The End of an Era: Social Security’s Transition to Direct Deposit

For generations, the arrival of a Social Security check in the mail has been a familiar ritual, a tangible symbol of financial security in retirement. But that tradition is poised for a significant shift, potentially impacting hundreds of thousands of Americans. A recent directive aims to eliminate paper checks entirely, transitioning all Social Security benefits to direct deposit. While this move is presented as a modernizing step, its implications are far-reaching and deserve careful consideration.

The primary driver behind this change is efficiency. Processing and mailing paper checks is undeniably costly and time-consuming. Direct deposit, on the other hand, automates the process, streamlining payments and reducing administrative burdens on the Social Security Administration (SSA). This efficiency translates into potential cost savings, which could be reallocated to other aspects of the Social Security system. Furthermore, electronic payments are generally considered more secure, minimizing the risk of lost or stolen checks.

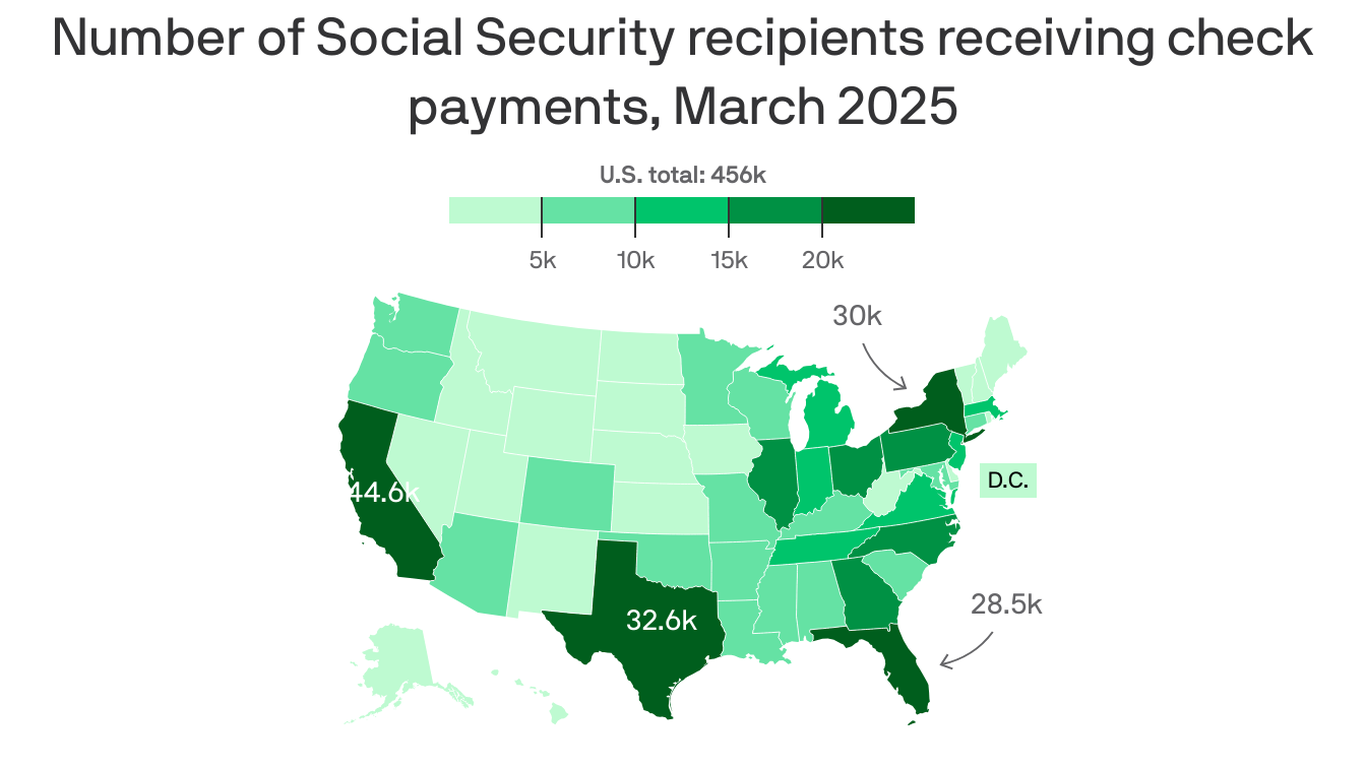

However, the transition isn’t without its challenges. The most immediate concern is the impact on the half-million or so Americans who currently receive their benefits via paper check. Many of these individuals are elderly, have limited technological literacy, or lack access to bank accounts. For them, the sudden switch presents significant hurdles. The process of setting up direct deposit requires a bank account, a level of digital proficiency that might not be present in everyone, and a proactive effort to initiate the change. The potential for confusion and frustration is high, and the risk of individuals missing payments during the transition is a real concern.

The SSA, in recognizing this vulnerability, will undoubtedly need to implement a robust support system to assist affected beneficiaries. This likely includes outreach programs, educational initiatives, and potentially partnerships with community organizations to guide individuals through the process. Simple, clear instructions and readily available assistance are crucial to ensure a smooth transition and prevent undue hardship. The success of this initiative hinges heavily on the effectiveness of these support systems.

Beyond the immediate concerns surrounding the transition, the long-term implications also require careful consideration. While direct deposit offers efficiency and security, it also raises questions about financial inclusion. The move towards a fully digital system risks exacerbating existing inequalities, potentially leaving vulnerable populations behind. It’s essential to ensure that the benefits of this modernization are broadly shared and that no one is left struggling to access their rightful payments. A comprehensive approach that includes financial literacy programs and access to banking services for underserved communities is paramount to mitigating potential negative impacts.

In conclusion, the shift from paper checks to direct deposit for Social Security payments represents a significant change with both potential advantages and undeniable challenges. While the long-term benefits of efficiency and security are undeniable, the immediate impact on a significant portion of the population needs to be carefully managed. A successful transition requires a strong focus on support and inclusivity, ensuring that everyone receives their benefits reliably and without undue hardship. Only then will this modernization effort truly be considered a success.

Leave a Reply