The Silent Shift: How a Change to Social Security Payments Could Impact Hundreds of Thousands

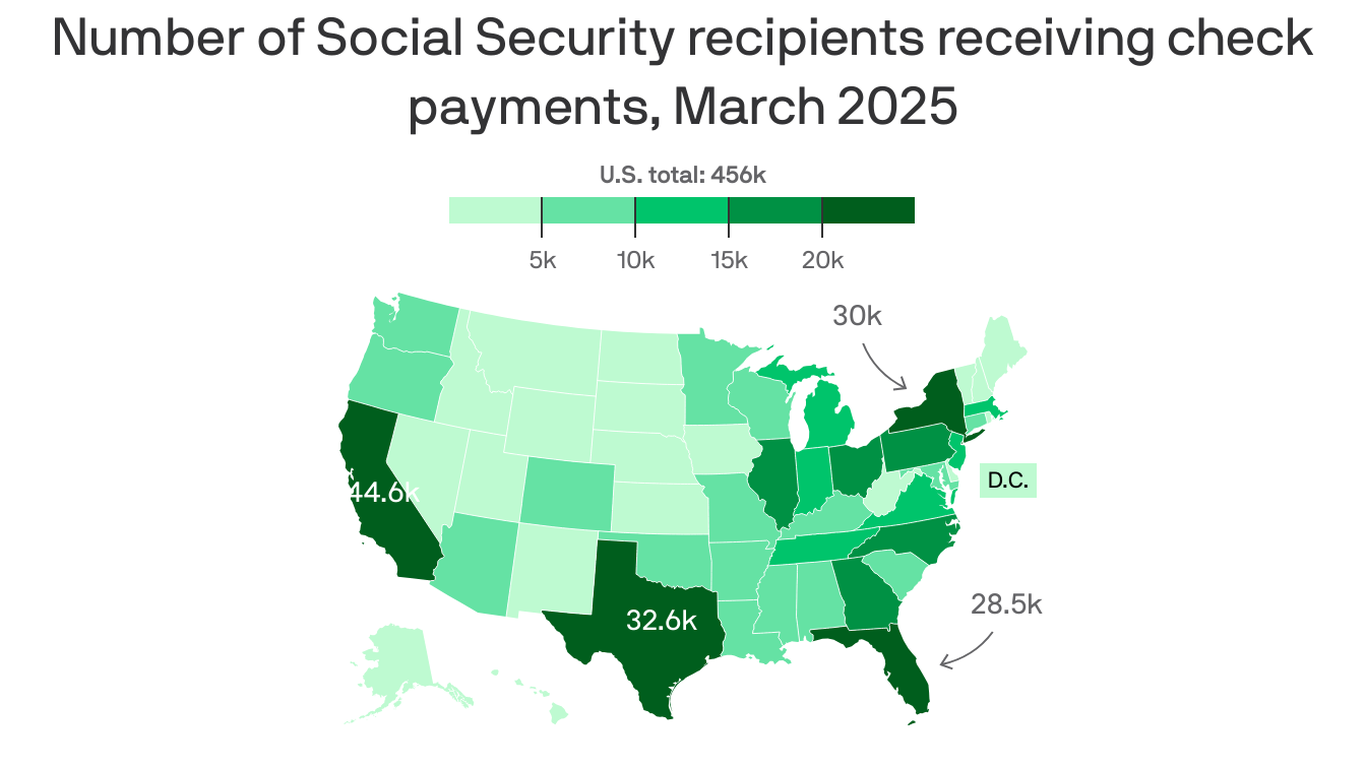

For many Americans, the arrival of their Social Security check is a monthly ritual, a dependable rhythm in the ebb and flow of life. It represents security, a promise kept, a lifeline for millions. But that familiar ritual is about to change for a significant number of people, potentially causing significant disruption and hardship. A recent policy shift will eliminate paper checks as a method of Social Security disbursement, affecting almost half a million recipients.

This move, while seemingly small in the grand scheme of federal policy, has the potential to create significant challenges for a vulnerable population. While the transition to direct deposit is touted as a modern, efficient solution, the reality is far more nuanced. For many older Americans, and especially those living in rural areas or with limited access to technology, navigating the complexities of electronic banking can be daunting, even insurmountable.

Imagine an elderly individual who has relied on the tangible security of a paper check for decades. The predictable arrival of a physical check in their mailbox is more than just a transaction; it’s a source of comfort and routine. Suddenly, this familiar process is replaced with a digital system that might require them to learn how to use online banking, a concept utterly foreign to their experience. This isn’t simply a matter of inconvenience; it’s a significant adjustment that can exacerbate feelings of isolation and anxiety.

Beyond the immediate hurdle of learning new technology, the transition to direct deposit raises crucial questions of access and security. What about those who lack reliable internet access? What about those who are digitally illiterate, or who struggle with cognitive impairments that make managing online accounts difficult? These individuals are disproportionately affected by this change, and the lack of adequate support mechanisms to guide them through the transition only compounds their vulnerability.

The financial implications are equally significant. The ease and predictability of receiving a paper check are vital for many individuals managing tight budgets. For those who rely on the physical check to pay bills, or to manage their spending in a tangible way, the shift to direct deposit may introduce unforeseen challenges. Accidental overdrafts, missed bill payments, and the increased risk of fraud are all realistic possibilities. The potential for financial instability caused by this policy change should not be underestimated.

The argument for efficiency and cost-savings often accompanies these types of policy shifts. While the elimination of paper checks might indeed reduce administrative costs, the human cost of this change is far too high to ignore. The real savings must be measured against the very real risks of increased hardship, financial instability, and potentially, even social isolation for a significant segment of the population. A successful transition requires more than simply issuing a directive; it demands a comprehensive support system, including targeted outreach programs, accessible educational resources, and readily available assistance for those who struggle to adapt.

This is not just a matter of updating outdated systems; it’s about recognizing the unique vulnerabilities of a population that has contributed immensely to the fabric of our society. A truly equitable and effective policy must acknowledge and address the very real human consequences of such sweeping changes. A simple switch to direct deposit should not come at the expense of the well-being and financial security of hundreds of thousands of Americans. The focus must shift from mere efficiency to genuine inclusivity and support.

Leave a Reply