Economic Headwinds: Are We Headed for a Recession?

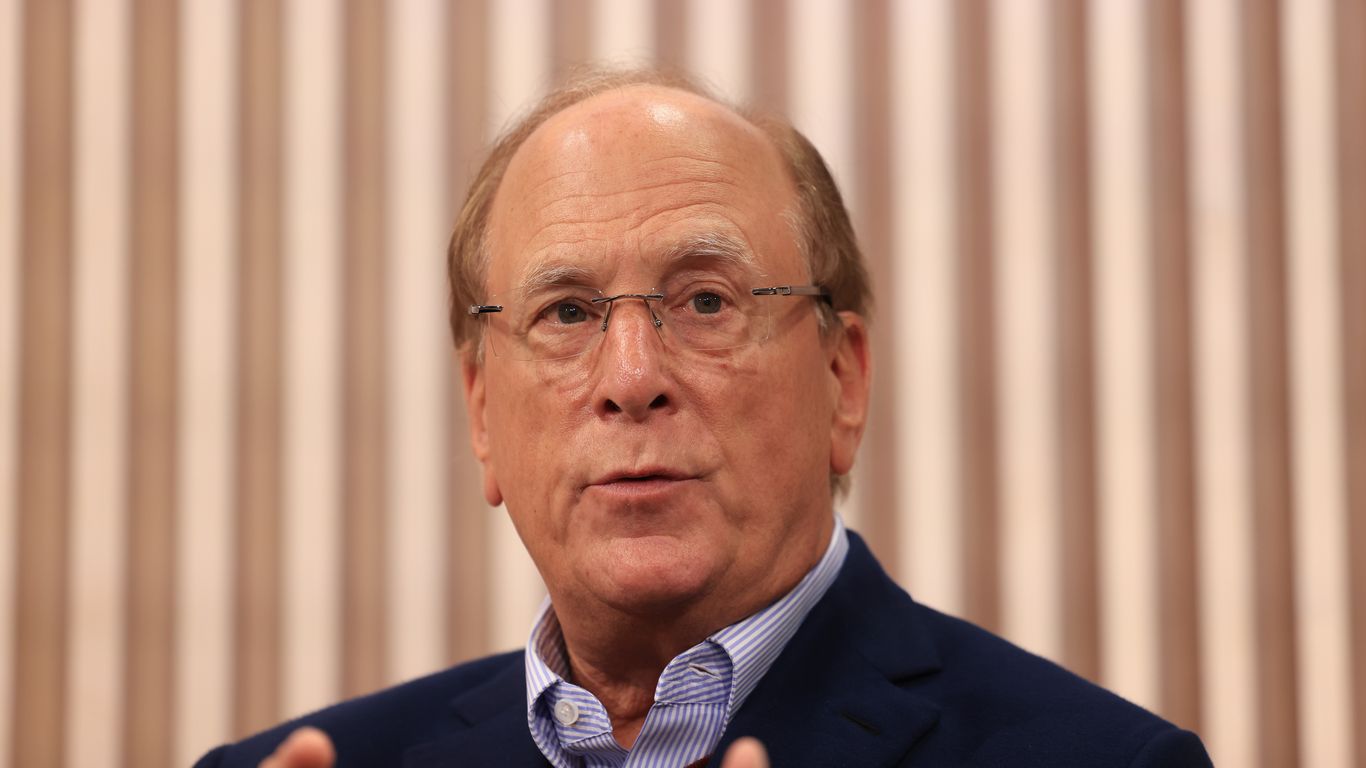

The whispers are growing louder. From boardrooms to kitchen tables, the question hangs heavy in the air: is a recession on the horizon? Recent pronouncements from a prominent figure in the financial world only amplify these concerns. A leading voice in the investment community has stated definitively that the economy is weakening, and that a significant portion of top executives believe the US is already in a recession.

This isn’t just idle speculation. This assessment comes from someone with unparalleled access to information and insight – someone who speaks directly with hundreds of CEOs across diverse sectors. Their perspective is invaluable, offering a window into the pulse of the American economy beyond the typical economic indicators. These CEOs, responsible for managing vast enterprises and thousands of jobs, aren’t making these predictions lightly. Their judgments are based on firsthand observations of slowing demand, tightening credit, and rising costs – all classic harbingers of an economic downturn.

The picture they paint is one of mounting pressure. Consumer spending, a cornerstone of the US economy, is showing signs of fatigue. Inflation, while possibly peaking, remains stubbornly high, eroding purchasing power and forcing consumers to tighten their belts. Businesses, facing rising input costs and uncertain future demand, are hesitant to invest, further dampening economic growth. The ripple effects are already being felt across various sectors, with some indicating reduced hiring or even layoffs.

However, the narrative isn’t entirely bleak. It’s crucial to acknowledge the nuances within this picture. While many executives see a recession as a present reality, others remain cautiously optimistic. This disparity highlights the inherent complexity of forecasting economic trends. Different industries are experiencing varying degrees of strain, with some sectors displaying resilience while others struggle. Moreover, the severity and duration of any potential recession remain uncertain, making definitive predictions incredibly challenging.

The current situation underscores the importance of prudent financial management, both for individuals and businesses. Consumers should carefully evaluate their spending habits, prioritize saving, and prepare for potential economic hardship. Businesses need to closely monitor market conditions, manage their cash flow effectively, and adapt their strategies to navigate the challenging environment. A proactive approach is paramount.

The warnings are clear: the economic climate is undeniably challenging. While the precise trajectory remains uncertain, the consensus among many prominent business leaders points towards a weakening economy. Whether this translates into a full-blown recession or a period of slower growth remains to be seen. What is certain, however, is the need for vigilance, informed decision-making, and preparedness in the face of this economic uncertainty. It’s a time to carefully assess risks, strengthen financial positions, and navigate carefully through the choppy waters ahead. The future may be unclear, but proactive preparation is the best course of action.

Leave a Reply