Nvidia: A Chip Off the Old Block, Riding the Tariff Rollercoaster

The global tech landscape is currently navigating choppy waters, thanks to the latest surge in international trade tensions. These escalating tariffs, impacting a wide range of goods, are creating uncertainty and ripple effects across various sectors, particularly the semiconductor industry. One company, however, is unexpectedly positioned to potentially thrive amidst this turmoil: Nvidia.

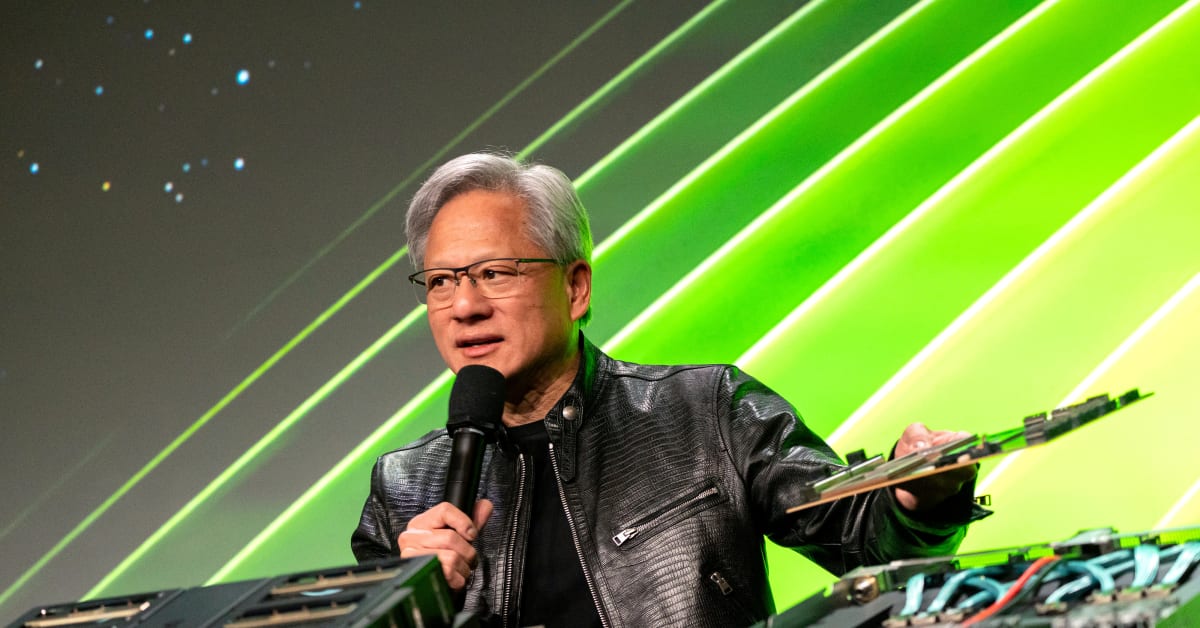

Nvidia, the undisputed king of the GPU market, is not your average tech company. While initially known for its high-performance graphics cards powering gaming PCs, the company’s reach has expanded significantly. Its processors are now critical components in data centers, powering artificial intelligence (AI) applications, self-driving cars, and high-performance computing (HPC) systems. This diversified portfolio provides a significant buffer against the economic headwinds created by trade disputes.

So, why is a financial institution predicting robust growth for Nvidia in the face of these tariffs? The answer lies in the complex interplay of several factors. First, the escalating trade war is not uniformly impacting all sectors. While certain industries might suffer from increased import costs, the demand for Nvidia’s products remains largely unaffected. In fact, the ongoing growth of AI, cloud computing, and autonomous vehicles continues to fuel an insatiable appetite for its high-performance chips. These are all sectors considered less directly affected by trade tensions compared to, say, consumer electronics or apparel.

Second, Nvidia’s strategic positioning in crucial technological advancements offers a considerable advantage. Many of its key markets are less susceptible to short-term economic fluctuations. Data centers, for instance, represent long-term investments, and companies are unlikely to significantly alter their technology infrastructure due to temporary tariff increases. Similarly, the development of autonomous vehicles is a long-term project that is unlikely to be drastically impacted by short-term economic shifts.

However, it’s not all sunshine and roses for Nvidia. There are potential downsides. While the demand for its products might remain strong, the increased costs of raw materials and components, potentially affected by tariffs, could impact Nvidia’s profitability margins. This is a factor that needs careful consideration. Moreover, if the trade war escalates significantly, creating broader economic uncertainty, it could eventually affect investment decisions in sectors that rely on Nvidia’s technology, even if indirectly.

Nevertheless, the bullish outlook for Nvidia suggests a belief that the positive factors outweigh the negative ones. The company’s position at the forefront of several rapidly expanding technological domains, along with the seemingly inelastic demand for its products in those domains, appears to be the driving force behind this optimistic projection. The ongoing growth trajectory of AI, cloud computing, and autonomous vehicles suggests a long-term growth outlook, potentially overshadowing the short-term turbulence created by global trade uncertainties.

In conclusion, while the global economic climate remains uncertain, Nvidia’s strategic positioning and the long-term demand for its technology offer a compelling case for continued growth. However, it’s crucial to acknowledge the inherent risks associated with operating in a volatile global market. Investors need to carefully weigh the positive and negative factors before making any investment decisions. The next few months will be crucial in determining how Nvidia navigates this challenging period and whether the optimistic forecast holds true.

Leave a Reply