The Dollar’s Unexpected Dip: A Conundrum of Trade and Confidence

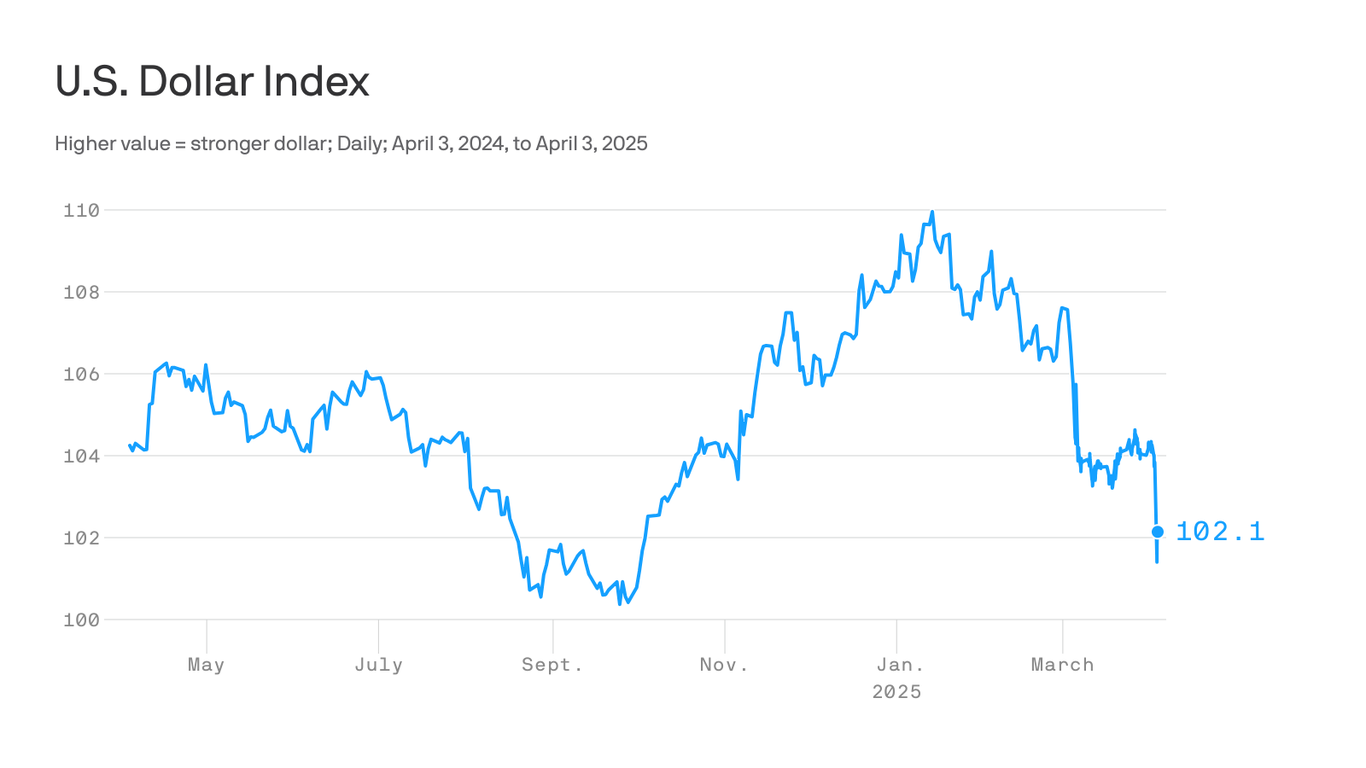

The US dollar, typically considered a safe haven asset, has recently exhibited behavior defying conventional economic wisdom. While increased tariffs are generally expected to bolster a nation’s currency, the recent imposition of significant trade barriers has, surprisingly, resulted in a weakening of the dollar. This unexpected downturn warrants a closer examination of the complex interplay between trade policy, investor sentiment, and the global economic landscape.

Economic theory posits that tariffs, by restricting imports and theoretically boosting domestic demand, should lead to a stronger currency. Increased demand for domestically produced goods translates to higher demand for the currency needed to purchase them. However, the reality is far more nuanced. The current situation reveals that simple economic models often fail to capture the full complexity of real-world scenarios.

The impact of tariffs extends far beyond simple supply and demand dynamics. Investor confidence plays a crucial role. The imposition of tariffs can be interpreted as a sign of protectionism and economic instability, potentially deterring foreign investment. This perception of uncertainty can trigger capital flight, leading to a decrease in demand for the dollar and consequently, a depreciation of its value. Uncertainty breeds risk aversion, pushing investors toward safer alternatives, even if those alternatives offer lower returns.

Furthermore, the magnitude and scope of the tariffs are critical factors. While small, targeted tariffs might have a minimal impact, large-scale tariffs impacting major trading partners can significantly disrupt global supply chains and fuel inflationary pressures. This can erode purchasing power and ultimately diminish the attractiveness of the dollar as a store of value. If the inflationary effect outweighs the perceived boost in domestic production, the dollar’s value can suffer.

Another key consideration is the global response to the tariffs. Retaliatory tariffs from other countries can create a domino effect, triggering trade wars that negatively impact global growth. A slowdown in global economic activity can diminish demand for the dollar, exacerbating its decline. The interconnectedness of the global economy means that unilateral trade actions rarely exist in isolation. The repercussions can be far-reaching and difficult to predict with complete accuracy.

Finally, the credibility of policymakers also plays a vital role. If investors lose confidence in the ability of policymakers to manage the economic consequences of their actions, this can further undermine the dollar’s value. Consistent and transparent communication about economic policy is essential in maintaining investor confidence and preventing market volatility. Uncertainty and inconsistent messaging can exacerbate anxieties, leading to a sell-off in the dollar.

In conclusion, the recent weakening of the dollar despite the imposition of tariffs highlights the limitations of simplistic economic models and the importance of considering a broader range of factors. Investor sentiment, global economic conditions, the magnitude and scope of trade barriers, and the credibility of policymakers all play a crucial role in determining the value of a nation’s currency. The current situation serves as a stark reminder that understanding currency fluctuations requires a holistic perspective that goes beyond the textbook explanations. The complex interplay of these factors emphasizes the importance of careful consideration and strategic planning in formulating trade policies to avoid unintended consequences.

Leave a Reply