The Digital Shift in Social Security: A Coming Change for Hundreds of Thousands

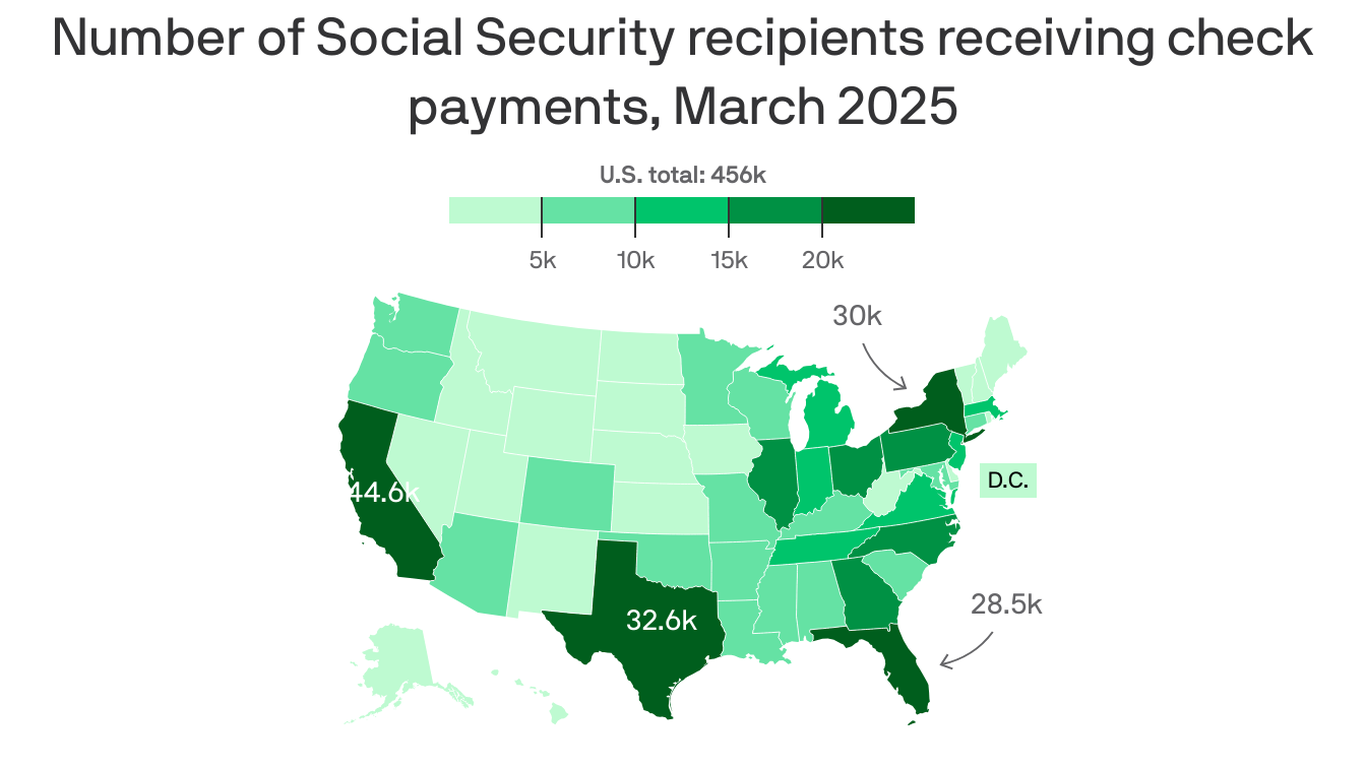

For many Americans, the arrival of their monthly Social Security check is a reassuring ritual, a tangible representation of decades of contributions and a vital source of income. However, this familiar routine is poised for a significant change, impacting a substantial portion of the population. The government is moving to eliminate paper checks as a payment method for Social Security benefits, a decision that will affect nearly half a million recipients.

This transition to electronic payments, while seemingly straightforward, carries significant implications for those accustomed to receiving their benefits by mail. For many senior citizens, particularly those living in rural areas with limited access to technology or banking services, the paper check represents more than just a payment; it’s a symbol of reliability and a familiar part of their financial routine. The shift to direct deposit or debit cards necessitates a degree of technological literacy and banking infrastructure that some recipients may lack.

The potential for disruption to the financial lives of these individuals is considerable. The immediate concern revolves around access to funds. Those who rely on receiving physical checks to manage their finances may struggle to adapt to the new system, potentially facing delays in accessing their benefits or encountering difficulties navigating the complexities of online banking or debit card usage. This could lead to unforeseen financial strain, particularly for individuals living on fixed incomes and already managing tight budgets.

Beyond the immediate accessibility issue lies the broader concern of digital literacy and inclusion. The digital divide, the gap between those with access to and proficiency in technology and those without, remains a persistent challenge in many communities. For older Americans who may not have grown up with computers and the internet, the transition to digital payments presents a steep learning curve. The lack of readily available support and training could exacerbate existing inequalities, leaving vulnerable individuals further marginalized.

The government acknowledges the potential challenges and is attempting to mitigate them through various outreach programs. These initiatives aim to provide support and guidance to those affected, assisting them in making the transition to electronic payments smoothly. However, the effectiveness of these programs remains to be seen, and the success of the transition hinges on the accessibility and comprehensiveness of these support systems. Concerns persist that the outreach efforts may not be sufficient to reach all those who need help.

Furthermore, the security of electronic payments must be ensured. While direct deposit offers a degree of security and efficiency, it also raises concerns about fraud and identity theft. Robust security measures must be in place to protect recipients from these risks. The government must prioritize the security of these electronic transactions and provide clear information to recipients on how to safeguard their accounts.

The transition to digital payments for Social Security benefits presents a complex challenge that necessitates a delicate balance between modernization and inclusivity. While the move towards digital systems offers potential efficiency gains and cost savings, it is critical to ensure that the needs of all recipients, particularly those most vulnerable to technological barriers, are adequately addressed. The success of this transition will depend not just on the implementation of the new system, but also on the comprehensive support provided to ensure a smooth and equitable experience for all.

Leave a Reply