competitive landscape. While Nvidia currently holds a dominant position in the high-performance computing market, competitors are investing heavily in developing their own AI-focused hardware. This increased competition could put pressure on Nvidia’s market share and pricing power in the long run.

Another critical factor is the broader macroeconomic environment. Rising interest rates and potential economic slowdowns can dampen investment in new technologies, including AI. Reduced spending on research and development could directly impact demand for Nvidia’s products, affecting both revenue and stock performance.

The future also depends on the evolution of AI itself. The current AI boom is largely centered on large language models and generative AI. However, the field is constantly evolving, with new breakthroughs and applications emerging regularly. Nvidia’s ability to adapt to these changes and provide the necessary hardware for future AI advancements will be crucial to its continued success.

Therefore, while the current excitement surrounding AI is undeniably justified, investors need to adopt a more balanced perspective. Nvidia’s success is inextricably linked to the ongoing progress and adoption of AI, but it’s not immune to market fluctuations and competitive pressures. Sustained growth will require the company to continue innovating, adapting to changing market conditions, and effectively navigating the complexities of the technology sector. The journey from AI darling to long-term tech leader is far from over, and it’s a journey that will be defined not just by the speed of AI’s growth, but also by Nvidia’s ability to consistently deliver and adapt. The revised forecasts reflect a healthy dose of realism, emphasizing the need for cautious optimism in this exciting but inherently volatile landscape.

Leave a Reply