The Thrill of the Hunt: Is the Resale Market Ready for its Close-Up?

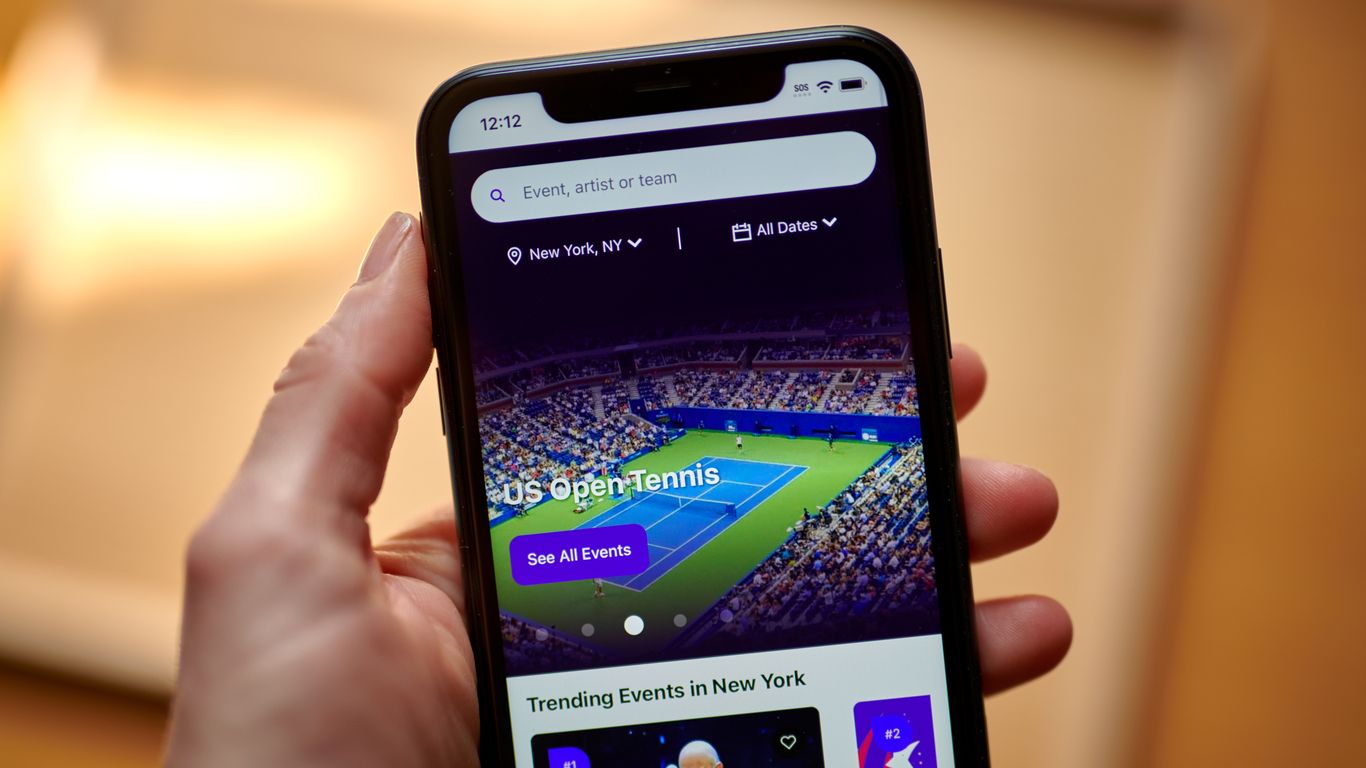

The live events industry, a vibrant tapestry woven from the shared experiences of concerts, sporting events, and theatrical performances, has always had a secondary market. For years, individuals have bought and sold tickets outside of official channels, a bustling ecosystem driven by demand, scarcity, and a dash of entrepreneurial spirit. Now, one of the largest players in this ecosystem is aiming for a significant leap: an initial public offering (IPO).

This move represents a fascinating intersection of several significant trends. Firstly, it’s a clear indication of the maturity and perceived stability of the secondary ticket market. While once considered a shadowy corner of the industry, platforms like StubHub have worked to legitimize and streamline the process, providing a relatively safe and transparent platform for buyers and sellers. This evolution from a somewhat disreputable practice to a mainstream, technology-driven business speaks volumes about the changing attitudes towards ticket resale.

Secondly, the IPO is a significant test of investor confidence in the live events industry itself. The pandemic dealt a devastating blow to this sector, forcing cancellations, postponements, and a prolonged period of uncertainty. The willingness of investors to back a company operating within this industry, particularly one heavily reliant on large gatherings, suggests a positive outlook for a sector that’s slowly, but surely, returning to its former vibrancy. A successful IPO could be interpreted as a vote of confidence in the industry’s resilience and future growth potential.

However, the road to success is not without its challenges. The secondary ticket market has faced criticism for contributing to inflated prices and potentially harming the relationship between artists/teams/venues and their fans. Concerns remain about the ethical considerations of profiting from tickets intended for genuine fans. The company will undoubtedly need to address these criticisms convincingly to attract and retain investors long-term. Transparency and fair pricing will be key elements of their narrative, alongside demonstrating a commitment to ethical practices within the industry.

Beyond the ethical considerations, the company will also need to navigate the constantly evolving technological landscape. The rise of blockchain technology and the potential for NFT-based ticketing systems represent significant disruptions, potentially altering the very nature of the secondary market. Adaptability and innovation will be crucial for navigating these changes and maintaining a competitive edge.

The IPO itself will be a significant data point for the broader economy. Its performance will serve as a gauge of investor sentiment towards the resurgence of live entertainment, and more broadly, of the technology sector’s ability to capitalize on existing and evolving markets. While the long-term implications are uncertain, the move undeniably represents a pivotal moment in the history of the secondary ticketing market, placing it firmly in the spotlight of both the financial and entertainment worlds. The future of this dynamic industry, and the role of resale markets within it, is now poised for a fascinating new chapter.

Leave a Reply