The End of an Era: Social Security’s Transition to Electronic Payments

For decades, the familiar crispness of a Social Security check arriving in the mailbox has been a reassuring ritual for millions of Americans. But this familiar comfort is nearing its end, as a significant shift towards electronic payments is underway. This transition, while intended to modernize the system and improve efficiency, carries with it the potential to disrupt the lives of a substantial number of recipients.

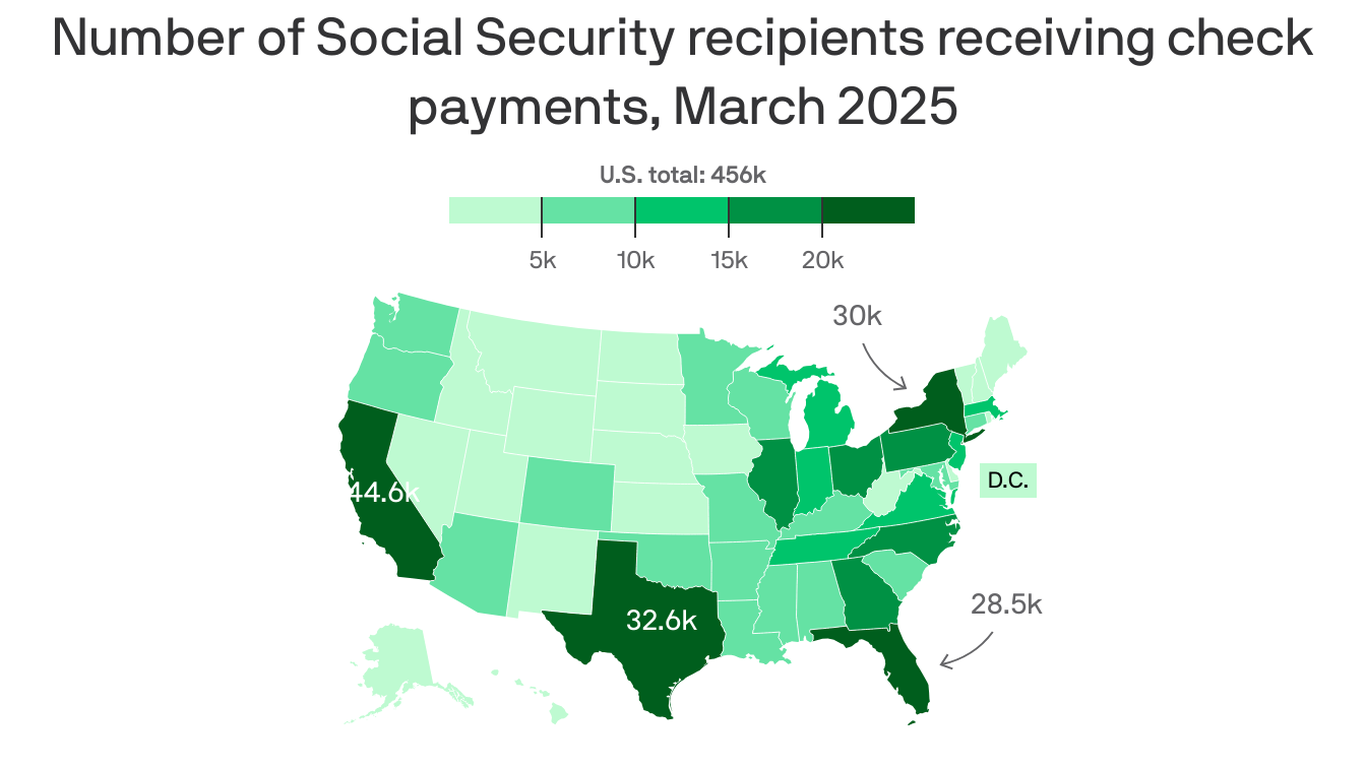

Estimates suggest that nearly half a million individuals currently rely on receiving their Social Security benefits via paper check. These are not simply numbers; these are real people, many of whom are elderly, disabled, or facing other significant challenges that make navigating the complexities of modern banking systems difficult or impossible. For them, a paper check represents more than just a payment; it’s a tangible, reliable source of income, a symbol of their entitlement to support.

The impetus for this change is multifaceted. The government argues that switching to electronic payments will streamline the process, reduce costs, and ultimately enhance security. Electronic transfers are undeniably more efficient, offering faster processing times and minimizing the risk of lost or stolen checks. Moreover, the administration likely sees the move as a step toward a more digitally-focused society, aligning Social Security with contemporary financial practices.

However, the transition is not without its significant drawbacks. The most immediate concern is the potential for exclusion. Many of those receiving paper checks currently lack access to bank accounts, debit cards, or the digital literacy required to manage electronic payments. This isn’t simply a matter of technological aversion; it’s often rooted in financial insecurity, limited access to financial institutions, and a lack of support to navigate the transition. For these individuals, the switch could mean significant delays in receiving their benefits, increased vulnerability to fraud, or even the complete disruption of their financial stability.

The logistical challenges are equally daunting. The transition will require a concerted outreach effort to inform and assist those affected. This will necessitate substantial investment in education programs, technological assistance, and potentially even direct support in opening bank accounts and setting up direct deposit. Failure to provide adequate support could lead to widespread confusion, frustration, and significant hardship for those least equipped to handle such a change.

Furthermore, the security implications of a complete shift to electronic payments must be carefully considered. While electronic transfers are generally safer than physical checks, they are still vulnerable to cyberattacks and fraud. Robust security measures are essential to protect recipients from malicious actors who might seek to exploit the transition for their own gain. The government must ensure that the new system is equipped to handle the increased volume of electronic transactions and safeguard the sensitive financial information of millions of Americans.

The planned shift to electronic Social Security payments is a complex undertaking with both potential benefits and significant risks. While modernization is desirable, the success of this transition hinges upon the government’s commitment to supporting those most vulnerable to its effects. Without adequate planning, outreach, and assistance, this well-intentioned initiative could inadvertently create significant hardship for a significant portion of the population. The focus must be on a smooth, inclusive transition that prioritizes the well-being of all Social Security recipients, regardless of their technological capabilities or access to financial services.

Leave a Reply