Executive Compensation: A Case Study in Goldman Sachs’s $80 Million Bonus Controversy

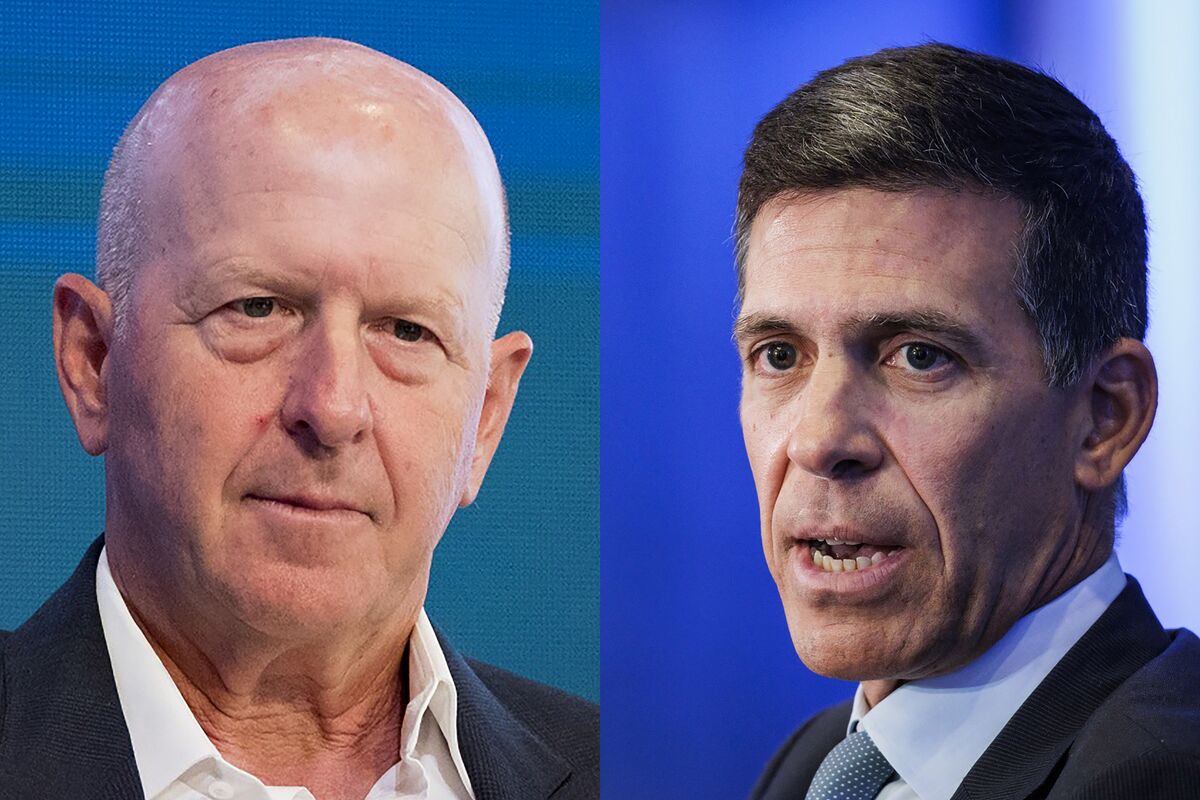

The recent news cycle has been dominated by discussions surrounding executive compensation, particularly a significant bonus awarded to top executives at Goldman Sachs. The proposed $80 million payout, split between CEO David Solomon and President John Waldron, has ignited a firestorm of criticism, raising fundamental questions about corporate governance and the disconnect between executive rewards and company performance.

Critics argue that the sheer size of the bonus is excessive and unwarranted, especially in light of Goldman Sachs’s recent financial performance. While the bank remains a major player in the financial world, its profitability has faced challenges in recent years. The argument centers on the notion that awarding such a substantial bonus, particularly during a period of relative underperformance compared to previous years, sends the wrong message to shareholders and employees. It suggests a prioritization of executive enrichment over long-term value creation and sustainable growth.

The controversy goes beyond simple dollar figures. It highlights a broader debate about fairness and equity within organizations. While acknowledging the significant contributions of top executives, opponents of the bonus argue that the vast disparity between executive compensation and the average employee’s salary contributes to growing inequality and erodes morale. This disparity is particularly striking when considering the potential impact of layoffs and salary freezes on lower-level employees, creating a sense of injustice and resentment.

Furthermore, the timing of the bonus announcement raises concerns about corporate transparency and accountability. The decision comes at a time when shareholders are increasingly demanding greater transparency in executive compensation packages. The lack of a clear and justifiable rationale for such a significant payout only fuels the skepticism surrounding the bank’s corporate governance practices.

Proxy advisory firms, such as Glass Lewis, play a crucial role in providing independent assessments of executive compensation plans. Their recommendations are closely followed by institutional investors who hold significant shares in publicly traded companies. In this instance, the recommendation to vote against the bonus package underscores the growing dissatisfaction among shareholders with the current structure of executive pay. This highlights the increasing influence of shareholder activism in shaping corporate decision-making.

The Goldman Sachs bonus controversy serves as a stark reminder of the challenges inherent in determining appropriate executive compensation. Striking a balance between rewarding exceptional leadership and ensuring fair compensation for all employees is crucial for fostering a healthy and productive corporate culture. Moving forward, increased transparency, clear performance metrics tied to executive pay, and a greater consideration of the broader societal impact of executive compensation are essential to address the concerns raised by this high-profile case. The debate is likely to continue, pushing companies to re-evaluate their compensation strategies and foster greater alignment between executive pay and shareholder value. The outcome of the shareholder vote will be closely watched as a potential indicator of a shifting tide in corporate governance.

Leave a Reply