Economic Headwinds: Are We Already in a Recession?

The whispers are growing louder. The feeling of unease in the market isn’t just a gut feeling; it’s being echoed by some of the most influential voices in global finance. Leading figures are openly acknowledging a significant weakening in the economy, suggesting we may already be experiencing a recession, even if the official declarations haven’t yet been made.

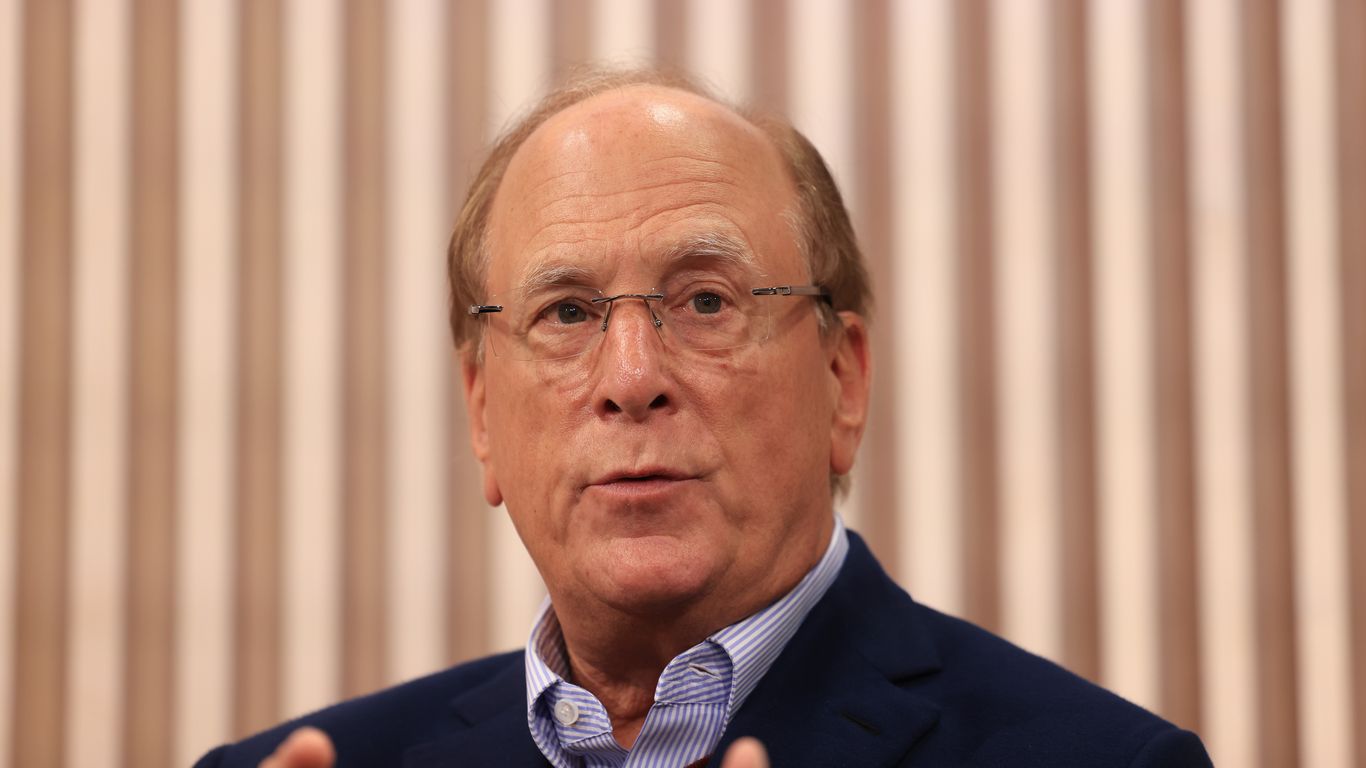

One prominent voice adding fuel to this fire is a heavyweight in the investment world. This individual, with unparalleled access to the upper echelons of corporate America, has observed firsthand the concerns and anxieties gripping the CEOs of major companies. Their perspective offers a compelling insight into the current economic climate, one that moves beyond the standard economic indicators and delves into the real-time experiences of those leading the charge in various industries.

The consensus among these CEOs, according to this influential figure, points to a worrying trend: a significant slowdown, if not an outright recession. This isn’t merely speculation; it’s a reflection of tangible changes witnessed within their own companies. Reduced investment, slowing growth, and tightening budgets are all signs pointing towards a considerable economic contraction.

Several factors contribute to this perception of a weakening economy. Inflation, stubbornly persistent despite efforts to curb it, continues to erode purchasing power and dampen consumer spending. Supply chain disruptions, though easing somewhat, still create uncertainty and impact production. The global geopolitical landscape, marked by ongoing conflicts and instability, adds further layers of complexity and risk.

The implications of a weakening economy, and potentially a recession, are far-reaching. Job security becomes a major concern, as companies adjust their workforce to align with reduced demand. Consumer confidence plummets, leading to further reductions in spending. Investment dries up, hindering future growth and innovation. The ripple effects can be felt across all sectors, from manufacturing to technology, and from small businesses to multinational corporations.

It’s important to note that the current situation is complex and multifaceted. While many indicators suggest a weakening economy, there are countervailing arguments. The unemployment rate, for example, remains relatively low in certain sectors, indicating a robust labor market in some areas. However, this should not overshadow the concerns voiced by those directly experiencing the pressures of a slowing economy. Their perspective, grounded in real-world observations, offers valuable insights that cannot be ignored.

Looking ahead, uncertainty reigns supreme. The extent and duration of any economic downturn remain unclear. However, the convergence of opinions from leading figures like this prominent investor, coupled with the tangible experiences of CEOs across various sectors, strongly suggests that navigating the current economic landscape requires a cautious and adaptable approach. Preparing for potential headwinds, both financially and strategically, is no longer a matter of conjecture but a necessity for individuals, businesses, and policymakers alike. The warnings are clear, and the time for proactive measures is now.

Leave a Reply